This Artificial Intelligence (AI) Stock Is Trading at a Massive Discount Despite Red-Hot Growth

Key Points

Taiwan Semiconductor Manufacturing Company (TSMC) has a near-monopoly on manufacturing advanced AI chips.

The company had its first $100 billion revenue year.

Its stock is trading lower than some of its closest competitors.

One of the more important artificial intelligence (AI) stocks on the market isn't one that the public interacts with. However, it arguably plays the most important role in the AI supply chain. It's Taiwan Semiconductor Manufacturing Company (NYSE: TSM) (TSMC), the world's largest semiconductor (chip) foundry.

Although companies like Nvidia and AMD design chips for their hardware, TSMC is the one that actually manufactures them, turning blueprints into reality. Without TSMC, the AI supply chain would suffer. And although it continues to post impressive growth, it's still trading at a discount in my view.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: TSMC.

What makes TSMC stand out?

When it comes to efficiency, scale, precision, and yield (the percentage of chips that work as planned), TSMC's capabilities are a step above its competitors.

Companies that need chips manufactured need dependability, or it could throw off their business. TSMC is the most dependable company in the business, so it's the go-to choice.

Its business used to primarily be making chips for smartphones, but now, amid the AI gold rush, it has found a lucrative lane in making advanced AI chips for data centers. Its market share for them is well into the upper 90% range.

TSMC's best year yet

TSMC generated $122.4 billion in revenue in 2025, up nearly 36% from 2024. This marked the first $100 billion year in TSMC's history, crossing the mark with plenty of room to spare.

Just as impressive is TSMC's margin growth over the past year. Its gross margin increased from 56.1% to 59.9% in 2025, and its operating margin increased from 45.7% to 50.8%. In the fourth quarter, its gross margin and operating margin were 62.3% and 54%, respectively.

A huge revenue jump alongside noticeable margin expansion is a sign of TSMC's operational execution over the past year. It also gives insight into the pricing power TSMC commands, operating a virtual monopoly on advanced AI chips. When you're basically the only game in town, you can charge a premium for your services.

TSMC looks like a good value

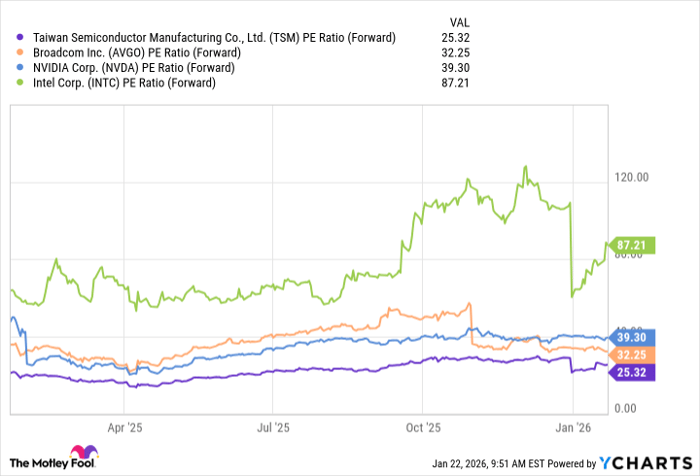

Even though TSMC's stock is up around 69% since the start of 2025 (as of Jan. 22), it trades at only 25 times its projected earnings over the next year. This is much cheaper than semiconductor companies like Broadcom, Intel, and Nvidia.

TSM PE Ratio (Forward) data by YCharts

Considering TSMC's market dominance, pricing power, and growth opportunities, its current valuation seems like a deal for long-term investors. It's trading a bit higher than its average over the past few years, but the business is also in a much better position now than it was for much of that time.

TSMC is a stock that I'd feel comfortable holding for the long haul.

Should you buy stock in Taiwan Semiconductor Manufacturing right now?

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $464,439!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,150,455!*

Now, it’s worth noting Stock Advisor’s total average return is 949% — a market-crushing outperformance compared to 195% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of January 26, 2026.

Stefon Walters has positions in Taiwan Semiconductor Manufacturing. The Motley Fool has positions in and recommends Advanced Micro Devices, Intel, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom. The Motley Fool has a disclosure policy.