The Most Undervalued AI Stock on Wall Street Right Now (It Will Shock You)

Key Points

Wall Street expects monster growth from Nvidia again this year.

Nvidia is well positioned to capture AI growth for many years.

"Undervalued" isn't typically a term that's associated with artificial intelligence (AI) stocks, but that's exactly what the market should think about Nvidia (NASDAQ: NVDA). It may seem odd to call the world's largest company undervalued, but that's what Nvidia is.

The reality is Nvidia's stock is incredibly cheap for the results it's delivering, and investors should use this opportunity to load up on shares, as they don't come around all that often.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

Nvidia's stock is barely more expensive than the broader market

If I were to present to you a stock that's expected to grow revenue at more than a 50% pace this year, yet is priced about the same level as the broader market (as measured by the S&P 500 (SNPINDEX: ^GSPC)), you'd be racing to scoop up as many shares as possible.

That's exactly where Nvidia finds itself.

For fiscal year 2027 (ending January 2027), Wall Street expects 52% revenue growth. That strong growth is based on massive AI spending, as Nvidia's graphics processing units (GPUs) are the go-to computing unit for running AI workloads. There are several growth catalysts Nvidia could experience throughout 2026, including a solid rollout of its next-gen Rubin architecture and a return of GPU sales to China. All of this could lead Nvidia to vastly outperform expectations.

While the consensus estimate among analysts is 52% growth, Wall Street analysts project anywhere from $226 billion to $412 billion in revenue for fiscal year 2027. For reference, its fiscal 2026 revenue is expected to be about $213 billion. That's a wide range of outcomes, which showcase the market's skepticism and optimism about Nvidia's prospects at the same time.

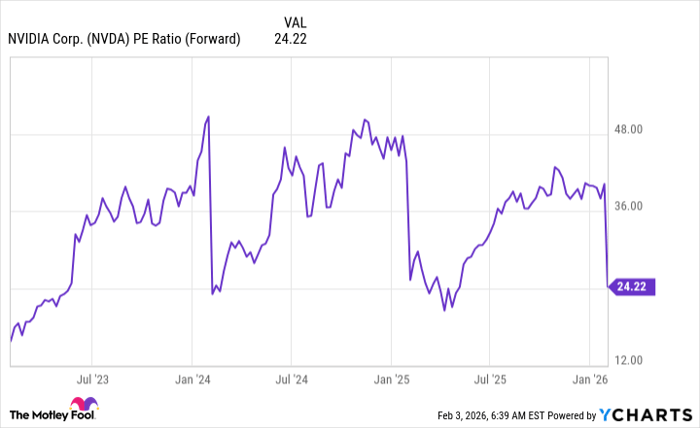

Still, the market is more bearish than bullish on Nvidia's stock, as it trades for a mere 24 times forward earnings.

NVDA PE Ratio (Forward) data by YCharts

Nvidia rarely trades at a level this cheap, and when it does, it's usually an excellent time to buy the stock. With the S&P 500 trading for 22.2 times forward earnings, it's only a slight premium to the broader market despite much faster growth expectations.

Most estimates call for AI spending to accelerate through at least 2030, so 2026 is still a long way away from needing to worry about what's next with Nvidia. As a result, I'm confident in recommending investors load up on Nvidia shares with a mindset of holding for several years. There are few stocks as no-brainer buys as Nvidia right now, and it's best not to overthink this one.

Should you buy stock in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $443,299!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,136,601!*

Now, it’s worth noting Stock Advisor’s total average return is 914% — a market-crushing outperformance compared to 195% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of February 8, 2026.

Keithen Drury has positions in Nvidia. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.