Here's How Micron Technology, AMD, and Nvidia Could Help This Magnificent ETF Turn $500 Per Month Into $1 Million

Key Points

The iShares Semiconductor ETF holds 30 of the world's best semiconductor stocks, and it has produced blistering returns over the last decade.

Its top three holdings are Micron Technology, AMD, and Nvidia, which are three of the largest suppliers of AI chips and components.

The iShares Semiconductor ETF could turn a consistent investment of $500 per month into $1 million in as little as 25 years, even if its returns slow.

Without advanced chips, networking equipment, and other hardware, we wouldn't have computers, smartphones, cloud computing, or artificial intelligence (AI). Plus, emerging innovations like quantum computing, robotics, and self-driving vehicles would remain nothing more than science fiction.

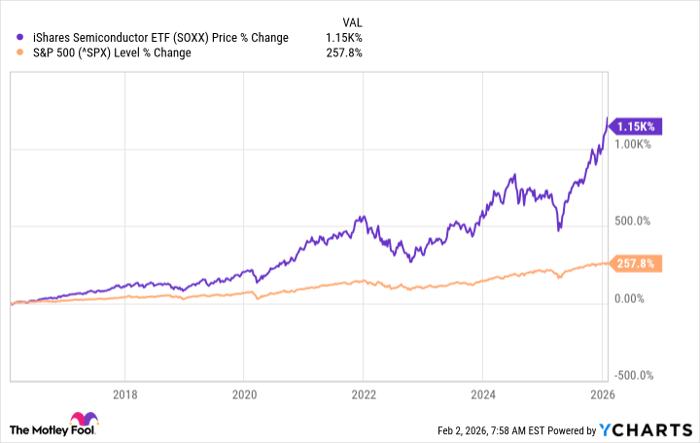

History suggests investing in the semiconductor industry tends to yield significant rewards over the long term. The iShares Semiconductor ETF (NASDAQ: SOXX) is an exchange-traded fund (ETF) that holds 30 of the world's most dominant semiconductor stocks, and it has delivered a return of 1,150% over the last decade. That was four times higher than the return in the S&P 500 over the same period.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Micron Technology (NASDAQ: MU), Advanced Micro Devices (NASDAQ: AMD), and Nvidia (NASDAQ: NVDA) are among the largest holdings in the iShares ETF, and they have made significant contributions to its historical returns. Looking ahead, here's how they can help the fund turn a consistent investment of $500 per month into $1 million over the long run.

Image source: Getty Images.

Nvidia, AMD, and Micron have experienced blistering growth

The iShares Semiconductor ETF invests exclusively in U.S.-listed companies that design, manufacture, and distribute chips and components, with a special focus on those supplying the AI boom. As a result, it doesn't offer much in the way of diversification, so investors should buy it only as part of a diversified portfolio of other ETFs and individual stocks.

As I touched on earlier, Micron, AMD, and Nvidia are the three largest holdings in the ETF, accounting for 23.6% of the value of its entire portfolio on their own:

|

Stock |

iShares ETF Portfolio Weighting |

|---|---|

|

1. Micron Technology |

8.82% |

|

2. Advanced Micro Devices |

7.43% |

|

3. Nvidia |

7.37% |

Data source: iShares. Portfolio weightings are accurate as of Jan. 30, 2026, and are subject to change.

Micron supplies high-bandwidth memory chips for use in a data center, and Nvidia and AMD have embedded the semiconductors in their latest graphics processing units (GPUs, the primary chips used in AI development). The company is also experiencing a surge in demand for memory and storage chips for personal computers and smartphones, where AI workloads are gradually migrating.

Nvidia's GPUs remain the top choice among AI developers, because they deliver best-in-class performance. But AMD will launch a new data center rack this year called Helios, which will be fitted with its latest MI450 GPUs, and it's expected to help the company close the gap to Nvidia.

