Pre-Bell|Wall Street Futures Tick Up; Confluent Jumped 18%; SES AI Up 4%; Penguin Solutions Plummeted 23%

U.S. stock index futures inched higher on Wednesday after declines a day earlier as investors awaited commentary from Federal Reserve speakers and the release of minutes from the central bank's September policy meeting.

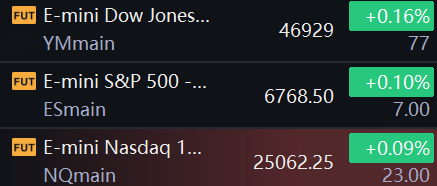

Market Snapshot

At 7:31 a.m. ET, Dow E-minis were up 77 points, or 0.16%, U.S. S&P 500 E-minis rose 7 points, or 0.1%, and Nasdaq 100 E-minis climbed 23 points, or 0.09%.

Pre-Market Movers

Tesla rose 0.6% after falling 4.5% on Tuesday following the electric-vehicle maker's announcement that it would roll out a pair of vehicles starting below $40,000, including a new standard Model Y starting at $39,900. The Model Y has limited paint options and a base mileage per charge of about 320 miles, 40 miles less than premium Model Y products. A new Model 3 will start at $36,900, Tesla added. Tesla has declined three of the past four sessions but remains up 7.2% in 2025.

Shares of SES AI Corp rose after the company said it would unveil its Molecular Universe 1.0 software to discover new battery materials on Oct. 20. The stock rose 4% in premarket after surging 12% on Tuesday.

Oracle rose 0.2% after a 2.5% drop on Tuesday following a report from the Information that highlighted the cloud and AI company's slim margins from renting out Nvidia chips. Oracle lost $100 million in the quarter ended in August from rentals of Nvidia Blackwell chips, according to the report, which cited internal documents. Nvidia gained 0.6% in premarket trading.

Confluent, Inc. jumped 18% after Reuters reported the data streaming software company was exploring a sale. The company is in an early stage of the sale process, which was set in motion after several private equity and technology companies expressed interest in acquiring Confluent, Reuters reported, citing people familiar with the matter. No sale price was disclosed. Confluent didn't immediately respond to a Barron's request for comment outside of normal working hours.

Penguin Solutions, Inc. plummeted 23% in premarket trading after the semiconductor company reported fiscal fourth-quarter earnings that beat analysts' estimates but revenue that missed, and issued a forecast for fiscal 2026 that was well below expectations. Penguin Solutions expects fiscal-year adjusted earnings of between $1.75 and $2.25 a share versus consensus of $2.12.

Fair Isaac declined 2.3% after Equifax said it was "responding to FICO's monopoly-like doubling of their mortgage credit score prices to $10 in 2026" by reducing VantageScore 4.0 mortgage credit scores more than 50% from Fair Isaac's 2026 prices, to $4.50, through the end of 2027. Fair Isaac last week unveiled new pricing models that will allow mortgage lenders to calculate and distribute FICO scores directly to borrowers and bypass credit bureaus like Equifax. Equifax shares rose 2.6%.

FedEx declined 2.2% to $236.98. Analysts at J.P. Morgan downgraded shares of the delivery giant to Neutral from Overweight and reduced their price target to$274 from $284. The analysts also lowered their price target on $United Parcel Service(UPS)$ to $85 from $96 and kept a Neutral rating on the shares. UPS fell slightly to $85.89.

AppLovin Corporation shares traded up 0.2% in premarket trading. The stock closed up 7.6% on Tuesday and snapped a four-session losing streak after falling 14% on Monday following a Bloomberg report that said the Securities and Exchange Commission was investigating the data-collection practices of the mobile advertising tech company. Shares have risen 95% this year.

Ford Motor rose 0.4% in the premarket session after the auto maker tumbled 6.1% on Tuesday in its largest daily percentage decrease since early February, according to Dow Jones Market Data. The stock was pressured by a report in The Wall Street Journal that said a fire that occurred three weeks ago at Novelis, a supplier of aluminum sheet to the auto industry, likely would crimp production at Ford and other auto makers.

Seagate Technology PLC gained 0.7%. The stock fell 7.3% on Tuesday and finished the session as the worst-performing stock in the S&P 500. The data-storage company has fallen for four consecutive trading days, losing more than 12% over the period. Profit-taking was to blame, according to Mark Miller, an analyst at Benchmark. Seagate rose 64% in the third quarter. Peer Western Digital rose 1.3% after a 4.3% drop on Tuesday. Western Digital finished the third quarter as the second-best stock in the S&P 500, rising 88%.

AZZ Inc., the metal coatings and welding services company, is scheduled to report quarterly earnings Wednesday. The stock rose 0.8% in premarket trading.

Market News

Goldman’s Oppenheimer Dismisses Bubble Fears in US Tech Stocks

It’s too early to be worried about a bubble in high-flying US technology stocks.

That’s the view of Goldman Sachs Group Inc. strategist Peter Oppenheimer, who said the record-breaking rally in tech heavyweights has been accompanied by robust earnings growth. In past bubbles, the market was driven higher mainly by speculation.

“Valuations of the technology sector are becoming stretched but not yet at levels consistent with historical bubbles,” Oppenheimer and his team wrote in a note.

SoftBank to Buy ABB’s Robotics Arm in $5.4 Billion Deal

SoftBank Group Corp. agreed to acquire ABB Ltd.’s industrial robots unit at an enterprise value of almost $5.4 billion, reflecting billionaire Masayoshi Son’s growing bets on emerging technology in artificial intelligence and robotics.

The Japanese investment firm agreed to take over a business with more than 7,000 employees, which supplies industrial arms and robots to manufacturers including BMW AG. Swiss conglomerate ABB — which originally aimed to spin off the unit — will instead focus on more profitable areas such as electrification, which is also surging as the likes of OpenAI and Meta Platforms Inc. spend trillions on data centers.