ConocoPhillips Stock May Be Down, but Is It Out?

Key Points

Shares of ConocoPhillips have underperformed the broader market over the past year.

The independent energy producer's business is highly tied to commodity prices.

The best time to buy a company like ConocoPhillips is often when others find it unappealing.

ConocoPhillips' (NYSE: COP) stock is down around 15% over the past year, but don't count this independent energy producer out. Once you understand the business you might actually view today's laggard stock performance as an opportunity to buy. You just need to weigh the risks and rewards properly and figure out how ConocoPhillips can help you diversify your portfolio.

What does ConocoPhillips do?

ConocoPhillips operates in what is known as the upstream in the broader energy sector. That basically means that the company drills for oil and natural gas. It is a fairly large business, with six operating segments that are defined by the geographic areas in which they operate: Lower 48; Europe, Middle East, and North Africa; Asia Pacific; Alaska; Canada; and "other international." Many of its smaller competitors drill for oil and natural gas in just the U.S. market.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now, when you join Stock Advisor. See the stocks »

Image source: Getty Images.

The problem with operating in the upstream is that oil and natural gas prices are, effectively, the sole determinant of the company's revenue. This leads to a lot of volatility on the top and bottom lines of the income statement, since energy prices are highly volatile. That said, ConocoPhillips has proven over time that it knows how to muddle through energy downturns in relative stride.

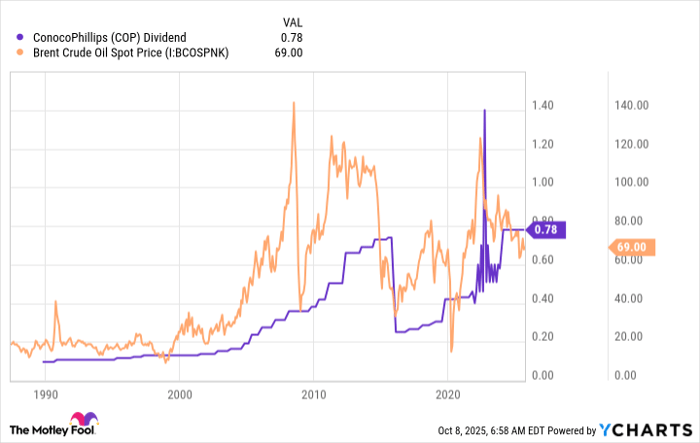

As the chart below highlights, ConocoPhillips has paid a dividend consistently for decades. That has included paying a dividend right through highly volatile periods in energy prices. To be fair, the dividend rises and falls over time, but the fact that ConocoPhillips has not eliminated or suspended the dividend is a testament to the ability of the company to survive energy price swings and the board of directors' commitment to rewarding investors for sticking with the stock.

COP Dividend data by YCharts

Energy is weaker than it was

What's going on today with ConocoPhillips' stock price isn't shocking at all when you understand its business. In the second quarter of 2025 the company's adjusted earnings came in at $1.42 per share, down from $1.98 a year earlier. That's a drop of nearly 30%, which is material. The main driver of the weakness on the income statement was a decline in the price ConocoPhillips realized for its production, which went from $56.56 per barrel a year ago to $45.77 a barrel in the second quarter of 2025.

When oil prices fall nearly 20% year over year there is little that ConocoPhillips can do to prop up its income statement. There's going to be a revenue and earnings hit. However, the company isn't sitting still. For example, the company recently acquired competitor Marathon Oil. The integration of this $22.5 billion deal has gone even better than expected, with greater synergies, more reserve growth, and higher streamlining dispositions lined up than originally planned.

Notably, ConocoPhillips' second-quarter 2025 production was slightly above the high end of its guidance range. And the company expects to hit its full-year production guidance numbers even as it sells $1.3 billion worth of assets. In other words, ConocoPhillips is becoming a better company despite the relatively weak energy market.

ConocoPhillips is a solid option if you want direct oil exposure

Oil and natural gas are vital to supplying the world's energy needs. A diversified portfolio should probably have some energy exposure. Although there are more conservative options for getting such exposure, some investors might appreciate the direct exposure to energy prices that ConocoPhillips offers. Simply put, when energy prices are rising it is highly likely that ConocoPhillips' share price will be, too.

Given ConocoPhillips' long history of surviving energy price swings and rewarding investors with dividends, more aggressive investors might actually want to buy the stock while Wall Street has pushed the price down. The key is that this resilient energy business is nowhere near out despite what the share price decline might suggest.

Should you invest $1,000 in ConocoPhillips right now?

Before you buy stock in ConocoPhillips, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and ConocoPhillips wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $663,905!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,180,428!*

Now, it’s worth noting Stock Advisor’s total average return is 1,091% — a market-crushing outperformance compared to 192% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of October 7, 2025

Reuben Gregg Brewer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.