Amazon Just Achieved This Major Milestone That Only 1 Other Company Has Done Since 2001

Key Points

Amazon is reporting double-digit growth across segments, resulting in a 14% increase in sales in the fourth quarter.

It has incredible opportunities in artificial intelligence (AI), but it's investing across its business, including a new type of big-box store type it's planning to open.

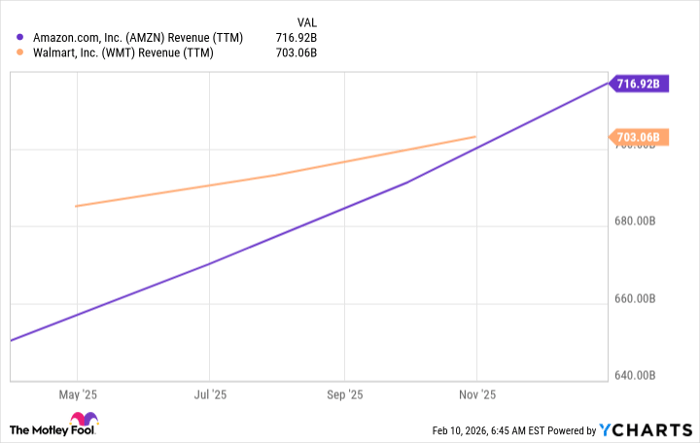

The news passed by largely unnoticed, but with the fourth-quarter results on record, Amazon (NASDAQ: AMZN) has become the largest company in the world by sales. Walmart held that status since it unseated ExxonMobil in 2001. It held on to the title for 25 years, briefly giving it back to the oil giant when oil prices surged.

It was going to happen at some point, and Amazon is finally in the lead.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Amazon.

The largest company in the world

Amazon had nearly $717 billion in 2025 revenue, edging out Walmart in trailing-12-month sales.

AMZN Revenue (TTM) data by YCharts

Despite its gargantuan size, Amazon continues to report double-digit sales growth, which is really an incredible feat. And the growth is coming from all over the business, not just artificial intelligence (AI); online store sales increased 10% year over year in the quarter, with a 23% increase in advertising sales and a 24% increase in Amazon Web Services (AWS) sales. Total sales jumped 14%

The AI business is definitely a major contributor, since it's driving interest in AWS cloud services. It represents the company's greatest opportunities today, but it's a fairly small portion of the total right now. Amazon is still investing in e-commerce, and it's still experimenting with physical stores. It recently closed down all of its Amazon Go and Amazon Fresh stores, and at the same time, it's planning a new big-box store type that's meant to be half retail and half distribution.

Can Walmart take it back?

Walmart reports 2026 fiscal fourth-quarter results (ended Jan. 31) next week. To match Amazon's revenue, it would need another $14 billion, or a 7.7% increase above last year's figure. To overtake it, it would need a higher increase.

This is Walmart's sales growth over the last four quarters:

| Metric | Q4 25 | Q1 26 | Q2 26 | Q3 26 |

|---|---|---|---|---|

| Sales growth YoY | 4.2% | 2.5% | 4.8% | 5.8% |

Data source: Walmart quarterly reports. YoY = year over year.

So it doesn't seem likely that there's going to be competition between them, and Walmart is likely to fall into and stay in second place.

While I wouldn't take that as a vote of no confidence in Walmart, I see it as an extra vote of confidence in Amazon. It's winning across segments and has huge ongoing opportunities, and since the stock tumbled after the fourth-quarter report, now is a great opportunity to buy it on the dip.

Should you buy stock in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $429,385!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,165,045!*

Now, it’s worth noting Stock Advisor’s total average return is 913% — a market-crushing outperformance compared to 196% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of February 13, 2026.

Jennifer Saibil has positions in Walmart. The Motley Fool has positions in and recommends Amazon and Walmart. The Motley Fool has a disclosure policy.