2 Vanguard ETFs to Buy With $1,000 and Hold Forever

Key Points

ETFs are a great alternative to investing in individual stocks.

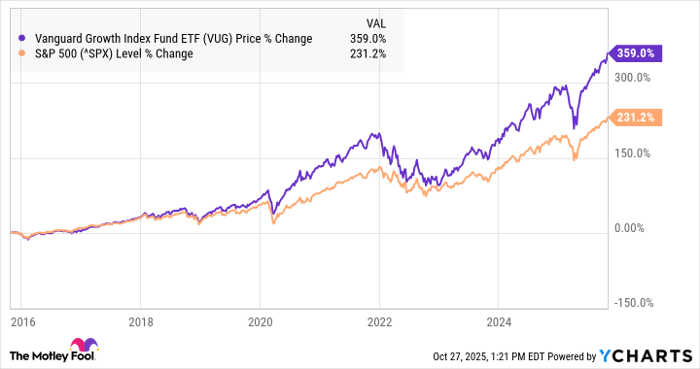

The Vanguard Growth ETF has outperformed the S&P 500 over the last decade.

This dividend appreciation ETF should reward investors over the long term.

Whether you're a newbie investor or a seasoned trader, exchange-traded funds (ETFs) can be a great option.

ETFs make investing easy by bundling individual stocks or other securities into a single tradeable ticker. Investors have the option of choosing from an index fund that tracks the S&P 500, for example, or a more specialized ETF that follows a specific sector, region, or theme.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

S&P 500 index funds are the most popular ETFs, but they're not necessarily the best. If you're looking to buy an ETF, Vanguard is a good place to start your search. The asset management company invented the index fund and has a reputation for low-cost funds, meaning you'll only pay a small fraction of your investment for the privilege of benefiting from its ETFs.

If you have $1,000 to invest, and you're looking to make that money grow, here are two Vanguard ETFs that should pay off over the long term.

Image source: Getty Images.

1. Vanguard Growth ETF

Growth stocks have reigned supreme in the current bull market and have dominated for a decade or longer.

In an era when artificial intelligence (AI) is at the forefront of the stock market and the economy, it's not surprising that growth stocks like Nvidia are dominating and outperforming. Unsurprisingly, the Vanguard Growth ETF (NYSEMKT: VUG) has been an outperformer as well.

As you can see from the chart below, the Vanguard Growth ETF has outpaced the S&P 500 by a substantial margin over the last decade.

The Vanguard Growth ETF holds many of the same top stocks as the S&P 500, but at greater percentages. It gives you more exposure to the "Magnificent Seven" (Apple, Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, and Tesla), and technology stocks like those make up 62% of the fund, since that is where much of the growth is in the stock market.

In fact, the top eight holdings in the fund are tech stocks -- the Magnificent Seven plus Broadcom -- and they make up 57% of the ETF, though it owns 160 stocks in total.

The ETF is expensive right now at a price-to-earnings ratio of 41, and it could be vulnerable to a sell-off. However, it's still very early in the AI era, and growth stocks continue to look like a good bet over the long term. That makes the Vanguard Growth ETF, which has an expense ratio of just 0.04%, a smart buy if you're looking to make investing in growth stocks easy.

2. Vanguard Dividend Appreciation ETF

For investors such as retirees or those nearing retirement who are looking for a different approach that's more focused on income than growth, the Vanguard Dividend Appreciation ETF (NYSEMKT: VIG) is a good choice.

The fund tracks the S&P U.S. Dividend Growers Index and invests in large-cap stocks that have a track record of growing their payouts every year.

It's a blend of value and growth, and it's more diversified than the Vanguard Growth ETF, even though its biggest sector is still technology, at 27.3% of the fund.

Its five biggest holdings are Broadcom, Microsoft, JPMorganChase, Apple, and Eli Lilly, which make up about 22% of the fund. With stocks like ExxonMobil and Walmart also in the top 10, you can see how the index is well diversified.

The Vanguard Dividend Appreciation ETF currently offers a yield of 1.6%. That won't win it much attention from investors looking for high-yield stocks, but that's better than the S&P 500's yield at 1.1%.

Dividend growth is also key to making dividend investing work as a strategy, as yield is also relevant to the price you paid for a stock. If you had held this ETF for the last five to 10 years, for example, the yield based on the price you paid would look a lot more impressive.

This ETF also allows for dividend reinvestment plans (DRIPs), which are a proven way to make your money grow in the market, and its expense ratio is only 0.05%.

If you're looking for a more balanced approach than pure growth, the Vanguard Dividend Appreciation ETF has you covered.

Should you invest $1,000 in Vanguard Index Funds - Vanguard Growth ETF right now?

Before you buy stock in Vanguard Index Funds - Vanguard Growth ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Vanguard Index Funds - Vanguard Growth ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $603,392!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,241,236!*

Now, it’s worth noting Stock Advisor’s total average return is 1,072% — a market-crushing outperformance compared to 194% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of October 27, 2025

JPMorgan Chase is an advertising partner of Motley Fool Money. Jeremy Bowman has positions in Amazon, Broadcom, Meta Platforms, and Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, JPMorgan Chase, Meta Platforms, Microsoft, Nvidia, Tesla, Vanguard Dividend Appreciation ETF, Vanguard Index Funds - Vanguard Growth ETF, and Walmart. The Motley Fool recommends Broadcom and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.