The Stock Market's Paradoxical Doomsday: Artificial Intelligence Is Running Out of Gas yet Bound to Replace Software

Key Points

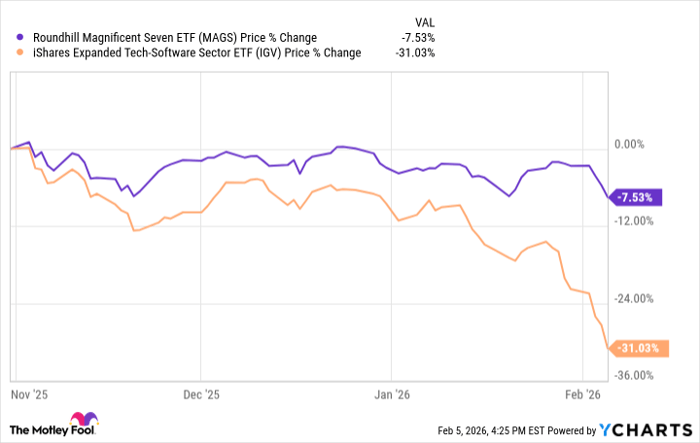

Artificial Intelligence stocks have gotten off to a tough start to the year, due to ongoing concerns about capital expenditures, valuations, and diminishing returns.

Meanwhile, software stocks have collapsed on concerns that AI will significantly disrupt the industry.

Can both really be true?

Heading into the year, investors had concerns about artificial intelligence (AI) stocks. Valuations were high, and the hyperscalers are each planning to pour hundreds of billions into AI-related capital expenditures this year. Investors began to question whether this kind of capex would truly yield worthwhile returns. The group sold off.

In recent weeks, software stocks have also crashed, largely due to concerns that AI can easily replicate or disrupt software-as-a-service (SaaS) products, business models, and margins. The combination of these two dynamics has resulted in a paradoxical doomsday of sorts: AI may be running out of gas, yet it is also going to disrupt software as we know it.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

Can AI really be struggling and disrupting software at the same time?

The issue for AI is that large tech companies like those in the "Magnificent Seven" have spent heavily on AI-related capex, yet the market is unsure whether the returns will pan out. For one, there is the issue of resources. AI runs on massive datasets and is powered by data centers. These data centers consume resources like power and fresh water to cool the chips in the data centers.

A report published by the Lawrence Berkeley National Laboratory in December 2024 found that by 2028, over half of the power being used by data centers will be for AI, which could consume enough electricity equivalent to 22% of all U.S. households. Another report published by the consulting firm McKinsey last year estimated that there would need to be $6.7 trillion in spending on data centers by 2030 to keep pace with the demand for computing power.

Meanwhile, the latest models from OpenAI's ChatGPT have faced criticism, leading investors to wonder whether all this spending will yield significantly better models. This, coupled with high valuations, has triggered a sell-off in recent months.

But at the same time, software stocks have been crushed on the threat of AI. More recently, Anthropic developed a new agentic AI tool called Claude Cowork, which can connect to files that a user grants access to and be prompted to complete a range of non-coding tasks on one's computer. This has led the market to believe that AI tools like this could eventually render many software models and tools obsolete.

Data by YCharts.

Still, the idea that AI investments will not pan out, yet AI will significantly disrupt software, "cannot occur at once," according to Bank of America's Vivek Arya. "AI models provide unprecedented levels of intelligence, yet harnessing and productizing that intelligence will take time, likely the next several years," Arya said in a research note, according to Barrons.

Is this a doomsday for software or a reset?

While investors have clearly been selling first and asking questions later, there are likely to be winners and losers. AI will certainly disrupt many software companies. However, there will also be plenty of software companies well-positioned to leverage AI and enhance their business models. There are already plenty of software companies that have partnered with major AI companies.

So I do think that some of this selling might be overdone. That said, this is more than likely a rerating of the sector as a whole. AI is going to enable companies and people to build software solutions much more quickly, which is likely to remove the big moats that some of these software players previously had and likely erode margins. The days of monster valuations, when unprofitable SaaS companies trade at 15 or 30 times revenue, could be coming to an end.

I suspect that, over time, the bridge between AI and software will converge until the two are indiscernible, but as seen in recent weeks, not all transitions are smooth or pleasant.

Where to invest $1,000 right now

When our analyst team has a stock tip, it can pay to listen. After all, Stock Advisor’s total average return is 918%* — a market-crushing outperformance compared to 196% for the S&P 500.

They just revealed what they believe are the 10 best stocks for investors to buy right now, available when you join Stock Advisor.

*Stock Advisor returns as of February 10, 2026.

Bank of America is an advertising partner of Motley Fool Money. Bram Berkowitz has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.