Prediction: Edge Computing Will Define Tech Winners in 2026

Key Points

Just as data centers become the AI industry’s hottest trade, a whole new hot button is already materializing.

It’s artificial intelligence itself, however, that’s making this aspect of the AI movement worth a closer look now.

There are really only one or two names right now that stand to dramatically benefit from the rise of next-generation edge computing solutions.

The early stages of the artificial intelligence (AI) revolution put hardware companies like Nvidia in the spotlight, and more recently, data centers have taken center stage as AI's top investment opportunity. But what's the next big thing for the business?

I predict it will be edge computing, which only offers a limited number of ways to play it.

Will AI create the world's first trillionaire? Our team just released a report on the one little-known company, called an "Indispensable Monopoly" providing the critical technology Nvidia and Intel both need. Continue »

What the heck is edge computing?

In simplest terms, edge computing is computing work that needs to be done, but not work that's important or urgent enough to be handled by a personal device like a smartphone or laptop, yet also work that isn't worth offloading to a remote server.

Wearables, security camera systems capable of facial recognition, self-driving vehicles, and so-called "smart" utility meters are all examples of edge computing devices. They handle tasks that can only be done with a true computer processor, but they don't consume valuable broadband bandwidth -- on-device computing (where it's utilized) is adequate.

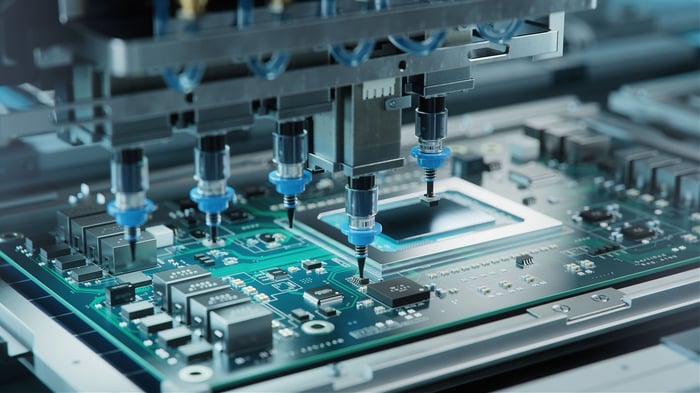

Image source: Getty Images.

It's not exactly a new idea. You've likely not noticed its adoption because the whole point is not needing human involvement. Well, that, and the fact that the idea never caught on quite as much as first anticipated.

As you might imagine, though, the advent of AI-capable processors is changing this. Edge computing work that wasn't possible before is now a reality. That's why technology market research outfit Technavio expects the global AI edge computing industry to grow at an average annualized pace of nearly 32% through 2029, although it's sure to keep growing well thereafter.

Naming edge computing names

Great, but which stocks should investors consider to capitalize on this growth?

The usual suspects like Amazon (NASDAQ: AMZN) and Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) are in the business. Amazon, for instance, offers edge computing tools to retailers looking for better in-store efficiency.

It's less prolific names like Broadcom (NASDAQ: AVGO) and Qualcomm (NASDAQ: QCOM), however, that may have the most to gain from this next chapter of AI's proliferation.

Take Broadcom's new eighth-generation Wi-Fi 8 transmitter and receiver tech. The underlying chipsets are the industry's first to allow a device like a wireless access point or antenna/switch to truly function as a machine-learning neural network for a factory, campus, or other enterprise-level facility without uploading all of the information these devices collect to a remote server where it's then processed.

Qualcomm may have even more to gain from the mainstreaming of AI at the edge of the cloud, though. Its newest Snapdragon processors found in laptops as well as smartphones are AI-capable in and of themselves, technically already qualifying them as edge-based artificial intelligence devices.

However, the company also envisions uses like driver assistance systems, predictive maintenance, traffic management, and factory optimization (just to name a few), as well as what it calls an "ecosystem of you" that can turn all of your tech into an omnipresent personal assistant.

AI's newest centerpiece?

These aren't the only edge AI prospects, of course, and perhaps not even the best ones. Regardless, this is an aspect of the AI movement you can't afford to ignore. As Qualcomm CEO Cristiano Amon recently explained in an interview with the Wall Street Journal, "the biggest opportunity [of 2026] ... is the opportunity that exists on the edge." He then went on to say at Davos that "I have this view that at the end of the day, the winner of the edge is going to be the winner of the AI race."

He may be biased, but that doesn't make him wrong. Indeed, given what we know about the technology, he's likely to be right.

Should you buy stock in Qualcomm right now?

Before you buy stock in Qualcomm, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Qualcomm wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $443,353!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,155,789!*

Now, it’s worth noting Stock Advisor’s total average return is 920% — a market-crushing outperformance compared to 196% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of February 11, 2026.

James Brumley has positions in Alphabet. The Motley Fool has positions in and recommends Alphabet, Amazon, Nvidia, and Qualcomm. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.