24H|AMD Falls 4%; Tempus AI down 7%; SMCI Drops 10%; Arista Networks Plunges 13%; Upstart down 17%; Pinterest Tumbles 19%

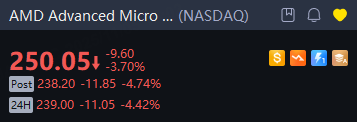

Advanced Micro Devices fell 4% in overnight trading.

Advanced Micro Devices forecast fourth-quarter revenue above market estimates on Tuesday, betting on the multibillion-dollar expansions of data center infrastructure to boost demand for its artificial intelligence chips.

AMD has received significant investments in AI hardware from companies such as ChatGPT maker OpenAI and the U.S. Department of Energy, as investors expect spending on advanced processors will continue. But fears remain that the AI boom has created mounting risks as it is still unclear whether the investments will generate the cash needed to sustain expectations.

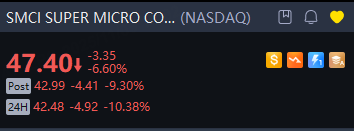

SUPER MICRO COMPUTER INC missed Wall Street estimates for quarterly profit and revenue on Tuesday, hit by a shift in delivery schedules for large artificial intelligence deals, sending the server maker's shares down more than 10% in overnight trading.

The company had warned that "design win upgrades" had pushed some expected first-quarter revenue to the second.

Tempus AI is down 7% in overnight trading despite reporting Q3 financial results that beat on both lines and boosting its 2025 revenue guidance range.

The health tech now sees full-year revenue of $1.265B from $1.26B prior. Consensus is $1.26B.

The company noted that its Paige acquisition is expecteds to increase losses by ~$5M per quarter, resulting in projected Q4 adjusted EBITDA of around ~$20M.

Pinterest, Inc. forecast fourth-quarter revenue slightly below Wall Street estimates on Tuesday, signaling fierce competition from larger platforms such as Meta during the holiday season, sending its shares down 19% in overnight trading.

The company expects quarterly revenue between $1.31 billion and $1.34 billion, with the midpoint below analysts' average estimate of $1.34 billion, according to LSEG-compiled data.

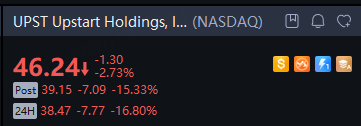

Lending company Upstart Holdings, Inc. expects its growth to slow going forward — and by more than Wall Street was expecting.

Shares of the financial-technology company, which uses AI to inform lending decisions, fell 17% in overnight trading following downbeat guidance for the December quarter. Upstart’s management is targeting $288 million in revenue, up 32% from a year before, while the FactSet consensus was for $304 million.

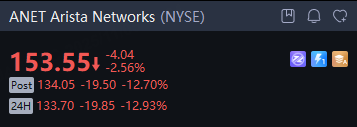

Arista Networks shares plunged 13% in overnight trading after reporting its third quarter 2025 financial results that topped estimates and showed revenue growing 27% year over year.

For the quarter ended September 30, the networking solutions company reported adjusted earnings per share of $0.75 versus the consensus estimate of $0.71. GAAP EPS came in at $0.67 compared to the estimate of $0.66.