Artificial Intelligence (AI) Backlog Has Exceeded $1 Trillion: 2 Ways You Can Benefit From This Massive Number

Key Points

The contractual backlogs reported by major cloud computing companies of late add up to more than $1 trillion.

Huge investments in additional AI infrastructure will be needed to satisfy this backlog.

This is great news for Nvidia and Taiwan Semiconductor Manufacturing, both of which play critical roles in the AI infrastructure buildout.

Artificial intelligence (AI) is expected to have a massive impact on the global economy over the long run. A study by the University of Pennsylvania's Penn Wharton Budget Model estimates that the proliferation of this technology could boost productivity and the global gross domestic product by 1.5% in the next decade alone. And it forecasts even greater gains in the decades that will follow.

This explains why companies and governments across the globe are jumping onto the AI bandwagon, attempting to integrate generative AI tools into their operations. That's the reason why demand for cloud computing infrastructure from the likes of Amazon, Microsoft, Google, and Oracle is well exceeding supply.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Image source: Getty Images.

Cloud computing giants are sitting on an eye-popping backlog

The cloud computing companies mentioned above lease capacity on their infrastructure, enabling their customers to run AI models, design custom applications, and run inference applications. This spares those customers from needing to invest in and maintain expensive hardware.

That cost effectiveness explains why Amazon, Google, and Microsoft reported a combined revenue backlog of $669 billion at the end of the last quarter. Throw in Oracle's remaining performance obligations of $455 billion, and the backlog crosses the trillion-dollar mark. But how can you capitalize on this gigantic opportunity?

These two chip stocks are no-brainer buys

The cloud computing giants mentioned above have been quickly expanding their data center infrastructure so that they can fulfill their massive contracted backlogs. This is requiring them to sharply increase their capital spending. The combined capital outlays of Amazon, Microsoft, Alphabet, and Meta Platforms are set to jump by 63% to $364 billion in 2025.

High capex can be expected to continue as long as demand for capacity grows. So, it is easy to see why sales of AI-capable chips and accelerators such as graphics processing units (GPUs) are forecast to jump to almost $600 billion next year from an expected $477 billion in 2025.

The simplest way for investors to profit from this wave of spending is by buying shares of Taiwan Semiconductor Manufacturing (NYSE: TSM). Popularly known as TSMC, it is the largest semiconductor foundry in the world, and because it offers the most advanced manufacturing processes, it's the go-to fabricator for almost all the major AI chip designers. Other chips fabricated by TSMC go into consumer electronic devices such as computers, smartphones, and gaming consoles.

All this explains why the rapid growth of AI has supercharged TSMC's top line. Its revenue in the first eight months of 2025 was up by 37% year over year. That's faster than the 30% growth it clocked in 2024. TSMC is expecting its AI accelerator revenue to double this year, and during its Q1 earnings call, CEO C.C. Wei predicted that its revenue from AI accelerators would grow at a compound annual percentage rate in the mid-40s for the five-year period starting in 2024.

With TSMC trading at just 24 times forward earnings, and so much more revenue growth clearly visible ahead, the stock is a no-brainer buy.

That brings us to the other company in pole position to capitalize on the massive AI backlog: Nvidia (NASDAQ: NVDA).

The GPUs designed by Nvidia are the go-to chips for cloud computing giants looking to train and run AI applications in data centers: It dominates the data center GPU market with a 92% share. Its control of that niche has helped it clock impressive growth over the past three years.

In the first six months of its fiscal 2026 (which ended July 27), its revenue rose by 62% year over year to $90.8 billion. It achieved that even though its sales to customers in China have taken a hit due to export restrictions and geopolitical factors. But the growth trend is likely to continue thanks to AI infrastructure projects such as Stargate.

Oracle, for instance, reportedly placed a $40 billion order for Nvidia's GPUs to power a new Stargate data center a few months ago. And now, the chip giant has entered into a strategic partnership worth $100 billion with OpenAI to develop at least 10 gigawatts of AI data centers. Given that annual spending on AI accelerators is expected to jump by $62 billion in 2026, it won't be surprising for Nvidia's data center business to sustain its healthy pace of growth.

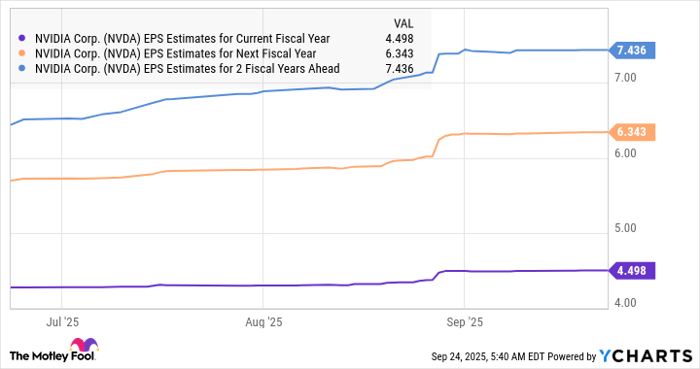

That's expected to translate into solid bottom-line growth for the company despite its massive size.

NVDA EPS Estimates for Current Fiscal Year data by YCharts.

With Nvidia trading at 40 times forward earnings, a discount to the U.S. technology sector's average earnings multiple of 51, investors can still consider buying this semiconductor stock, as it has the potential to fly higher thanks to the secular growth opportunity in the AI infrastructure space.

Should you invest $1,000 in Nvidia right now?

Before you buy stock in Nvidia, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nvidia wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $652,872!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,092,280!*

Now, it’s worth noting Stock Advisor’s total average return is 1,062% — a market-crushing outperformance compared to 189% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of September 22, 2025

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, Oracle, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.