Should You Buy CoreWeave Before Feb. 26?

Key Points

Companies come to CoreWeave for something they need a lot of right now: capacity for AI workloads.

The tech player has seen revenue soar in the triple digits quarter after quarter.

CoreWeave (NASDAQ: CRWV) has been one of the artificial intelligence (AI) industry's biggest growth stories over the past year. The company launched its initial public offering in late March and saw its stock soar more than 300% in the months that followed -- the stock has pared gains, but it's still up nearly 140% since its market debut.

There are many things to like about CoreWeave. The company, which rents out access to AI chips, has seen revenue soar quarter after quarter. Nvidia, the world's top chip designer, is an investor in the company. And CoreWeave is well-positioned to benefit from the next stages of AI development.

Will AI create the world's first trillionaire? Our team just released a report on the one little-known company, called an "Indispensable Monopoly" providing the critical technology Nvidia and Intel both need. Continue »

So, if you're a growth investor, you may want to get in on this stock. But how should you time your investment? Should you rush to buy the shares before a key event on Feb. 26? Let's find out.

Image source: Getty Images.

Capacity for AI workloads

Before deciding, though, it's a good idea to take a closer look at the CoreWeave path so far. CoreWeave has been popular with AI customers because it offers them something they desperately need right now: capacity for their workloads. CoreWeave has invested in a fleet of Nvidia's top graphics processing units (GPUs), and customers may rent these powerful tools by the hour -- so they can use this compute briefly or for a long period of time.

Customers clearly love this solution as it means they don't have to go the expensive and time-consuming route of investing in their own GPUs. And it also offers them a great deal of flexibility. All of this has resulted in mind-boggling revenue growth for CoreWeave -- it's climbed in the triple digits in each of the past three quarters.

CoreWeave also has attracted customers because it's been the first to make Nvidia's latest systems -- from Blackwell to Blackwell Ultra -- fully available. Demand is high for Nvidia GPUs, often surpassing supply, so gaining access early on is a big plus. And we may count on this moving forward, considering the close relationship CoreWeave has developed with the chip giant.

Nvidia and CoreWeave

As mentioned, Nvidia holds CoreWeave shares and also has pledged to buy any unused CoreWeave cloud capacity through April of 2032. So it's fair to say that Nvidia has faith in the company -- and Nvidia, given its visibility on what's to come in the AI market, is well positioned to recognize a potential winner.

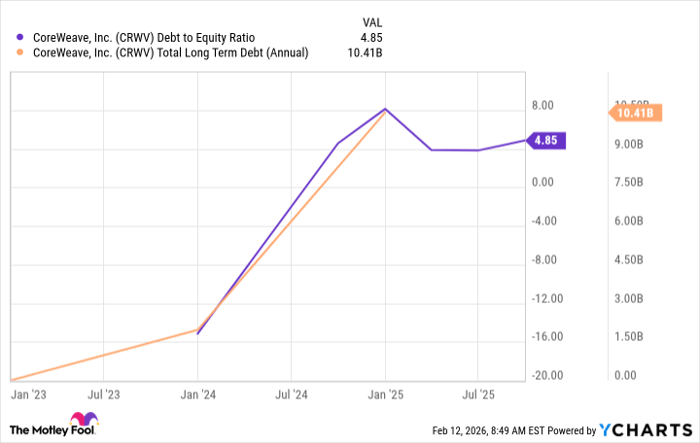

Of course, the one major challenge CoreWeave faces is that, to meet demand for its services, it must invest heavily in infrastructure. And that means taking on more and more debt. This represents a risk, especially considering CoreWeave already is highly leveraged.

CRWV Debt to Equity Ratio data by YCharts

This means CoreWeave isn't the best investment for a cautious investor. But growth investors who accept some risk might consider picking up a few shares of this company as it could continue to win big as the AI boom marches on.

What happens on Feb. 26

Now let's consider the timing of a potential investment. CoreWeave is set to report earnings on Feb. 26 after the market closes. This is well after the earnings reports of many other AI companies, from chip designer Advanced Micro Devices to cloud leader Amazon. And these major players in the AI space each have spoken of soaring demand for AI capacity. Amazon even said it plans $200 billion in capital spending this year, with a focus on its cloud computing arm.

So there's reason to be optimistic about CoreWeave's upcoming report. That said, a positive earnings report may not immediately drive the stock price higher. In recent weeks, investors have worried about the valuations of certain AI stocks, so they have become more cautious about the sector. For example, AMD and Amazon both saw their stock prices fall in the trading session following their reports.

What's an investor to do? Avoid trying to time the market and instead buy a stock when it looks reasonably priced -- and when you're confident about the company's prospects. What I like about this strategy is that it means you don't have to worry about near-term price movement. And if you calculate any particular stock's performance over five or 10 years, it's rare to see a short-term movement truly make a difference in that long-term performance. All of this means that, for growth investors, CoreWeave is a solid stock to buy -- now or after Feb. 26.

Should you buy stock in CoreWeave right now?

Before you buy stock in CoreWeave, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and CoreWeave wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $409,108!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,145,980!*

Now, it’s worth noting Stock Advisor’s total average return is 886% — a market-crushing outperformance compared to 193% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of February 14, 2026.

Adria Cimino has positions in Amazon. The Motley Fool has positions in and recommends Advanced Micro Devices, Amazon, and Nvidia. The Motley Fool has a disclosure policy.