eBay Inc Stock Moved Up by 4.92% on Feb 19: Facts Behind the Movement

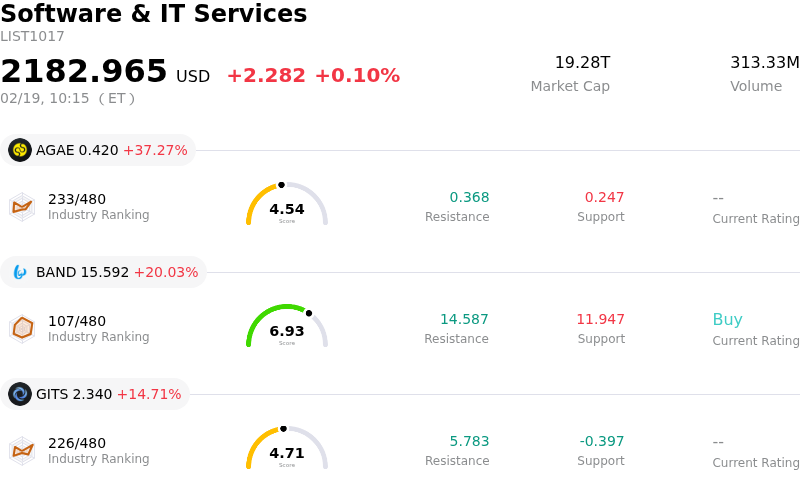

eBay Inc (EBAY) moved up by 4.92%. The Software & IT Services industry is up by 0.10%. The company outperformed the industry. Top 3 gainers of the industry: Allied Gaming & Entertainment Inc (AGAE) up 37.27%; Bandwidth Inc (BAND) up 20.03%; Global Interactive Technologies Inc (GITS) up 14.71%.

eBay experienced a notable increase in its share price today, driven by a confluence of positive company-specific developments. The primary catalyst appears to be the release of robust fourth-quarter 2025 financial results, which significantly surpassed Wall Street's expectations for both revenue and earnings per share. The company reported double-digit year-over-year growth in revenue and gross merchandise volume, with non-GAAP earnings per share beating analyst estimates.

Further bolstering investor confidence was eBay's optimistic guidance for the first quarter of 2026, projecting revenue and non-GAAP earnings per share above consensus estimates. This forward-looking outlook signals continued momentum and effective execution of its strategic initiatives, including its focus on "Focus Categories, Recommerce, and C2C" which now represent a substantial portion of its gross merchandise volume.

In a significant strategic move, eBay announced the acquisition of Depop for $1.2 billion in cash. This acquisition is aimed at expanding eBay's presence in the fast-growing recommerce market and attracting a younger demographic, specifically Gen Z and Millennial consumers. Analysts view this deal as strategically compelling, expecting it to broaden eBay's buyer base and create technological revenue synergies.

Adding to the positive sentiment, the company's board declared an increase in the quarterly cash dividend and authorized a new $2 billion stock buyback program. These actions underscore management's confidence in the company's financial health and its commitment to returning capital to shareholders. The combination of strong financial performance, an encouraging outlook, a strategic acquisition, and shareholder-friendly capital allocation measures has led to several analysts reiterating "Buy" or "Overweight" ratings and raising their price targets for the stock.

Technically, eBay Inc (EBAY) shows a MACD (12,26,9) value of [-1.13], indicating a sell signal. The RSI at 39.49 suggests neutral condition and the Williams %R at -78.48 suggests oversold condition. Please monitor closely.

eBay Inc (EBAY) is in the Software & IT Services industry. Its latest annual revenue is 11.10B, ranking 37 in the industry. The net profit is 2.03B, ranking 26 in the industry. Company Profile

Over the past month, multiple analysts have rated the company as HOLD, with an average price target of 95.07, a high of 115.00, and a low of 65.00.

Company Specific Risks:

- Operating margins experienced a decline in the fourth quarter of 2025, with both GAAP and non-GAAP operating margins decreasing compared to the prior year, continuing a multi-year downward trend in gross profit and operating margins.

- eBay continues to face market share erosion and stagnation in its active user base, particularly against competitors like Amazon, Temu, and Walmart, suggesting a fundamental weakness in capturing growth within the broader e-commerce market.

- International Gross Merchandise Volume (GMV) declined due to macroeconomic conditions in Europe and ongoing trade policy changes, which are also anticipated to pressure operating income and EPS in 2026.

- Concerns persist regarding the sustainability of advertising revenue growth as a primary driver for overall GMV, with previous analyst downgrades citing decelerating advertising revenue as a risk to profit growth.