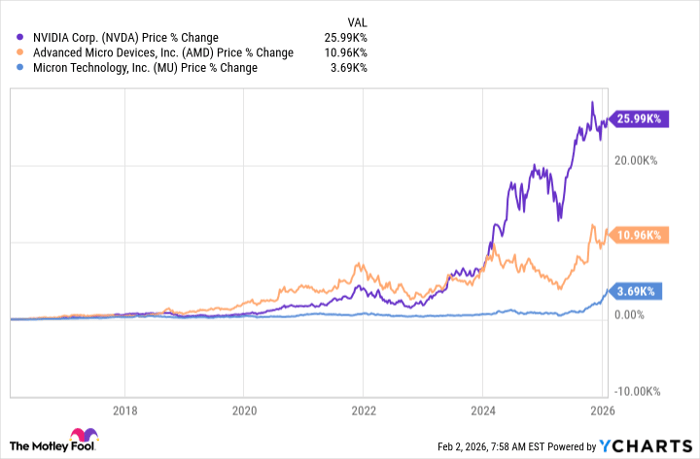

These three companies are a big reason the iShares ETF consistently produces market-beating returns. Over the last 10 years, the worst performer of the group is Micron, which still soared by a staggering 3,690% -- or a multiple of almost 37 times:

I also want to mention a couple of other powerhouses that could make meaningful contributions to the future returns of the iShares ETF:

- Broadcom: Its AI accelerators (data center chips) have become popular alternatives to GPUs because they can be fully customized to suit specific workloads. The company also supplies some of the best networking equipment for regulating how fast data travels between chips and devices in AI applications.

- Taiwan Semiconductor Manufacturing: This is the largest semiconductor fabrication company in the world. It manufactures around 90% of all advanced chips across the entire industry, including those designed by Nvidia and AMD.

Turning $500 per month into $1 million

The iShares Semiconductor ETF has delivered a compound annual return of 12.2% since its inception in 2001, and an accelerated annual return of 27.3% over the last decade specifically, thanks to soaring demand for chips from cloud providers and AI developers.

Here's how long it might take the iShares ETF to turn a consistent investment of $500 per month into $1 million, based on three different average annual returns:

|

Monthly Investment |

Compound Annual Return |

Time To Reach $1 Million |

Total Deposits |

|---|---|---|---|

|

$500 |

12.2% |

25 years and 2 months |

$151,500 |

|

$500 |

19.7% (midpoint) |

18 years |

$108,500 |

|

$500 |

27.3% |

14 years and 2 months |

$85,500 |

Calculations by author.

It isn't realistic to expect this ETF (or any fund) to deliver a blistering annual return of over 27% forever, because the law of large numbers eventually leads to some crazy math. For example, Nvidia is a $4.6 trillion company as I write this, but it would be worth $51 trillion a decade from now if it grew by 27.3% per year. For some perspective, the output of the entire U.S. economy was just $30.6 trillion in 2025.

But per the table above, the iShares Semiconductor ETF could turn $500 a month into $1 million in 25 years even if its annual return reverted back to its more modest long-term average of 12.2%.

With that said, I think the ETF could deliver accelerated returns for at least the next few years based purely on the incredible demand for chips for AI. According to Nvidia CEO Jensen Huang, data center operators could be spending $4 trillion annually on AI infrastructure by 2030, which is a huge opportunity for his company, but also other market leaders like AMD and Micron.

Even when the AI build-out eventually slows down, I think newer innovations like quantum computing, robotics, and autonomous vehicles will pick up the slack. Each of those technologies will require a substantial amount of computing power, taking semiconductor demand to new heights.

Should you buy stock in iShares Trust - iShares Semiconductor ETF right now?

Before you buy stock in iShares Trust - iShares Semiconductor ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and iShares Trust - iShares Semiconductor ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $443,299!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,136,601!*

Now, it’s worth noting Stock Advisor’s total average return is 914% — a market-crushing outperformance compared to 195% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of February 8, 2026.

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Micron Technology, Nvidia, Taiwan Semiconductor Manufacturing, and iShares Trust-iShares Semiconductor ETF. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.