Analog Devices Inc Stock Moved Up by 3.44% on Feb 11: A Full Analysis

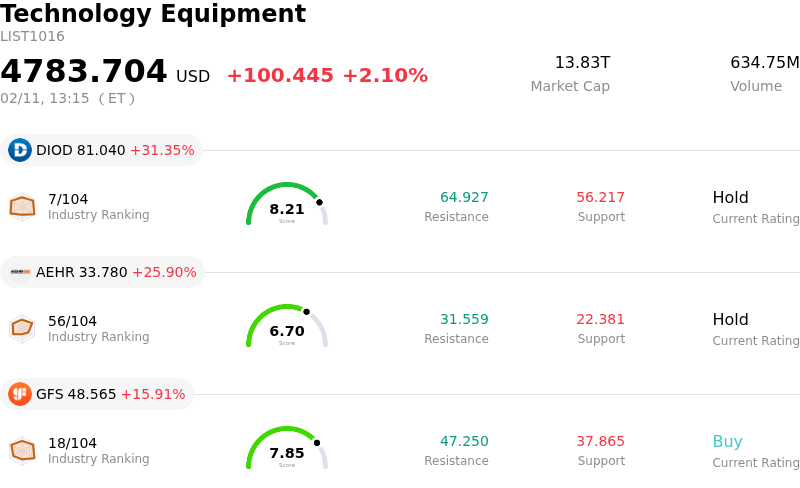

Analog Devices Inc (ADI) moved up by 3.44%. The Technology Equipment industry is up by 2.10%. The company outperformed the industry. Top 3 gainers of the industry: Diodes Inc (DIOD) up 31.35%; Aehr Test Systems (AEHR) up 25.90%; GlobalFoundries Inc (GFS) up 15.91%.

Analog Devices (ADI) experienced significant upward momentum and intraday volatility, reflecting strong investor sentiment in anticipation of its upcoming Q1 2026 earnings report and a series of positive analyst revisions. The company is scheduled to announce its first-quarter fiscal year 2026 results on February 18, 2026, and analysts are forecasting a year-over-year increase in both earnings per share and revenue. This builds on ADI's consistent history of beating consensus estimates, including its Q4 2025 performance where it surpassed EPS and revenue expectations.

Contributing to the positive price action were several recent analyst upgrades and increased price targets. Notably, UBS raised its price target to $400 from $320 on February 9, maintaining a Buy rating, citing strong positioning in key growth markets such as data centers, aerospace and defense, and test and instrumentation. Other firms, including TD Cowen, Stifel, and Wells Fargo, also recently raised their price targets and reiterated positive ratings, indicating growing confidence in ADI's revenue growth trajectory and a cyclical recovery in the analog semiconductor sector. These upward revisions signal a bullish outlook from institutional research, further fueling investor interest.

The broader semiconductor industry is also experiencing robust growth, primarily driven by escalating demand for artificial intelligence (AI) applications. Global semiconductor sales are projected to reach a historic peak of $975 billion in 2026, benefiting companies like Analog Devices that are key players in this sector. This favorable industry dynamic, combined with ADI reaching new all-time and 52-week highs during the trading day, underscores strong investor confidence in the company's market position and future prospects. The intraday volatility likely reflects active trading around these new high levels and the impending earnings release.

Technically, Analog Devices Inc (ADI) shows a MACD (12,26,9) value of [9.71], indicating a buy signal. The RSI at 68.28 suggests neutral condition and the Williams %R at -9.58 suggests oversold condition. Please monitor closely.

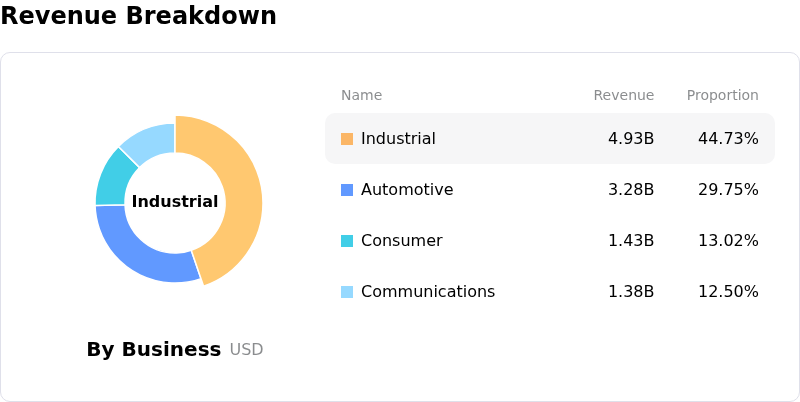

Analog Devices Inc (ADI) is in the Technology Equipment industry. Its latest annual revenue is 11.02B, ranking 17 in the industry. The net profit is 2.27B, ranking 12 in the industry. Company Profile

Over the past month, multiple analysts have rated the company as BUY, with an average price target of 310.98, a high of 400.00, and a low of 155.00.

Company Specific Risks:

- Analog Devices experienced a 20 basis point quarter-over-quarter decline in gross margin, compounded by challenges from weak end-market demand, excess inventory, rising inflation, and deteriorating business confidence.

- Revenue growth is slower than anticipated in critical sectors, including 5G wireless and automotive, with a projected 12% quarter-over-quarter decline specifically in automotive revenue.

- The company's elevated stock valuation relative to peers and fair value estimates introduces execution risk ahead of the upcoming Q1 2026 earnings report, particularly given recent analyst commentary highlighting broader end-market softness and below-average returns on capital.

- Planned price increases of 10-30% across a broad product portfolio, effective February 1, 2026, aimed at offsetting rising raw material and operational costs, carry the risk of customer resistance and potential demand contraction in a sensitive market environment.