1 Reason Microsoft Stock Could Outperform the Market in 2026

Key Points

Azure is Microsoft's fastest-growing segment.

Microsoft doesn't give out a ton of information about Azure's finances.

Microsoft (NASDAQ: MSFT) hasn't had a great start to 2026. Its stock recently was down 11% for the year, with the bulk of that fall coming after its second-quarter fiscal year 2026 earnings report, when it declined 10% in a single day.

This decline will make it difficult to outperform the market in 2026, as the stock doesn't get the benefit of starting at its current low price tag. It must make up the ground it has lost. The S&P 500 (SNPINDEX: ^GSPC) is up a mere 1%, so it doesn't have a ton to make up. Still, it won't be easy for Microsoft.

Will AI create the world's first trillionaire? Our team just released a report on the one little-known company, called an "Indispensable Monopoly" providing the critical technology Nvidia and Intel both need. Continue »

However, I think there's one clear reason why Microsoft can still outperform the market in 2026, and it all revolves around Azure.

Image source: Getty Images.

Cloud computing is the key to AI

Azure is Microsoft's cloud computing division. Cloud computing plays a huge role in AI, as upstarts and developers cannot afford to build a massive data center filled with the necessary computing equipment to train and run an AI model properly. Instead, big tech companies like Microsoft are building excess computing capacity, then renting it to their clients. As long as Microsoft can build the data centers, buy the expensive computing units, and then operate them for less than what they charge, it's a huge opportunity for Microsoft.

Unfortunately, we don't know what the economics of Azure's business are, because Microsoft doesn't individually break out its profits by division. However, two of Azure's competitors, Amazon Web Services (AWS) and Alphabet's Google Cloud, do. During the first quarter, AWS delivered a 35% operating margin. Google Cloud's operating margins were 24% during the same period.

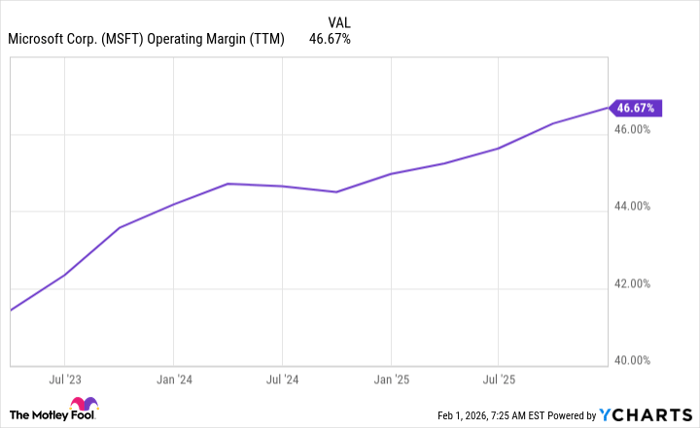

So I think it's safe to assume that Azure's operating margins are likely within 25% to 35%. Compared to Microsoft's overall operating margin of around 47%, this means that Azure could be a drag.

MSFT Operating Margin (TTM) data by YCharts.

However, Azure's operating margin may be better than its peers'. There's just no way to be certain. Regardless, Azure is Microsoft's fastest-growing segment, increasing its revenue at a 39% pace during Q2 (ended Dec. 31, 2025). Management also noted that Azure's growth rate could have been faster if it had used the computing capacity that came online during Q1 and Q2 for external use rather than internal.

Microsoft's overall growth rate for Q2 was 17%. The next-fastest-growing segment was Microsoft 365 Consumer Cloud at 29% growth. Clearly, cloud computing is leading the way for Microsoft, and I think it will continue to do so for many years. Microsoft can still rise to outperform the broader market, and if it does, it will be because of its cloud computing platform.

Should you buy stock in Microsoft right now?

Before you buy stock in Microsoft, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Microsoft wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $443,299!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,136,601!*

Now, it’s worth noting Stock Advisor’s total average return is 914% — a market-crushing outperformance compared to 195% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of February 8, 2026.

Keithen Drury has positions in Alphabet, Amazon, and Microsoft. The Motley Fool has positions in and recommends Alphabet, Amazon, and Microsoft. The Motley Fool has a disclosure policy.