Where Will Palo Alto Networks Be in 1 Year?

Key Points

Palo Alto's growth is slowing but remains ahead of industry averages.

Recent acquisitions and the company's valuation may discourage prospective investors.

Since launching its stock in 2012, Palo Alto Networks (NASDAQ: PANW) has dramatically overperformed the market. Its suite of cybersecurity products helped companies protect networks and devices as innovations such as cloud computing and smartphones dramatically transformed the cybersecurity needs of IT networks.

Unfortunately, cybersecurity has also become a highly competitive industry, and with questions surrounding its growth and recent acquisitions, its stock has struggled over the last year, falling by around 15%. Now the question for investors is whether the stock can get back on track over the next 12 months, or if investors should refrain from adding more shares.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

The state of Palo Alto and its stock

First, investors should understand that most analysts do not regard Palo Alto stock as a sell. Customers continue to turn to its integrated security platforms, and its offerings are adept at turning surging cyber threats into recurring revenue.

To that end, Palo Alto grew its revenue by 16% in the first quarter of fiscal 2026 (ended Oct. 31) and 15% in fiscal 2025. This is ahead of Grand View Research's estimated compound annual growth rate (CAGR) of 12% through 2033 for the cybersecurity industry.

Still, while Palo Alto's growth is ahead of the industry average, it has steadily decelerated from 2023 levels, when revenue grew by 25%. Analysts also expect the gradual slowing of growth to continue, with revenue increases forecast at 14% for fiscal 2026 and 13% in the following fiscal year.

Additionally, it has made some massive acquisitions recently, particularly its $25 billion purchase of CyberArk Software, expected to close in the second half of fiscal 2026. Some analysts question whether it can fully integrate that and Chronosphere, its $3.35 billion acquisition that closed in January.

Furthermore, valuation is a concern. The P/E ratio for the cybersecurity stock stands at 101, and even at a forward P/E of 41, its various earnings multiples are well above the S&P 500 average of 29.

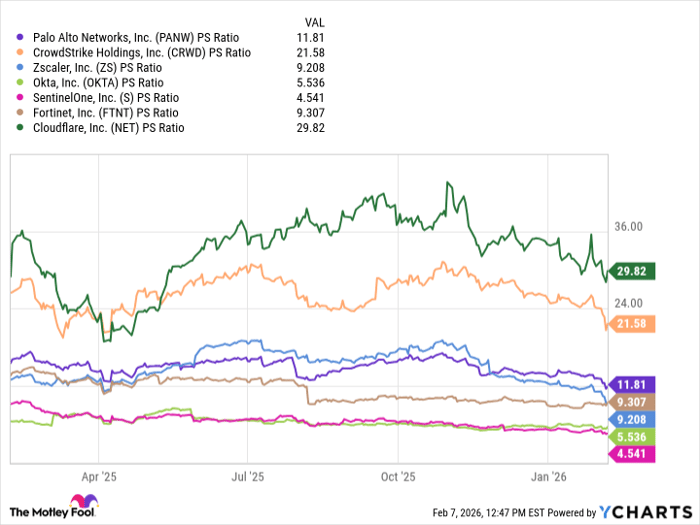

Also, it sells at a price-to-sales (P/S) ratio of around 12. Such a sales multiple is not unusual for a tech growth stock, though that does make it more expensive than most of its peers. Considering the slowing revenue growth, that could cause concerns about whether it can again become a market-beating stock in the near term.

Data by YCharts.

Palo Alto stock in one year

Although Palo Alto stock should move higher in the long run, it will more than likely underperform the S&P 500 over the next year.

Palo Alto should remain a top cybersecurity stock. Unfortunately, its revenue growth has slowed significantly from a few years ago, and analysts expect that deceleration to continue.

Moreover, questions remain as to whether its recent acquisitions will succeed. Considering that its P/S ratio is higher than most of its peers, Palo Alto is offering investors few reasons to add shares at this time.

Should you buy stock in Palo Alto Networks right now?

Before you buy stock in Palo Alto Networks, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Palo Alto Networks wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $443,353!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,155,789!*

Now, it’s worth noting Stock Advisor’s total average return is 920% — a market-crushing outperformance compared to 196% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of February 11, 2026.

Will Healy has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Cloudflare, CrowdStrike, Fortinet, Okta, SentinelOne, and Zscaler. The Motley Fool recommends Palo Alto Networks. The Motley Fool has a disclosure policy.