IonQ's Growth Story Is Just Beginning. Here's What Investors Should Know.

Key Points

IonQ quickly assembled technology to address quantum computing's shortcomings through acquisitions.

The company is seeing revenue growth with third-quarter sales up 222% year over year.

IonQ is not profitable as its net loss exceeded $1 billion in Q3.

Wall Street's excitement over quantum computing's potential drove up IonQ (NYSE: IONQ) shares in 2025. The stock soared to a 52-week high of $84.64 in October.

But the situation has changed in 2026. Year to date, IonQ stock is down 14% through Feb. 3. This creates a buy opportunity, because IonQ's growing business is just getting started.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Here's a deeper look into this pure-play quantum computer company to understand the factors that make it a compelling long-term investment.

Image source: Getty Images.

IonQ's robust quantum solution

IonQ quickly expanded its technology in recent years through strategic acquisitions. It now claims it's the sole company to possess a vertically integrated full-stack quantum platform. This means its solutions encompass key end-to-end elements for delivering quantum tech, ranging from quantum computer chip manufacturing to the necessary software.

And the company isn't done. In January, it added more acquisitions to its collection of companies. One is Skyloom, which strengthens IonQ's ability to build a scalable quantum computer network.

This is no small feat. Quantum machines encode data onto qubits, the fundamental units of quantum information, akin to a classical computer's bits. But qubits are fragile, so transmitting quantum data across long distances is difficult.

Skyloom, coupled with other acquisitions such as Lightsynq, can help to solve this challenge by allowing IonQ to control the entire end-to-end data flow in a quantum network.

Along with Skyloom, IonQ announced the acquisition of SkyWater Technology, the largest pure-play semiconductor foundry operating exclusively in the U.S. The move was made to enhance IonQ's supply chain, enabling faster quantum chip fabrication.

Its other major 2026 addition was Seed Innovations, which will help IonQ develop artificial intelligence (AI)-powered software to scale quantum computer tasks through automation. Each of these acquisitions strengthens IonQ's platform with new capabilities, as well as helping it overcome challenges inherent in the industry.

For instance, quantum computers are delicate machines prone to calculation errors. Last year's acquisition of Oxford Ionics, an expert in improving the accuracy of quantum computations, assists with overcoming this critical blocker to widespread adoption.

In October, IonQ achieved a world record for its quantum machine's accuracy. The company predicts its devices will go from supporting 256 qubits in 2026 to over a million qubits by 2030. The higher the number of qubits, the greater the quantum computer's computational power.

IonQ's financial situation

The strength of IonQ's technology is validated by its growing sales. In the third quarter, its revenue rose 222% year over year to $39.9 million.

Despite the accomplishments, IonQ's stock is down in 2026 due in part to mounting losses. While the acquisitions build up IonQ's quantum computing suite, the costs weigh on its financials.

In Q3, the company's operating expenses rose to $208.7 million compared to $65.5 million in 2024. This resulted in an operating loss of $168.8 million, a significant increase from the prior year's loss of $53.1 million.

Compounding the issue is the company's issuance of warrants as a means of raising funds. In Q3 2025, the value of those warrant liabilities resulted in IonQ posting an astronomical $1.1 billion net loss, a massive jump up from 2024's loss of $52.5 million.

Fortunately, IonQ possesses a strong balance sheet. After performing an equity offering last July and again in October, the pure-play quantum provider boasted cash and equivalents of $3.5 billion and no debt as of Nov. 4.

The lack of debt is important, since it means the company doesn't have the added cost of interest payments. This allows more income to go toward the research needed to evolve its quantum computers.

Time to buy IonQ stock?

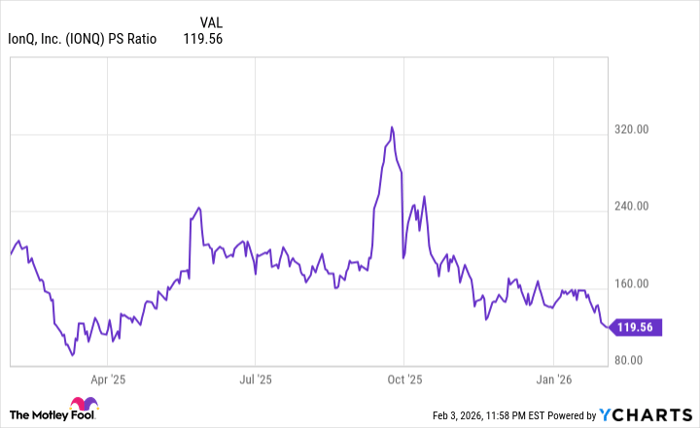

Given its potential in the quantum computing sector, IonQ's share-price drop presents a possible buying opportunity. Its stock has sported a high valuation for some time, as evidenced by its price-to-sales (P/S) ratio, which played a factor in the recent price decline.

IONQ PS Ratio data by YCharts.

As the chart shows, IonQ's sales multiple has come down dramatically from the lofty valuation reached in October. It's still not in bargain territory, but given IonQ's impressive platform, and quantum computing's potential to reshape the tech industry, now isn't be a bad time to pick up shares.

With IonQ's tech poised to deliver the much-hyped potential of quantum computers, the company is well positioned for continued revenue growth. In fact, IonQ expects to wrap up 2025 with sales between $106 million and $110 million, an impressive increase over 2024's $43.1 million. And thanks to its acquisitions, the company looks poised for greater growth in the years ahead.

Should you buy stock in IonQ right now?

Before you buy stock in IonQ, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and IonQ wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $443,299!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,136,601!*

Now, it’s worth noting Stock Advisor’s total average return is 914% — a market-crushing outperformance compared to 195% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of February 8, 2026.

Robert Izquierdo has positions in IonQ. The Motley Fool has positions in and recommends IonQ and SkyWater Technology. The Motley Fool has a disclosure policy.