Pre-Bell | Nasdaq Futures Jump 1.3%; Amazon Soars 12%; Western Digital Gains 9%; Coinbase up 5%; Apple, Netflix Jump 2%

Stock futures rose Friday as investors digested strong quarterly results from tech giants Amazon.com and Apple.

Market Snapshot

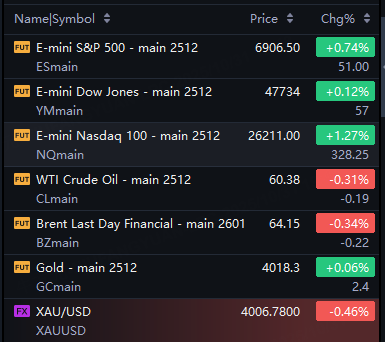

At 7:50 a.m. ET, S&P futures gained 0.7%, while Nasdaq 100 futures added 1.3%. Futures tied to the Dow Jones Industrial Average added 57 points, or 0.1%.

Pre-Market Movers

Apple rose 2% in premarket trading as revenue jumped 8% from a year earlier to $102.5 billion and topped consensus. Revenue from the tech giant's iPhone business gained 6% but missed analysts' expectations. Apple reported iPhone revenue of $49 billion, below calls for $50.1 billion. Fiscal fourth-quarter earnings of $1.85 a share were higher than Wall Street consensus estimates of $1.78 and up from $1.64 a year earlier. Apple expects fiscal first-quarter total revenue to jump 10% to 12%, according to Chief Financial Officer Kevan Parekh, well ahead of Wall Street forecasts for an increase of 6%.

Amazon.com jumped 12% after posting third-quarter adjusted earnings of $1.95 a share, including investment gains from artificial-intelligence start-up Anthropic, and topping Wall Street expectations of $1.57. Revenue of $180.2 billion beat analysts' expectations of $177.9 billion, and revenue at the company's cloud computing arm, Amazon Web Services, rose 20% to $33 billion. Amazon anticipates fourth-quarter revenue of between $206 billion to $213 billion, up 10% to 13% from a year earlier. "We continue to see strong demand in AI and core infrastructure, and we've been focused on accelerating capacity," said Amazon CEO Andy Jassy.

Meta Platforms rose 1.5% after declining 11% on Thursday as Wall Street questioned the Facebook and Instagram parent company's aggressive spending plans on artificial intelligence. Meta lost $215 billion in market cap on Thursday, the 10th largest one-day market cap loss by a U.S. company on record, according to Dow Jones Market Data. Meta's decline ended a nine-session winning streak for the stock.

Netflix gained 2% in the premarket session after Reuters reported the video streamer was exploring a bid for Warner Bros Discovery's studio and streaming business. Netflix also said it would be splitting its stock 10-for-1 to "reset the market price of the company's common stock to a range that will be more accessible to employees who participate" in Netflix's stock option program. Coming into Friday, Netflix has risen 22% this year. Warner Bros. gained 2.9% in premarket trading.

Exxon Mobil declined 1.7%. The company reported adjusted earnings of $1.88 a share in the third quarter, better than analysts' estimates of $1.82. Revenue of $85.3 billion fell short of Wall Street's call for $86.5 billion.

Strategy gained 6% after the largest corporate holder of Bitcoin reported third-quarter profit of $8.42 a share compared with a year-earlier loss of $1.72. The company said its Bitcoin holdings rose to 640,808 in the period.

Coinbase posted third-quarter earnings and revenue that beat analysts' expectations on higher transaction revenue. Revenue of $1.9 billion jumped 55% from the year-earlier period. Transaction revenue jumped 37% to $1 billion, and subscription and services revenue of $747 million rose 14%. Shares of the cryptocurrency exchange rose 5% ahead of the opening bell.

Western Digital jumped 9% after the data-storage company reported fiscal first-quarter profit that more than doubled as revenue soared 27% to $2.82 billion. "As AI accelerates data creation, Western Digital's continued innovation and operational discipline position us well to capture new opportunities and drive sustained shareholder value," said CEO Irving Tan.

Reddit rose 11% after the social media company topped analysts' expectations for both third-quarter earnings and revenue. Revenue in the period jumped 68% and ad revenue soared 74%. Daily active users rose 19% in the quarter to 116 million.

Cloudflare added 9% after the IT security company beat Wall Street's earnings targets, reporting an adjusted profit of 27 cents a share as revenue climbed 31% from a year earlier to $562 million.

Zillow, the real estate listings and technology company, earned 4 cents a share on revenue of $676 million in the third quarter, better than estimates that called for profit of 2 cents a share on revenue of $671 million. Zillow said it anticipates fourth-quarter revenue in a range from $645 million to $655 million, more than expectations of $644 million. The stock gained 2%.

Market News

Data Storage Firms Western Digital, Seagate Soar on AI-Driven Demand Spike

Shares of data storage companies such as Seagate Technology PLC and Western Digital have sharply outperformed the broader market this year, powered by the staggering demand for hard drives in the global race to scale up AI-related infrastructure.

Both Seagate and Western Digital stocks are trading near record highs, having surged more than 200% this year on the artificial intelligence boom.

Chevron Tops Q3 Earnings Estimates with Record Production After Hess Deal

Chevron beat analyst estimates on Friday as record oil and gas production, boosted by its $55 billion acquisition of Hess, and stronger refining margins lifted the No. 2 U.S. oil producer's results for the third quarter.

Adjusted earnings for the three-month period ended September 30 were $3.6 billion or $1.85 per share, which handily beat the consensus estimate from analysts of $1.68 per share as compiled by LSEG.