If I Could Choose Only 1 ETF to Buy and Hold Forever, This Would Be It

Key Points

Many investors are worried about market volatility right now.

Over time, the stock market is incredibly likely to see positive long-term returns.

With the right investment, you can limit risk while still supercharging your earnings.

The stock market has been stumbling in recent weeks, with the S&P 500 (SNPINDEX: ^GSPC) falling by more than 4% since late October, as of this writing. Many investors are also feeling pessimistic about the future, with more than 40% saying they're "bearish" about the next six months, according to the most recent weekly survey from the American Association of Individual Investors.

Even if more volatility is around the corner, I'm going to continue investing in the stock market. And if I could only own one ETF, I would hold the Vanguard Total Stock Market ETF (NYSEMKT: VTI). Here's why.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

Why broad market ETFs are fantastic long-term buys

A broad market ETF is an investment that aims to replicate the performance of the stock market as a whole. Some funds, like S&P 500 ETFs, target specific areas of the stock market. Others, like the Vanguard Total Stock Market ETF, are even broader and all-encompassing.

This particular ETF contains a whopping 3,531 stocks from every corner of the market. It includes everything from small-cap to megacap stocks from all industries, essentially allowing you to invest in a slice of the entire stock market with a single investment.

Total stock market ETFs offer a few distinct advantages over other funds, including:

- Maximum diversification: A total stock market ETF is perhaps the most diversified investment you can get. Unlike S&P 500 ETFs, which only contain large-cap stocks, this fund also contains hundreds of small- and mid-cap stocks. Increased diversification, in general, can lower your risk when investing.

- Less tech concentration: Over time, the market has become much more tech-centered. Tech and communication services stocks make up more than 46% of the Vanguard S&P 500 ETF, for example, while those two industries make up only around 41% of the Vanguard Total Stock Market ETF. While it's not an enormous difference, if you're concerned about an artificial intelligence (AI) bubble burst on the horizon, even a slightly smaller focus on tech stocks could result in less volatility.

- Greater stability: Compared with growth ETFs, which are funds that only include stocks with higher growth potential, a total stock market ETF will often be less volatile. That can be a significant advantage for more risk-averse investors looking to avoid stomach-churning price fluctuations.

Perhaps the best advantage of a total stock market ETF, however, is that it's more likely to pull through even severe periods of market turbulence. With enough time, you're all but guaranteed to see positive long-term returns.

A proven track record of surviving volatility

No investment is immune to volatility, and even a broad market ETF will still experience short-term downturns when the market is struggling. But because this ETF is designed to follow the market as a whole, it's also incredibly likely to recover.

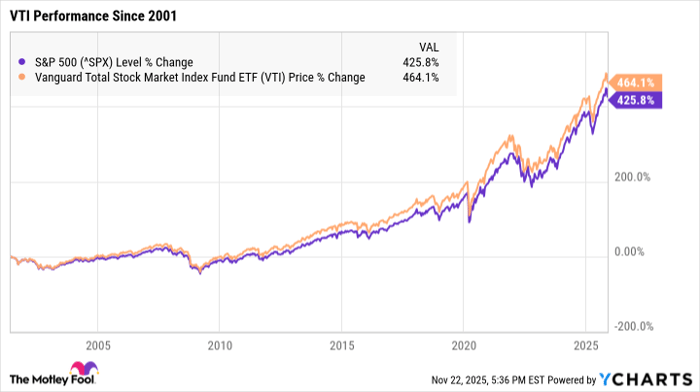

The Vanguard Total Stock Market ETF was launched in 2001, and since then, it's faced everything from the tail end of the dot-com bubble burst to the Great Recession to the COVID-19 crash to the bear market throughout 2022. And in that time, it's earned a total return of more than 464%.

In fact, despite its relative safety and increased diversification, it's managed to just barely outperform the S&P 500 in that time. It also means that if you'd invested $5,000 in the Vanguard Total Stock Market ETF at its launch in 2001, you'd have more than $28,000 by today.

Throughout history, the stock market has experienced extreme downturns -- from record-breaking recessions to prolonged bear markets to nauseating crashes. Yet it's not only survived every single one so far, but it's also managed to earn positive returns in spite of that turbulence.

That level of stability is one of the greatest advantages of the Vanguard Total Stock Market ETF. The market itself has a flawless track record of surviving volatility, and by investing in a fund that aims to follow the market's performance, your investment is incredibly likely to see consistent growth over decades.

Should you invest $1,000 in Vanguard Total Stock Market ETF right now?

Before you buy stock in Vanguard Total Stock Market ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard Total Stock Market ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $562,536!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,096,510!*

Now, it’s worth noting Stock Advisor’s total average return is 981% — a market-crushing outperformance compared to 187% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of November 17, 2025

Katie Brockman has positions in Vanguard S&P 500 ETF and Vanguard Total Stock Market ETF. The Motley Fool has positions in and recommends Vanguard S&P 500 ETF and Vanguard Total Stock Market ETF. The Motley Fool has a disclosure policy.