Palantir vs. Microsoft Stock: Which Is Wall Street More Bullish On?

Key Points

Microsoft is valued at a more traditional level.

Palantir is growing at a rapid pace.

Palantir (NASDAQ: PLTR) and Microsoft (NASDAQ: MSFT) have both had rocky starts to 2026. Microsoft is down nearly 20% while Palantir is down more than 25% so far, which is disappointing considering how good they have been as investments over the past few years. However, if you take a look at what Wall Street analysts have to say about each stock, it's less clear which is a better buy.

So, which one am I picking? Let's take a look.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

Wall Street is nearly equal on these two stocks

According to Yahoo! Finance, the average analyst following Microsoft has a one-year price target of $596 on the stock -- a far cry from its current $400 per share level. That represents about a 49% upside. If the analysts are right, Microsoft is a no-brainer stock to buy right now.

Analysts' projections for Palantir are similarly upbeat. The stock trades for about $130 per share right now, but the average price target is $190 per share -- an expected 46% upside. Based on the day-to-day movements of each of these stocks, it's possible that Palantir could have more upside than Microsoft during any given trading session.

The reality is, their stocks have nearly the same potential, at least according to Wall Street analysts. However, there's one key point to note here.

Wall Street analysts are nearly unanimously bullish on Microsoft. The lowest target price on Microsoft is $392 -- nearly the same price it trades at now. Palantir is far more divisive. The current low target price is $70 -- indicating huge downside if that projection comes true. But why is there such a discrepancy?

Palantir's stock trades at a huge premium to the market

Palantir is one of the most expensive stocks on the market on a forward price-to-earnings basis, but it's also one of the fastest growing. That combination of attributes is a recipe for diverse opinions on the stock, as some investors put more importance on traditional valuation metrics while others just want to focus on growth.

It's a near-impossible task to value a company that's thriving in one of the biggest technological revolutions we've ever seen (generative artificial intelligence), especially when that company grew by 70% year over year in Q4. Furthermore, management is guiding for incredible growth again in 2026.

Microsoft isn't growing nearly as fast -- its revenue rose 17% during its fiscal 2026 Q2, which ended Dec. 31. A growth rate like that is far more familiar to investors, so valuing Microsoft's stock isn't as difficult.

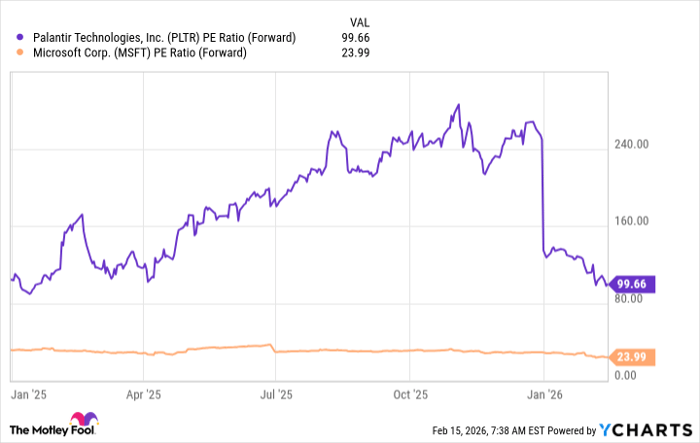

PLTR PE Ratio (Forward) data by YCharts.

Palantir trades for around 100 times forward earnings, while Microsoft is trading at about 24 times. Is it worth paying four times as much on an expected earnings basis for Palantir stock? That's what the Microsoft versus Palantir investment question really boils down to.

In my opinion, Microsoft is the far better buy. While Palantir's growth is impressive, the reality is that it just isn't fast enough. If Microsoft maintains its 17% revenue growth rate while Palantir grows at 70% annually, and other metrics scale similarly, after four years at those rates, their forward earnings ratios would be nearly equal. This assumes that they maintain their respective growth rates into the fifth year. Sustaining a 70% growth rate for an extended time isn't impossible, but it would be extremely difficult. In that light, it's not unreasonable to think it will be even longer before Palantir's business growth catches up to the optimism that's baked into its stock price.

Is Palantir's stock worth paying a four-year (or greater) premium for? Investors who are patient and willing to endure the ups and downs of owning a volatile stock might think so, and prefer the AI software specialist to the tech sector veteran. If you're not so risk tolerant, however, then I think Microsoft is a phenomenal buy right now, and investors should scoop up shares at their currently cheap price.

Should you buy stock in Palantir Technologies right now?

Before you buy stock in Palantir Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palantir Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $415,256!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,133,904!*

Now, it’s worth noting Stock Advisor’s total average return is 889% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of February 19, 2026.

Keithen Drury has positions in Microsoft. The Motley Fool has positions in and recommends Microsoft and Palantir Technologies. The Motley Fool has a disclosure policy.