Billionaire Chase Coleman Has Formed His Own "Magnificent Seven" and It's Even Better Than the Original

Key Points

Apple and Tesla are excluded from the new grouping.

Broadcom and Taiwan Semiconductor are key additions.

Prospects for Coleman's new grouping look promising.

The "Magnificent Seven" is a common grouping of stocks used to describe some of the largest and most influential stocks in the market today. The Magnificent Seven consists of these familiar names:

- Nvidia (NASDAQ: NVDA)

- Apple (NASDAQ: AAPL)

- Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL)

- Microsoft (NASDAQ: MSFT)

- Amazon (NASDAQ: AMZN)

- Meta Platforms (NASDAQ: META)

- Tesla (NASDAQ: TSLA)

However, billionaire hedge fund manager Chase Coleman has created an alternative Magnificent Seven, and I think it's even better than the original. Which companies were cut and which ones were added? Let's take a look.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

AI is the theme in the new Magnificent Seven

Investors have access to what hedge fund managers own. This is thanks to the Securities and Exchange Commission (SEC) requirement that managers with $100 million or more in assets must disclose their end-of-quarter holdings to the public 45 days after the quarter ends in a Form 13F. While this isn't up-to-date information, it's better than nothing.

In Tiger Global Management's third-quarter portfolio, we can see that Chase Coleman has heavily positioned his portfolio to take advantage of the massive artificial intelligence buildout. Some of his major holdings are:

- Microsoft (10.5% of portfolio)

- Alphabet (8% of portfolio)

- Amazon (7.5% of portfolio)

- Nvidia (6.8% of portfolio)

- Meta Platforms (6.4% of portfolio)

- Taiwan Semiconductor Manufacturing (NYSE: TSM) (4% of portfolio)

- Broadcom (NASDAQ: AVGO) (3% of portfolio)

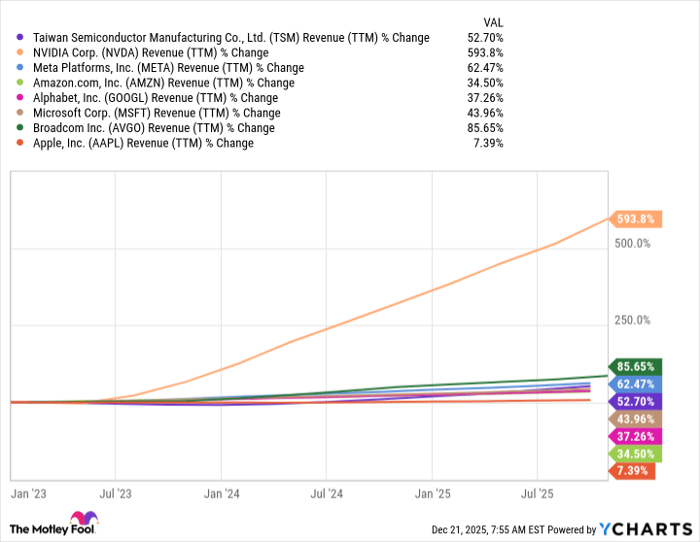

Altogether, these stocks make up 46.2% of Coleman's portfolio, which is a massive concentration. However, the track record of each company speaks for itself, and all of these have been great investments over the past few years.

What's notable is that Apple and Tesla aren't included. I think there are a few reasons why, and I like the inclusion of Taiwan Semiconductor and Broadcom over these two in the new Magnificent Seven.

Apple lacks an AI focus, and Tesla's business model took a hit this year

Apple has been a notable AI laggard in recent years. Its AI technology is really non-existent, and many of the features Apple promised users years ago still haven't been released. The only step left is for Apple to become a client of one of the major generative AI providers, which doesn't bode well for the future.

Furthermore, Apple is surviving on past innovations, and hasn't released anything groundbreaking in the past few years. All the companies on this list have had incredible results, leaving Apple in the dust in terms of growth.

TSM Revenue (TTM) data by YCharts.

Tesla is a bit different. It has an AI strategy for implementing self-driving capabilities in its cars. It also has a close partnership with xAI, another one of Elon Musk's companies. I think it shouldn't be excluded from the new Magnificent Seven based on AI alone.

Yet, it's impossible to ignore the shifting landscape in Tesla's primary market. Electric vehicles aren't as hot as they used to be, and with U.S. government subsidies ending, they aren't as attractive to consumers. This isn't to say the EV market is dead, but growth will be more difficult to come by in the future.

An investment in Tesla is a bet that its various aspirations, like robotaxis and humanoid robots, will be successful. These are far from surefire bets, unlike the other seven companies that are making money right now.

Taiwan Semiconductor and Broadcom are great inclusions, as they are each thriving in the AI market. They are also large businesses, with Broadcom and Tesla often swapping places as the seventh and eighth largest companies, while Taiwan Semiconductor is the 10th largest in the world at a $1.5 trillion market cap.

Broadcom is competing in the AI race with its custom AI accelerator chips, which are starting to grow in popularity as an alternative to Nvidia's graphics processing units (GPUs). Taiwan Semiconductor is a key provider of chips to nearly every company on this list. As long as more data centers keep being built, Taiwan Semiconductor will be an excellent stock pick.

I'm confident that Chase Coleman's new Magnificent Seven will outperform the old Magnificent Seven in 2026. I think investors should consider moving on from Apple and Tesla and into Broadcom and Taiwan Semiconductor, as they are better positioned for the next few years.

Should you buy stock in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $509,470!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,167,988!*

Now, it’s worth noting Stock Advisor’s total average return is 991% — a market-crushing outperformance compared to 196% for the S&P 500. Don't miss the latest top 10 list, available with Stock Advisor, and join an investing community built by individual investors for individual investors.

*Stock Advisor returns as of December 27, 2025.

Keithen Drury has positions in Alphabet, Amazon, Broadcom, Meta Platforms, Nvidia, Taiwan Semiconductor Manufacturing, and Tesla. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, Taiwan Semiconductor Manufacturing, and Tesla. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.