Prediction: This Popular Cryptocurrency Will Plunge 50% (or More) by Year-End 2026

Key Points

Investors are fleeing speculative cryptocurrencies and rotating capital elsewhere.

Dogecoin has witnessed pronounced selling pressure over the last few months.

Dogecoin lacks the same investment thesis compared to larger, mainstream crypto assets.

The cryptocurrency market is really taking it to the shins right now. Just a little over a month into 2026, popular assets such as Bitcoin, Ethereum, and XRP, as well as mainstream cryptocurrency stocks Robinhood Markets and Coinbase are all lagging the broader market.

While this may be disorienting for some investors, I remain confident in each of the names above. By contrast, another plummeting member of the crypto realm, Dogecoin (CRYPTO: DOGE), may not fare as well as its peers.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Let's explore what makes Dogecoin different than the companies and tokens referenced above and assess why it could be headed for further selling pressure.

Image source: Getty Images.

What is Dogecoin?

Back in 2013, software engineers Billy Markus and Jackson Palmer created Dogecoin. Unlike Ethereum or XRP, though, Dogecoin's origins don't really lie in disrupting digital commerce. Moreover, Dogecoin has an unlimited supply -- making it starkly different than Bitcoin, which will only ever have 21 million coins.

In reality, Dogecoin was created in response to a then-viral internet meme featuring a Shiba Inu dog. It is not a store of value, nor is it considered an innovative feature within the rapidly evolving fintech ecosystem.

What is Dogecoin used for?

Broadly speaking, cryptocurrency is yet to be widely adopted as a form of payment. While some businesses accept Bitcoin and some banks leverage XRP, the volume of crypto transactions are nowhere near that of fiat currency.

Given its extreme lack of utility, it shouldn't be surprising that Dogecoin's application in the real world is almost nonexistent. Industry data suggests that only about 2,000 businesses worldwide accept Dogecoin in some capacity.

Against this backdrop, Dogecoin has no appeal to institutional backers. Rather, the altcoin is a staple among speculative day traders and retail investing communities known as the "Doge Army." In this sense, Dogecoin's volatility is used for quick trading and entertainment as opposed to long-term portfolio durability.

Where is Dogecoin headed?

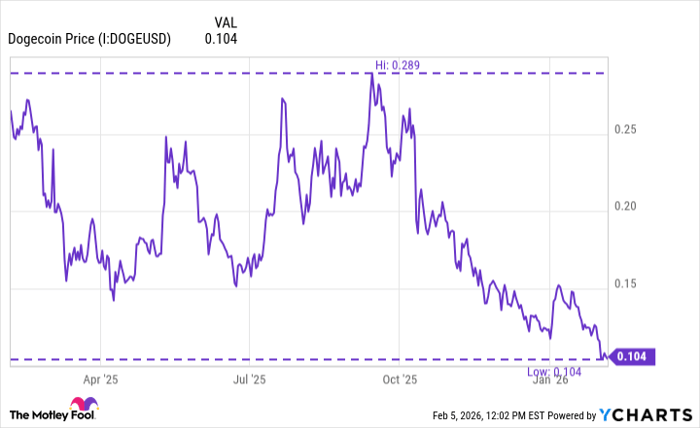

As of this writing, Dogecoin's price of $0.10 is its lowest in a year. Moreover, its price has slid dramatically over the last three months -- plummeting by 64%.

Dogecoin Price data by YCharts

Predicting asset prices accurately is often an exercise in false precision. But when it comes to cryptocurrency in particular, relying on technical analysis is often even more misguided. This is especially true when it comes to meme coins.

Investors have no idea when the next viral narrative will surface on the internet and spark a crypto rally. Given Dogecoin's lack of institutional appeal, trivial presence in decentralized finance (DeFi), and its ongoing selling pressure, I see the token headed for further losses.

To me, there is no strategic value in owning Dogecoin. Even if you're open to the idea of alternative assets or speculation, smart investors understand there are far better asymmetric opportunities in those regards.

By the end of 2026, I think Dogecoin could revert toward its five-year lows of $0.05 -- perhaps even lower.

Should you buy stock in Dogecoin right now?

Before you buy stock in Dogecoin, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Dogecoin wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $443,299!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,136,601!*

Now, it’s worth noting Stock Advisor’s total average return is 914% — a market-crushing outperformance compared to 195% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of February 9, 2026.

Adam Spatacco has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Bitcoin, Ethereum, and XRP. The Motley Fool recommends Coinbase Global. The Motley Fool has a disclosure policy.