Apple Inc Stock Moved Up by 3.94% on Feb 17: Key Drivers Unveiled

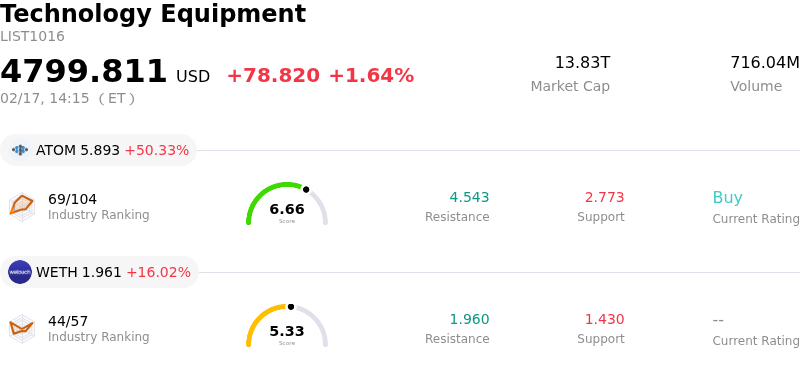

Apple Inc (AAPL) moved up by 3.94%. The Technology Equipment industry is up by 1.64%. The company outperformed the industry. Top 3 gainers of the industry: Utime Ltd (WTO) up 328.46%; Atomera Inc (ATOM) up 50.33%; Wetouch Technology Inc (WETH) up 16.02%.

Apple (AAPL) experienced significant upward movement today, driven primarily by favorable analyst commentary that provided a strong boost to investor sentiment. A prominent investment firm reiterated its "Outperform" rating for the stock, emphasizing that recent concerns regarding the company's artificial intelligence (AI) strategy were largely unfounded.

The analyst firm highlighted 2026 as a pivotal year for Apple, anticipating the company will solidify its position in the AI landscape with the release of advanced AI features slated for the summer. This perspective countered previous market anxieties about perceived delays in Apple's AI rollout, suggesting that the company is on track to deliver its revamped AI architecture, including significant updates to Siri, across its ecosystem. The firm also projected that Apple's AI monetization efforts could add substantial value to the share price over the coming years.

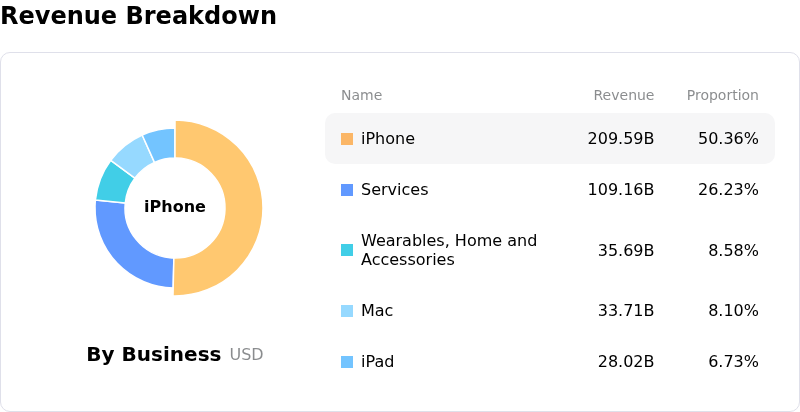

This renewed confidence in Apple's strategic direction builds upon the strong financial results reported for the first quarter of fiscal year 2026. The company had previously announced record-breaking revenue and earnings per share, exceeding analyst expectations and showcasing robust performance driven by strong demand for its flagship iPhone products and continued growth in its Services segment.

Further contributing to the positive outlook is the anticipation of a busy product cycle. Apple has announced a series of "special Apple Experience" events in early March, where it is expected to unveil several new products, including updated MacBook models, new iPads, and potentially a new iPhone variant. This robust product pipeline, coupled with an optimistic re-evaluation of its AI capabilities, appears to have resonated positively with investors today.

Technically, Apple Inc (AAPL) shows a MACD (12,26,9) value of [1.16], indicating a neutral signal. The RSI at 39.44 suggests neutral condition and the Williams %R at -87.47 suggests oversold condition. Please monitor closely.

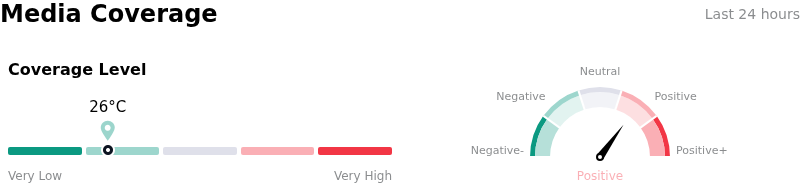

In terms of media coverage, Apple Inc (AAPL) shows a coverage score of 26.28, indicating a low level of media attention, with bullish sentiment.

Apple Inc (AAPL) is in the Technology Equipment industry. Its latest annual revenue is 416.16B, ranking 1 in the industry. The net profit is 112.01B, ranking 1 in the industry. Company Profile

Over the past month, multiple analysts have rated the company as BUY, with an average price target of 289.83, a high of 350.00, and a low of 215.00.

Company Specific Risks:

- Apple faces doubled NAND flash memory prices starting in Q1 2026 due to new contract terms, which is expected to increase iPhone 18 production costs by 15% and pressure gross margins.

- Internal technical hurdles have delayed the full rollout of key AI-powered Siri and Apple Intelligence 2.0 upgrades, potentially pushing them past March or into fall 2026, raising concerns about Apple's competitive position in artificial intelligence.

- The Federal Trade Commission has issued a formal warning to Apple regarding alleged political bias and content curation policies within Apple News, indicating potential legal or operational interventions.

- A federal judge has scheduled a February 2026 trial for a class-action lawsuit alleging that Apple's App Store policies lead to artificially inflated application prices.