This Stock Up Over 900% in 10 Years Looks Like a Genius Buy Right Now

Key Points

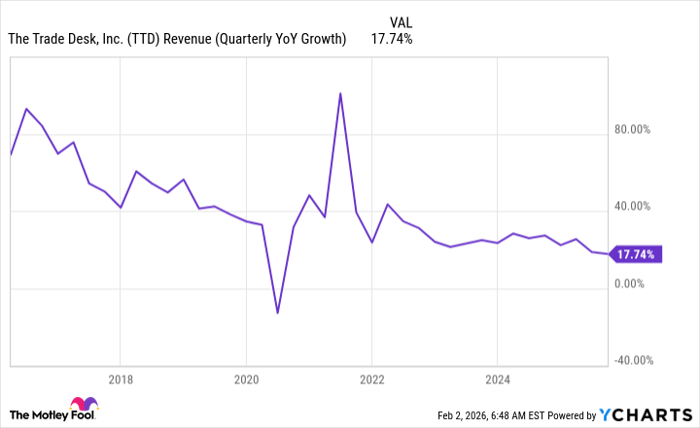

The Trade Desk is still growing its revenue at a strong rate.

The stock is cheaper than it has ever been before.

Rising 900% over the past decade is a feat that few stocks accomplish. However, thanks to a recent sell-off, this figure is a lot lower than it used to be for one stock. At its peak, The Trade Desk (NASDAQ: TTD) stock was up an incredible 4,500%, but that's no longer the case.

Huge sell-offs don't happen all that often for The Trade Desk stock, but we're at a point that has never been seen for the stock before. It's down nearly 80% from its all-time highs, but I think this stock could be a great turnaround investment in 2026.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

While it may be many years before it returns to all-time highs, I think the stock is far too cheap to ignore and can deliver market-crushing returns this year.

Image source: Getty Images.

The Trade Desk's ad dominance is waning

The Trade Desk operates a buy-side ad platform, which helps place its clients' ads in the most opportune location on the internet. The Trade Desk has partnerships with connected TV platforms, websites, podcasts, and many other places that allow clients to place their ads on the internet, but its growth has slowed.

The Trade Desk's revenue growth rate was at the lowest level during Q3, outside of one COVID-19-affected quarter.

TTD Revenue (Quarterly YoY Growth) data by YCharts

Still, 18% is market-beating growth, and Wall Street expects 16% growth in 2026. That's not nearly as bad as the stock price indicates, so there may be an investment opportunity here.

Part of the reason why The Trade Desk's growth slowed is rising competition. Some of its clients moved ad placement in-house, while there has also been market share taken by Amazon (NASDAQ: AMZN), as clients can place ads for their products directly on a platform where consumers are looking to buy.

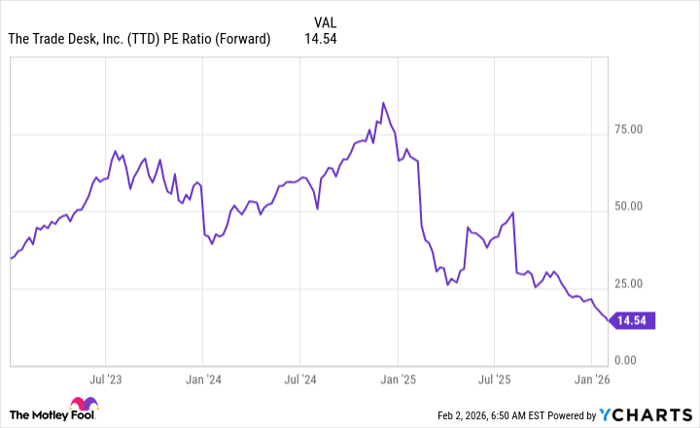

The Trade Desk's ceiling has certainly declined from where investors thought it could be, thus the sell-off. However, the stock is far too cheap now, and trades for less than 15 times forward earnings.

TTD PE Ratio (Forward) data by YCharts

Normally, a stock trading for this valuation is shrinking, not growing its revenue at a mid-double-digit pace. I think this makes for a prime buying opportunity, as it's not often you can scoop up a high-quality company like The Trade Desk at this much of a discount to the broader market.

It may take some time for The Trade Desk's stock to recover, but I still think it's well positioned to take advantage of the shifting ad market over the next decade. As a result, it's a great stock to buy on the dip.

Should you buy stock in The Trade Desk right now?

Before you buy stock in The Trade Desk, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and The Trade Desk wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $443,299!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,136,601!*

Now, it’s worth noting Stock Advisor’s total average return is 914% — a market-crushing outperformance compared to 195% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of February 8, 2026.

Keithen Drury has positions in Amazon and The Trade Desk. The Motley Fool has positions in and recommends Amazon and The Trade Desk. The Motley Fool has a disclosure policy.