Why Aehr Test Systems Stock Soared Today

Key Points

Aehr Test Systems' stock jumped as much as 39.7% on news of a major AI chip-testing contract.

The company has signaled the deal for months, but this announcement is the first firm production contract.

The stock now trades at 459 times forward earnings with negative operating margins.

Shares of Aehr Test Systems (NASDAQ: AEHR) took off like a rocket on Wednesday morning, rising as much as 39.7% a few minutes after the opening bell. The stock settled down to a still-impressive 25% increase as of 2 p.m. ET. The price surge lifted Aehr's stock to fresh multi-year highs, all thanks to a new contract in the artificial intelligence (AI) chip-testing space.

Someone important just called Aehr

One of the company's top customers just ordered several Aehr Sonoma test and burn-in systems with shipments scheduled for the summer of 2026. Aehr didn't name the "world-leading hyperscaler," but it's a "premier large-scale data center provider" that also designs high-performance AI accelerator chips.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

This profile narrows the list of possible clients down to the usual hyperscaler suspects, specifically the ones who combine premium-quality hardware designs with massive cloud computing platforms. Aehr has signaled upcoming deals with this particular client for months, but this is a firm contract with real revenue attached.

The company didn't release financial details on this deal, but it should make a significant impact on Aehr's top and bottom lines as early as Q2 2026.

"We believe this initial production order positions Aehr very well for high-volume system and consumable shipments later this year and into 2027," said CEO Gayn Erickson.

Image source: Getty Images.

Wall Street loves the AI connection

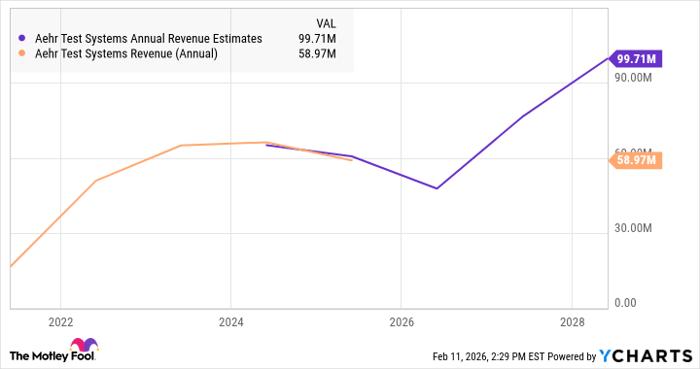

The new contract moves Aehr closer to the epicenter of the ongoing AI boom. And Wall Street has taken notice. The stock is up by 238% over the last year and trades at 459 times forward earnings estimates. That's a lot, especially for a company with negative operating margins and negative revenue trends. Investors are baking huge growth expectations into the stock price.

AEHR Annual Revenue Estimates data by YCharts

One large contract could be enough to drive Aehr's stock even higher as the AI surge continues to play out. However, I'd be more impressed if the company could follow up with additional deals across the hyperscaler sector. Otherwise, I'd prefer more profitable rivals with lower-priced stocks.

Should you buy stock in Aehr Test Systems right now?

Before you buy stock in Aehr Test Systems, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Aehr Test Systems wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $443,353!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,155,789!*

Now, it’s worth noting Stock Advisor’s total average return is 920% — a market-crushing outperformance compared to 196% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of February 11, 2026.

Anders Bylund has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.