Crypto Daily| Michael Saylor Teases Another Bitcoin Purchase; Coinbase Denies White House Standoff

Crypto Daily is our column tracking crypto market trends, offering timely insights and valuable updates to keep you informed.

Crypto News

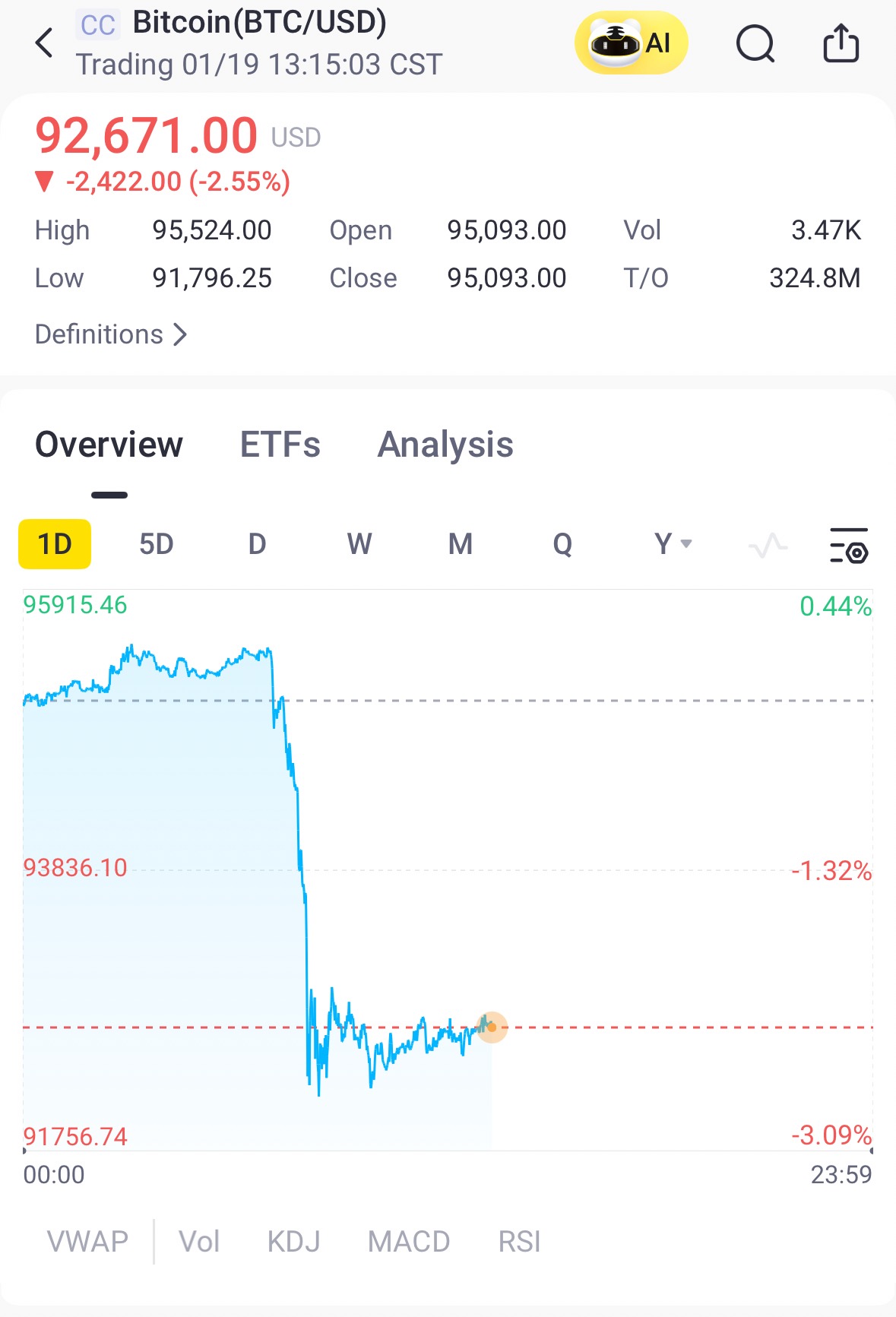

Bitcoin slides below $93,000 as $680 million longs are liquidated

Bitcoin is in the red as Asia begins its trading week, falling about 3% to trade near $92,500 as a derivatives-driven rally lost momentum.

The move underscores the market’s fragile footing despite signs that late-2025 sell pressure is beginning to ease.

The world’s largest cryptocurrency is retreating from a recent push toward the mid-$90,000s. CoinGlass data showed more than $680 million in crypto positions were liquidated over the past 24 hours, with roughly $600 million coming from long positions, a sign that bullish positioning had become crowded following the rally.

Michael Saylor Teases Another Bitcoin Purchase As MSTR Stock Price Rebounds

Michael Saylor has indicated that another Bitcoin buy will be made with Strategy holding over 3% of the entire supply. This comes as MSTR shares attract fresh interest. Also, there is tightening liquidity and cautious positioning by traders near significant BTC price levels.

Saylor posted “Bigger Orange” on X with a chart of the Bitcoin purchase of Strategy since 2020. This chart demonstrates that Strategy possesses approximately 687,410 Bitcoin. That is actually approximately 3% of the total amount of Bitcoin (21 million BTC).

Coinbase Denies White House Standoff, Targets Stablecoin Compromise for CLARITY Act

Coinbase CEO Brian Armstrong has pushed back against reports of a deepening rift with the Trump administration, insisting that collaboration remains “super constructive” regarding the CLARITY Act.

Armstrong disputed the characterization that the White House is threatening to kill the bill. Instead, he framed the situation as a strategic directive from the administration to solve the specific concerns of regional lenders.

He noted that the White House tasked the exchange with negotiating a deal with the banks, and that the specific details were “coming soon.”

Bitcoin Spot ETF Flow

The overall net inflow of the US Bitcoin spot ETF on Thursday was $100.18 million. The total net asset value of Bitcoin spot ETFs is $125.18 billion, and the ETF net asset ratio (market value compared to total Bitcoin market value) is 6.58%.

The Bitcoin spot ETF with the highest net inflow on Jan. 15 was iShares Bitcoin Trust, with a net inflow of $315.79 million. Followed by Grayscale Bitcoin Mini Trust, with a net outflow of $6.74 million, according to SoSoValue.