Cruise Stocks Took a Hit in 2020. Five Years Later, Is It Time for Investors to Reconsider?

Key Points

Cruise demand is as strong as it's ever been, with 2025 expected to be an all-time high for passenger count.

All three major cruise line stocks have soared since their 2022 lows.

Despite being the best performer, Royal Caribbean's stock could still be the most attractive investment.

When the pandemic disrupted life as we know it in 2020, cruise line stocks were some of the hardest hit in the entire stock market. And it certainly made sense. Cruise ships weren't operating for a year or more in many cases, and even after cruising resumed, it was a while before ships were sailing at full capacity.

In the meantime, the major cruise lines had to take on added debt. Maintaining a fleet of billion-dollar ships is expensive, even when they aren't moving.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Now that the bad news is out of the way, let's get to the good news. Demand for cruises rebounded quickly once the world returned to normal and things like vaccine and masking requirements went away. And unlike demand for certain other types of travel, cruise demand has stayed incredibly strong ever since.

Image source: Getty Images.

Demand is stronger than ever

When cruising returned to a sense of semi-normalcy in 2022, cruise volume rebounded from virtually nothing to 84% of pre-pandemic (2019) levels. And beyond that, we've seen a remarkable surge in demand.

The year 2023 set a new all-time record, with 16.9 million cruise passengers in the United States, 2.7 million more than in 2019. Then in 2024, 18.2 million Americans set sail on cruise ships, fueled by the introduction of several huge ships to the fleets of major cruise lines. And 2025 is expected to be the third consecutive year of record high passenger volume.

To be sure, cruising is certainly a cyclical business -- usually. But we really haven't seen consumers pumping the brakes on cruise spending as they have with other forms of travel and tourism, even in the uncertain economic times of the past few years.

Are cruise stocks worth a look right now?

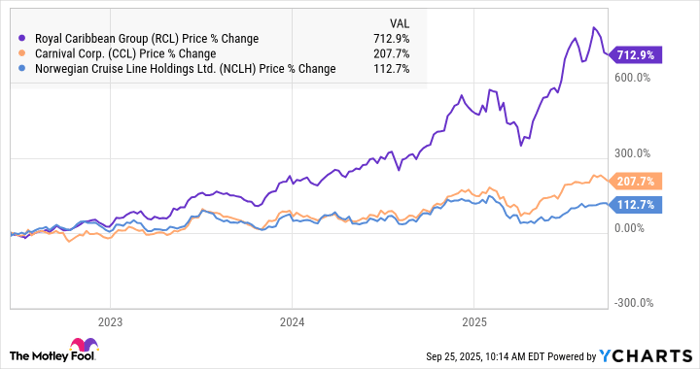

As you might expect, all of the major cruise lines' stocks have rebounded sharply from the pandemic-era lows. Since the bottom in mid-June 2022, before it was clear that cruise demand was roaring back, shares of Norwegian Cruise Line Holdings (NYSE: NCLH) are up by 112%, and that's the worst performer of the three major cruise lines.

In the same time period, the stock of Carnival (NYSE: CCL) has more than tripled. And Royal Caribbean Group (NYSE: RCL) has been the biggest winner by far, with an outstanding 711% gain. In a nutshell, Royal Caribbean's new megaships -- especially the Icon of the Seas, launched in 2024 -- have been wildly successful, and demand for them has resulted in incredible profit growth.

With that in mind, here's a snapshot of where the three major cruise lines stand today:

|

Company |

Revenue (TTM) |

Revenue Growth (Most Recent Quarter) |

Forward P/E Ratio |

Market Cap/Debt |

|---|---|---|---|---|

|

Royal Caribbean |

$17.2 billion |

10.4% |

19.5 |

$88.5 billion/$19 billion |

|

Carnival |

$26 billion |

9.5% |

14.5 |

$39.9 billion/$28.7 billion |

|

Norwegian Cruise Line |

$9.56 billion |

6.1% |

10.8 |

$11.3 billion/$14.9 billion |

Data source: Company financials, CNBC. P/E ratios and market caps as of Sept. 25; TTM = trailing 12 months.

Which cruise stock is the best buy now?

To be clear, assuming that cruise demand stays strong (and this is a big assumption), all three look rather attractive right now. But even after its big move, if I were to buy one of the three today, it would be Royal Caribbean. It has (by far) the healthiest balance sheet of the group, and although it is the most richly valued, it also has the highest growth rate.

Plus, management is doing a great job of executing, and with its next megaship and several new destinations coming over the next year, it wouldn't be a shock to see revenue growth accelerate a bit.

Should you invest $1,000 in Royal Caribbean Cruises right now?

Before you buy stock in Royal Caribbean Cruises, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Royal Caribbean Cruises wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $652,872!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,092,280!*

Now, it’s worth noting Stock Advisor’s total average return is 1,062% — a market-crushing outperformance compared to 189% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of September 22, 2025

Matt Frankel has no position in any of the stocks mentioned. The Motley Fool recommends Carnival Corp. The Motley Fool has a disclosure policy.