Crypto Daily | Bitcoin Drops Below $86K and ETH Surpasses $2,800; Michael Saylor’s Strategy Risks Losing Billions in Index Flows

Crypto Daily is our column tracking crypto market trends, offering timely insights and valuable updates to keep you informed.

Crypto News

Bitcoin(BTC) Drops Below $86,000 with a 7.09% Decrease in 24 Hours

Bitcoin has dropped below $86,000 and is now trading at $85,940, with a narrowed 7.09% decrease in 24 hours.

Ethereum(ETH) Surpasses $2,800 with a Narrowed 7.45% Decrease in 24 Hours

Ethereum has crossed the $2,800 benchmark and is now trading at $2,812, with a narrowed 7.45% decrease in 24 hours.

Retail Investors Drive Recent Crypto Market Decline, Says JPMorgan

JPMorgan analysts have identified retail investors as the primary force behind the recent downturn in the cryptocurrency market. This decline, particularly marked by Bitcoin falling below the bank's estimated production cost/support level of $94,000, has been exacerbated by the selling of Bitcoin and Ethereum spot ETFs by retail investors, rather than crypto-native traders.

The analysts highlighted that retail investors have withdrawn approximately $4 billion from Bitcoin and Ethereum spot ETFs so far this month, surpassing the historical record net outflow seen in February. This behavior contrasts sharply with retail investors' activity in the stock market, where they have invested around $96 billion into stock ETFs, including leveraged products, in November. If this pace continues, the total could reach $160 billion by the end of the month, aligning with levels seen in September and October.

Michael Saylor’s Strategy Risks Losing Billions in Index Flows

Michael Saylor’s Strategy Inc. is among the most exposed to the crypto slump — and now faces the real risk of being dropped from the benchmark indices that have underpinned its presence in mainstream portfolios.

In a note this week, analysts at JPMorgan Chase & Co. warned that Strategy could lose its place in the likes of MSCI USA and Nasdaq 100. As much as $2.8 billion could exit if MSCI moves ahead — and billions more if other index providers follow suit. Passive funds tied to the firm already account for nearly $9 billion of market exposure. A decision is expected by Jan. 15.

Bitmine Acquires Additional Ethereum Holdings Worth $49 Million

Bitmine has expanded its Ethereum holdings by purchasing 17,242 ETH from FalconX and BitGo. The acquisition is valued at approximately $49.07 million based on current market prices, as reported by Onchain Lens.

Tether Backs LatAm Crypto Firm Parfin to Expand Institutional USDT Adoption

Tether, the digital asset company behind the USDT stablecoin, has invested in Latin American crypto platform Parfin to accelerate the institutional adoption of USDT across the region, it said on Thursday.

The investment, terms of which were not disclosed, reflects Tether's push to support financial institutions in using dollar-pegged USDT (USDT-USD) -- the world's largest stablecoin by market cap -- as a core settlement asset for use cases like global transactions, real-world asset tokenization and yield-bearing credit markets.

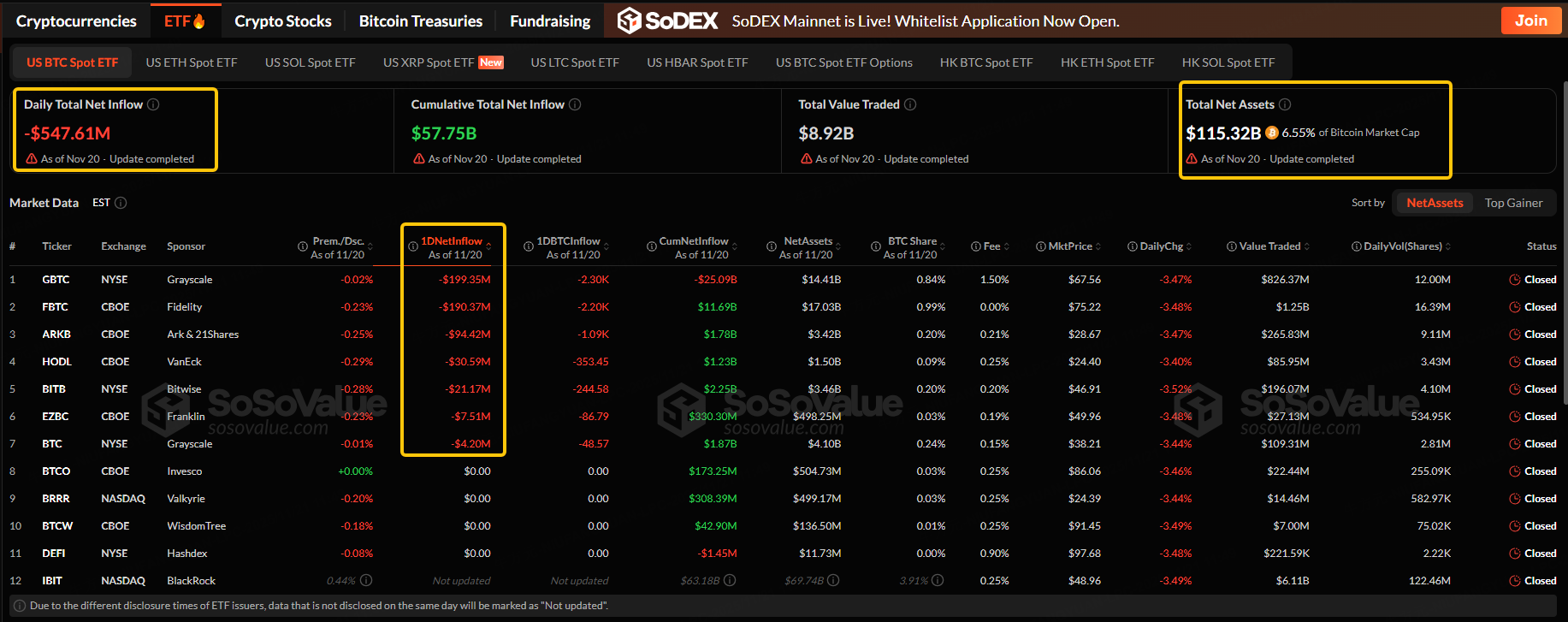

Bitcoin Spot ETF Flow

The overall net outflow of the US Bitcoin spot ETF on Thursday was $547.61 million. The total net asset value of Bitcoin spot ETFs is $115.32 billion, and the ETF net asset ratio (market value compared to total Bitcoin market value) is 6.55%.

The Bitcoin spot ETF with the highest net outflow on Nov. 20 was Grayscale Bitcoin Trust ETF, with a net outflow of $199.35 million. Followed by Fidelity Wise Origin Bitcoin Fund, with a net outflow of 190.37 million, according to SoSoValue.

SoSoValue

SoSoValue