What Are 2 Great Tech Stocks to Buy Right Now?

Key Points

Over the last 15 years, technology stocks have outperformed the broader stock market.

Healthcare technology company Tempus AI saw revenue shoot up 90% in the latest quarter.

Oracle's revenue growth -- and stock price -- have sprung back to life, thanks to a big bet on AI.

There's no doubt about it. The technology sector has been a great place to invest for decades. Indeed, since 2010, the tech-heavy Nasdaq Composite has generated a compound annual growth rate (CAGR) of nearly 16%.

Meanwhile, the S&P 500 has generated a CAGR of 12% over the same period. The Dow Jones Industrial Average, which is the least-weighted toward tech stocks of the major benchmark indexes, has recorded a 10% CAGR.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

So, what are some great tech stocks that investors should target right now? Here are two that I think could deliver for years to come.

Image source: Getty Images.

1. Tempus AI

First up is Tempus AI (NASDAQ: TEM). To start, there's no shame in not knowing Tempus AI or what they do. Tempus is a relatively small company with a market cap of $15 billion, and its stock has only been public for a little over a year.

The company was founded in 2015 and specializes in healthcare technology. It focuses on sequencing, molecular genotyping, and pathology testing that is of use to drug-makers in particular. Indeed, the company sits at the crossroads of two fast-growing and state-of-the-art technologies: artificial intelligence (AI) and genomics.

As a result, there is plenty to like about Tempus' long-term prospects, particularly as AI continues to improve and offers the ability to treat disease. However, Tempus is already showing signs of financial growth. As of the company's latest quarter (ended on June 30), Tempus reported:

- $315 million in revenue, up 90% year over year

- $195 million in gross profit, representing a gross margin of 61%

- $(43) million in net loss, an improvement over its net loss of $(552) million one year ago

The company's genomics testing business generated $242 million, or 77%, of its revenue. At the same time, $73 million, or 23%, of the company's revenue came from its data and services business, mostly from licensing.

In summary, Tempus remains a young company with plenty of room to grow. Its next challenge will be consistent profitability, paired with maintaining its rapid revenue growth. Given its place at the nexus of genomics and AI, I'm bullish on the company's chances to pull it off.

2. Oracle

Next is Oracle (NYSE: ORCL). The reason Oracle makes the cut as one of the best tech stocks to own right now is simple. The stock has outperformed recently, and it has several catalysts that I expect will continue to power it higher.

It may come as a surprise that Oracle stock has outperformed of late. After all, many people remember the stock for its big collapse following the dot-com bubble more than 20 years ago. And while it's true that Oracle's stock took about 15 years to regain its pre-dot-com bubble highs, the stock has simply been on fire for the last five years.

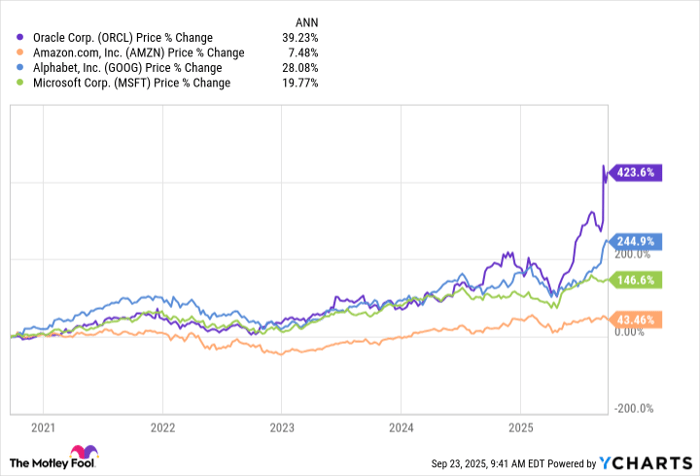

Indeed, Oracle stock has outperformed many high-profile big tech stocks over that period -- in some cases, by a huge margin. For example, Oracle stock has generated a compound annual growth rate (CAGR) of 39% over the last five years. That beats Amazon, Microsoft, and Alphabet.

This resurgence is thanks to Oracle's big push to provide cloud services to companies within the red-hot AI sector. In short, the organizations that want to dominate the AI space require enormous cloud resources to train and run their models, and Oracle is stepping up to supply the data centers to meet the surging demand.

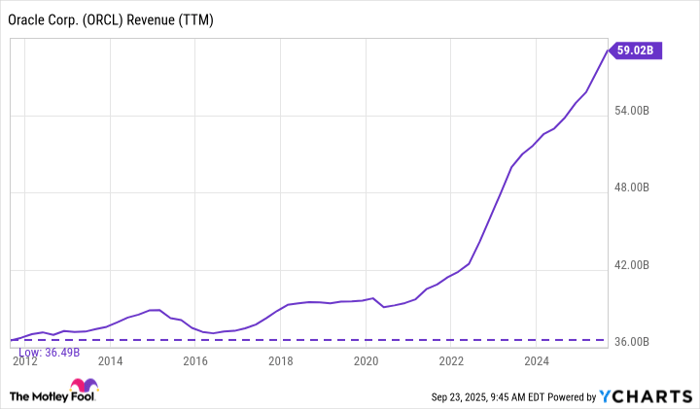

As a result, Oracle's revenue has grown by about 46% over the last five years, jumping from $39 billion to $59 billion. That's key, as the company struggled with sluggish revenue growth for a decade between 2011 and 2021. Indeed, during those years, Oracle's revenue bounced between $35 billion and $40 billion, before significantly breaking out in 2022.

ORCL Revenue (TTM) data by YCharts

Considering the rapid growth and demand for AI applications, I think Oracle's strategy is sound. Investors looking for AI exposure shouldn't overlook the company's stock.

Should you invest $1,000 in Oracle right now?

Before you buy stock in Oracle, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Oracle wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $652,872!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,092,280!*

Now, it’s worth noting Stock Advisor’s total average return is 1,062% — a market-crushing outperformance compared to 189% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of September 22, 2025

Jake Lerch has positions in Alphabet and Amazon. The Motley Fool has positions in and recommends Alphabet, Amazon, Microsoft, and Oracle. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.