Crypto Daily | Bitcoin Rebounds to $94K; Crypto Firm Tied to Trumps Sinks 38% as Lockup Ends; Strategy CEO Says Reserve Reduces Pressure to Sell Bitcoin

Crypto Daily is our column tracking crypto market trends, offering timely insights and valuable updates to keep you informed.

Crypto News

The crypto market staged a broad rebound, with most sectors rising between 3% and 12% in the past 24 hours, led by a sharp 11.87% jump in NFTs as Pudgy Penguins and SuperVerse soared over 20%. Bitcoin climbed 3.25% to reclaim $93,000, while Ethereum rose 2% to move back above $3,000.

Crypto Firm Tied to Trumps Sees Shares Sink as Lockup Ends

American Bitcoin Corp. stock plunged on Tuesday after restricted shares of the crypto miner co-founded by Eric Trump were freed up to be traded.

The selloff was swift. Shares lost more than half of their value in less than 30 minutes as the equity lockup expired, triggering repeated trading halts. The stock pared declines later in the trading session, falling 38.83% to $2.19.

Shares from a private placement that took place before American Bitcoin merged with Gryphon Digital Mining Inc. became available on Tuesday, according to the crypto miner and a post on the social media platform X by Trump.

Strategy CEO Says Reserve Reduces Pressure to Sell Bitcoin

Strategy Inc.’s new $1.4 billion reserve gives the Bitcoin accumulator flexibility to meet short-term obligations such as dividend and interest payments during market turbulence, according to Chief Executive Officer Phong Le.

The move aims to calm investor concerns that Strategy might be forced to sell Bitcoin to cover ballooning payouts. Funded by share sales, the reserve buys the firm time: 21 months of dividend coverage, extendable to two years, without having to liquidate any of its $59 billion Bitcoin stockpile.

“We really don’t want to have to utilize that Bitcoin at times when our equity value goes” below that of the Bitcoin holdings, Le said during an interview on Bloomberg TV on Tuesday. “Our objective is to pay the dividend into perpetuity.”

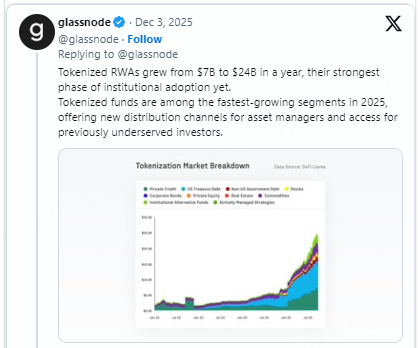

Glassnode: Institutional Participation Climbs in Current Bitcoin Cycle as Tokenized RWA Market Hits $24B

Glassnode’s Q4 digital asset report shows that Bitcoin has attracted $732 billion in new capital this cycle, with one-year realized volatility nearly cut in half and institutional participation markedly higher. Bitcoin processed about $6.9 trillion in settlements over the past 90 days, matching or surpassing Visa and Mastercard, despite more trading shifting off-chain via ETFs and brokers. The report also highlights rapid growth in tokenized real-world assets, with market size jumping from $7 billion to $24 billion in a year, marking the strongest wave of institutional adoption to date.

South Korea Moves Forward With Digital Asset Basic Act; Stablecoin Issuers May Require 51% Bank Ownership

South Korea’s government and National Assembly are advancing the second phase of digital asset legislation under the forthcoming “Digital Asset Basic Act.” A key provision under consideration would restrict stablecoin issuance to consortiums in which banks hold at least 51% ownership. The framework, largely confirmed by the Democratic Party’s Digital Asset Special Task Force, signals a push toward stricter oversight and bank-anchored accountability in Korea’s stablecoin market.

Coinbase Institutional: Liquidity Improving but Bitcoin Still Under Pressure as Whales Sell and ETF Outflows Mount

Coinbase Institutional notes that although the end of quantitative tightening and the Fed’s renewed bond purchases have boosted liquidity conditions, a theoretically positive backdrop for crypto, Bitcoin continues to face mounting pressure. BTC has broken key bull-market support levels, options sentiment has turned bearish, OG whales remain consistent sellers, spot ETFs are seeing sizable net outflows, and on-chain treasury activity (DATs) has slowed sharply, signaling weakening momentum.

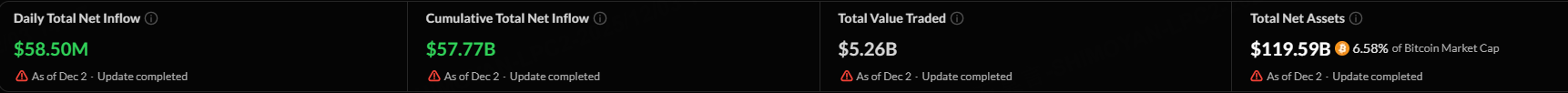

Bitcoin Spot ETF Flow

The overall net inflow of the US Bitcoin spot ETF on Tuesday was $58.5 million. The total net asset value of Bitcoin spot ETFs is $119.59 billion, and the ETF net asset ratio (market value compared to total Bitcoin market value) is 6.58%.

SoSoValue

SoSoValue

The Bitcoin spot ETF with the highest net inflow on Dec. 2 was iShares Bitcoin Trust, with a net inflow of $120.14 million. Followed by Fidelity Wise Origin Bitcoin Fund, with a net inflow of 21.85 million, according to SoSoValue.

SoSoValue

SoSoValue