Quanta Services Inc Stock Moved Up by 4.40% on Feb 19: A Full Analysis

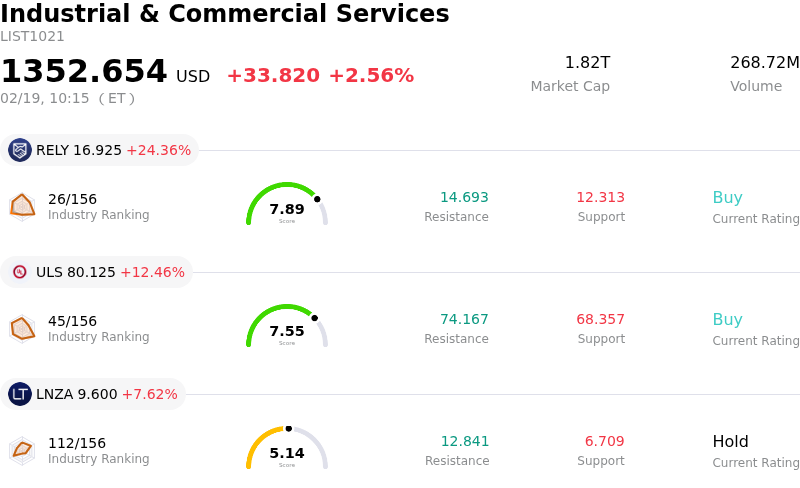

Quanta Services Inc (PWR) moved up by 4.40%. The Industrial & Commercial Services industry is up by 2.56%. The company outperformed the industry. Top 3 gainers of the industry: Remitly Global Inc (RELY) up 24.36%; UL Solutions Inc (ULS) up 12.46%; Lanzatech Global Inc (LNZA) up 7.62%.

Quanta Services, Inc. (PWR) experienced an upward movement today, primarily driven by a combination of strong financial results, optimistic future guidance, strategic business developments, and positive analyst sentiment.

The company announced its fourth quarter and full-year 2025 results, which demonstrated robust performance. More significantly, Quanta Services provided an upbeat full-year 2026 earnings guidance that surpassed consensus estimates for both earnings per share and revenue. This forward-looking outlook projects double-digit growth across key financial metrics, including revenues, net income, and adjusted EBITDA, suggesting a strong operational trajectory for the coming year.

Adding to the positive momentum are the company's recent strategic actions and a record backlog. Quanta Services completed several acquisitions during 2025, including three notable purchases in the final quarter, which are expected to contribute positively to future earnings and strengthen its market position in electrical infrastructure and aviation services. The company concluded 2025 with an all-time high backlog, particularly in its Electric Infrastructure Solutions segment, indicating substantial future demand for its specialized services.

Furthermore, the company highlighted that significant investments in AI infrastructure are increasing demand for its core electric services, benefiting from the broader convergence of utility, power generation, and large-load industries. This industry dynamic positions Quanta Services favorably as a key partner for critical infrastructure projects.

The market's positive reaction is also supported by generally favorable analyst forecasts. The stock holds a "Moderate Buy" consensus rating from analysts, with several firms recently maintaining or raising their price targets, reflecting confidence in the company's robust outlook and execution capabilities.

Technically, Quanta Services Inc (PWR) shows a MACD (12,26,9) value of [16.34], indicating a buy signal. The RSI at 64.49 suggests neutral condition and the Williams %R at -26.02 suggests oversold condition. Please monitor closely.

Quanta Services Inc (PWR) is in the Industrial & Commercial Services industry. Its latest annual revenue is 23.67B, ranking 1 in the industry. The net profit is 904.82M, ranking 3 in the industry. Company Profile

Over the past month, multiple analysts have rated the company as BUY, with an average price target of 477.16, a high of 548.00, and a low of 280.00.

Company Specific Risks:

- Quanta Services' stock is trading at an elevated valuation, with a price-to-earnings ratio of 77.18 near its 10-year high, and a Relative Strength Index (RSI) of 64.5 indicating it is approaching overbought conditions, potentially increasing its susceptibility to downward price adjustments.

- Operational and execution risks persist despite a record backlog, driven by potential supply chain disruptions, permitting challenges, and a constrained market for skilled labor such as electricians and technicians, which could impact project timelines and profitability.

- Recent insider trading activity reveals sales of company stock without corresponding purchases, which could be interpreted by investors as a lack of strong confidence from company insiders regarding future stock performance.