A Once-in-a-Decade Opportunity: 1 Magnificent S&P 500 Dividend King Down 26% to Buy Right Now

Key Points

The market continues to set new all-time highs.

Most of this incredible run was powered by growth stocks, whereas many stable, low-beta stocks dipped in value.

Today, I'll examine one of these overlooked steady Eddies and explore what makes it a lucrative opportunity.

First things first, most Dividend Kings (stocks that have increased dividends for at least 50 years in a row) won't provide investors with multibagger returns anytime soon.

In fact, they may struggle to keep pace with the market as a whole -- particularly when it is making a run like it has been so far in 2025. However, with the market tiptoeing around in "bubble-y" territory, the stability and passive income provided by certain Dividend Kings can serve as a refuge for investors seeking safer options.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

This idea is especially true when the Dividend King in question is available to buy at a once-in-a-decade valuation, which is the case for consumer goods juggernaut Colgate-Palmolive (NYSE: CL) today.

Here's why the company is my favorite Dividend King to buy right now.

Image source: Getty Images.

Colgate-Palmolive's brand moat

Colgate-Palmolive has delivered total returns of 12% annually since 1990, becoming a 55-bagger over that period.

Now a true consumer goods juggernaut, Colgate's high-growth days may be behind it, but it can still be a lucrative investment for the right investors.

The main differentiator for Colgate is its category-leading brands. The company is the global market share leader in toothpaste, manual toothbrushes, pet nutrition at vet clinics, and liquid hand soap.

Furthermore, Colgate holds the No. 2 share in four other categories: mouthwash, bar soap, liquid fabric softeners, and hand dishwashing liquids.

In addition to its namesake Colgate and Palmolive brands, the company is also home to a range of other well-known labels, including Hill's pet food, Softsoap, Irish Spring, Hello, Tom's, Ajax, and Fabuloso, among others.

Image source: Colgate-Palmolive Investor Presentation.

Not only does Colgate have a powerful brand moat in each of the consumer product categories into which it sells, but most of its products are essential, repeat purchases. These consistent sales help make Colgate one of the most stable stocks on the market, which explains how the company has raised its dividend for 61 straight years.

Colgate's continuous innovation

While the company doesn't make many massive acquisitions or dive into wholly unrelated product categories, it is masterful at finding niche tuck-in acquisitions and reinventing its already successful products.

This notion is evident in the company's impressive 33% return on invested capital (ROIC). Measuring the profitability Colgate generates from its debt and equity, this high ROIC shows that the company thrives when it reinvests in its operations.

This top-tier ROIC is especially powerful considering Colgate spent nearly $4 billion on acquisitions over the last decade.

While many aging stocks are excellent at lighting cash on fire when they try to integrate new acquisitions, Colgate has a long track record of successfully generating outsize profits from its new businesses and product iterations.

This ability to invest in new growth areas and defend its market share with new versions of products makes Colgate's long-term outlook as steady as ever.

Colgate's once-in-a-decade valuation

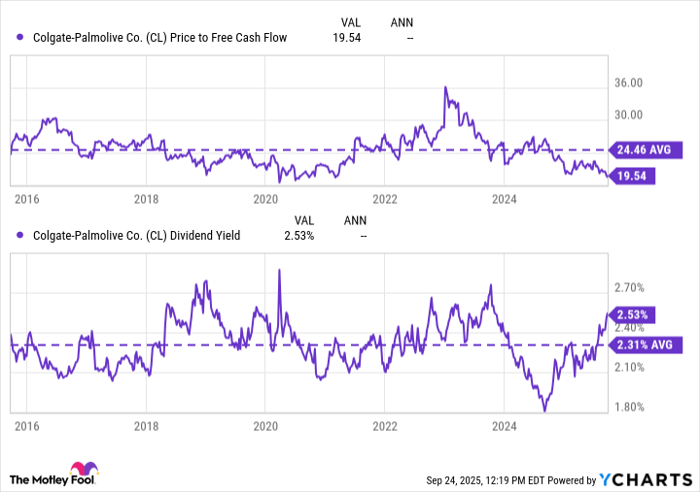

Best yet for investors, despite Colgate's brand power and high ROIC, the company currently trades at about 20 times free cash flow (FCF), far below its historical averages.

CL Price to Free Cash Flow and Dividend Yield data by YCharts

Meanwhile, the company's 2.5% dividend yield is also higher than usual, making it particularly alluring at today's prices.

If I plug Colgate's data into a reverse discounted cash flow calculator, I find that the company would have to grow its FCF by 4.5% annually to justify its current share price.

Considering the company grew its organic sales and FCF by 7% and 8% over the last five years, I don't think it's outrageous to believe Colgate can clear this 4.5% hurdle.

The cherry on top for investors?

Despite paying a respectable 2.5% dividend yield, Colgate only uses 48% of its FCF to fund its dividend payments, leaving plenty of room for future increases.

And if that's not enough, management has steadily lowered the company's shares outstanding by 1% annually over the last decade, further juicing investors' returns.

Ultimately, if you're an investor looking for market-stomping returns or the possibility of a mega-multibagger, Colgate-Palmolive isn't the pick for you.

However, if you're looking for a Steady Eddie Dividend King home to a powerful brand moat and an ability to profitably expand and innovate over the long haul, Colgate-Palmolive looks like a once-in-a-decade opportunity at today's price.

Should you invest $1,000 in Colgate-Palmolive right now?

Before you buy stock in Colgate-Palmolive, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Colgate-Palmolive wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $652,872!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,092,280!*

Now, it’s worth noting Stock Advisor’s total average return is 1,062% — a market-crushing outperformance compared to 189% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of September 22, 2025

Josh Kohn-Lindquist has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Colgate-Palmolive. The Motley Fool has a disclosure policy.