Should You Buy Reddit Stock Before Oct. 30?

Key Points

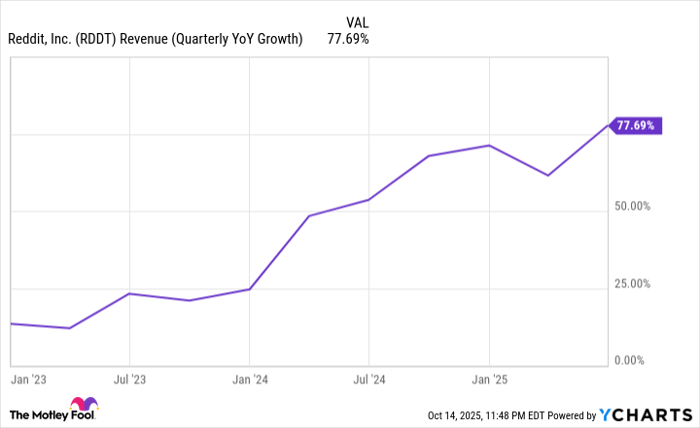

Reddit's revenue growth rate has coasted comfortably above 50% in recent quarters.

However, the stock's high valuation could make it difficult for it to take off after earnings.

Shares of Reddit (NYSE: RDDT) have soared 160% in the past 12 months, as the social media company proves to be a rising star in the tech world. It's arguably still in the early innings of its growth, however, and investors have been eager to get in relatively early on what could be a much bigger business in the future.

Reddit will report its latest earnings numbers on Oct. 30, and they could be crucial in determining whether the stock's impressive rally can continue, or if it may crumble on under the weight of some hefty expectations. Here's a closer look at how the tech company has been performing recently, and whether it may be a good buy before it releases its earnings report.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

Will Reddit's growth continue to impress investors?

A big reason Reddit has been winning over investors this year has been due to its incredibly strong revenue growth rate. Not only has it been well above 50% in recent quarters, but it has also been trending upward. With a pattern like this, it's little wonder why growth investors are willing to pay a big premium for the stock.

RDDT Revenue (Quarterly YoY Growth) data by YCharts

In the company's most recent quarter, which ended on June 30, revenue grew by 78%, to $500 million. It also experienced a 21% rise in its daily active uniques (people who have visited the website or used its app within a 24-hour period), to 110.4 million.

Reddit has many levers to pull on to expand its business even further, such as expanding globally and tapping into more ways to add value for its users to keep them on its platform for longer.

One example is Reddit Answers, which it began rolling out late last year. The new feature allows users to ask questions as they might with a chatbot, and it uses artificial intelligence to help connect them to answers (from within Reddit), potentially eliminating the need for users to search for relevant Reddit posts on external search engines.

The company projects that revenue for the upcoming quarter will be within a range of $535 million to $545 million, which would translate into a year-over-year growth rate of around 55%. The key will be how strong its guidance is, as that could play a key role in determining whether the stock continues its impressive rally, because a simple earnings beat may not be enough given its high valuation.

Why the stock may be due for a decline

Although Reddit's stock has done well this year, rising further may not be so easy given the current macroeconomic conditions and concerns of high valuations in the stock market these days; investors may be looking for excuses to cash out their profits. Reddit's shares trade at a whopping 90 times its trailing earnings and is extremely expensive when you consider the average S&P 500 stock trades at a price-to-earnings multiple of just 26.

The trouble with such a high valuation is that not only does the business need to show that it's doing well but there may be the expectation that it raises its guidance, to keep investors convinced the high price tag is justifiable. That won't be easy. The stock has already been sliding in recent weeks and without a strong performance, there could be more of a decline in the cards for the social media stock.

I'd hold off on buying Reddit stock for now

Reddit is going into earnings with high expectations and an inflated premium. Even if it does well, I don't anticipate much of a bump up in price given how expensive the stock is. This is a quality business that can make for a good long-term investment, but at such a steep premium, there are better-priced growth stocks out there to buy than Reddit.

This is a stock that I'd put on a watchlist for the time being; there's no need to rush out and buy it today.

Should you invest $1,000 in Reddit right now?

Before you buy stock in Reddit, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Reddit wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $648,924!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,102,333!*

Now, it’s worth noting Stock Advisor’s total average return is 1,052% — a market-crushing outperformance compared to 190% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of October 13, 2025

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.