The Best Small-Cap Value ETF to Invest $100 in Right Now

Key Points

Small-cap value stocks are knocking the cover off the ball this year.

It's an investing combination that rewards over the long term.

This ETF offers investors some interesting advantages.

Thanks to inflation, $100 doesn't sound like much these days, but there's another way for investors to look at that amount. Consider it as a seed to be planted and, when tended to, one that will grow and bear fruit.

Here's how to put $100 to work right now. A fine idea is small-cap value stocks, particularly when considering the Russell 2000 and the S&P SmallCap 600 indexes are both sporting double-digit year-to-date percentage gains.

Will AI create the world's first trillionaire? Our team just released a report on the one little-known company, called an "Indispensable Monopoly" providing the critical technology Nvidia and Intel both need. Continue »

For investors who don't want to pick individual stocks in the small-cap value arena, the good news is that this asset class is accessible via a slew of exchange-traded funds (ETFs), including the Dimensional US Small Cap Value ETF (NYSEMKT: DFSV).

Investors looking to put $100 to work might like this ETF. Image source: Getty Images.

With this ETF, DNA matters

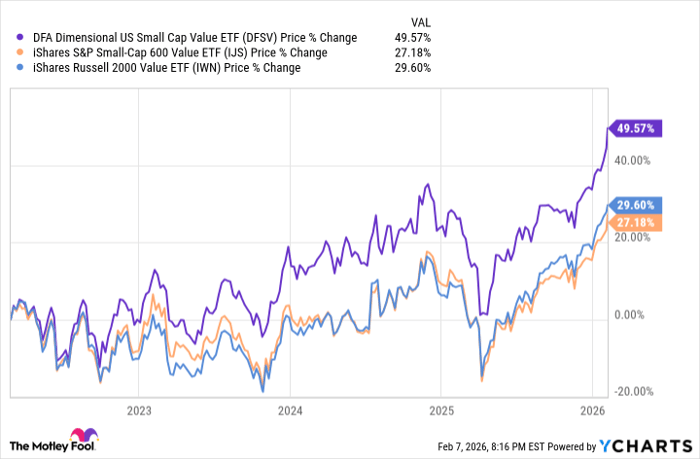

This $7 billion small-cap value ETF turns four years old later this month, and while that's young compared to plenty of the legacy funds in the category, the Dimensional fund is off to an impressive start, soundly outpacing some of the most well-known ETFs tracking the aforementioned small-cap value benchmarks.

The Dimensional fund is proof positive that active stock-picking can serve investors well in the small-cap value space. In fact, this factor combination arguably lends itself to active management because the universe of smaller equities is, in the eyes of some experts, littered with pricing inefficiencies, and these stocks often lack sell-side analyst coverage comparable to larger peers.

Another perk offered by this ETF's management style is that it puts investors on the right side of the small-cap profitability equation. This corner of the equity market is littered with companies that aren't profitable, many of which aren't close to getting there. In the value realm, those are called value traps, and active management can mitigate exposure to those financially flimsy firms.

Something else to consider with the Dimensional ETF is that it's the ETF offshoot of a mutual fund, but not just any old mutual fund. This ETF's "parent" is the DFA US Small Cap Value Portfolio, a mutual fund that's been around since March 1993 and is considered one of the best funds of any type in the small-cap value category. The ETF's returns aren't guaranteed to match those of the mutual fund, but its lineage is a point in favor of the former.

What makes this ETF tick

For an investor who wants to put $100 to work with ETFs and is on the fence, one more factor to consider is the fund's fee. The Dimensional small-cap value ETF's expense ratio is 0.30% per year, which is decent among actively managed funds, but above some of its passive rivals.

In this case, the fee shouldn't be a deterrent because investors get, well, value with this ETF. For example, the portfolio's average profitability beats that of the Russell 2000 Value index, potentially providing a long-term tailwind for buy-and-hold investors.

This ETF's "secret sauce" includes limited exposure to the capital-intensive real estate and utilities sectors, the latter of which Dimensional views as lacking significant upside potential due to the group's status as a regulated industry.

Should you buy stock in Dimensional ETF Trust - Dimensional Us Small Cap Value ETF right now?

Before you buy stock in Dimensional ETF Trust - Dimensional Us Small Cap Value ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Dimensional ETF Trust - Dimensional Us Small Cap Value ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $439,362!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,164,984!*

Now, it’s worth noting Stock Advisor’s total average return is 918% — a market-crushing outperformance compared to 196% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of February 10, 2026.

Todd Shriber has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.