The Smartest Dividend ETF to Buy With $1,000 Right Now

Key Points

The Schwab U.S. Dividend Equity ETF aims to hold high-quality companies.

This fund has averaged a 3.1% dividend yield over the past decade.

It also has one of the lowest expense ratios for a dividend ETF.

When it comes to making money in the stock market, stock price appreciation gets a lot of attention because it's the most straightforward way to do so. You buy a stock for one price, sell it for a higher price, and make a profit. Simple enough. However, dividends can be just as effective at making money from stocks in many cases.

Assuming you're investing in high-quality stocks or exchange-traded funds (ETFs), dividends are guaranteed income that investors can rely on quarterly (or monthly in some cases). Dividends can be an added plus when a stock is growing, as well as a buffer when a stock is falling.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

If you're looking for a high-quality dividend ETF to add to your portfolio, you should consider the Schwab U.S. Dividend Equity ETF (NYSEMKT: SCHD). A $1,000 investment today could go a long way with time and patience.

Image source: Getty Images.

SCHD has a criteria fit for high-quality companies

The saying "Everything that glitters ain't gold" also applies to dividend stocks. Just because a stock has a high dividend yield doesn't mean it's worth owning. In some cases, it could be a yield trap, where the dividend is only high because the stock price has dropped due to bad business performance.

Investing in SCHD removes much of the risk of a yield trap because of the criteria it takes to be included in the ETF. It tracks the Dow Jones U.S. Dividend 100 Index, and to be included, a company must have the following:

- A strong balance sheet

- Consistent cash flow

- At least 10 years of dividend payouts

- Strong profitability metrics (such as return on equity)

These criteria is a good vetting tool for investors, removing some of the need to do more in-depth research on the companies within the ETF. Some notable dividend kings (companies with at least 50 consecutive years of dividend increases) in the ETF are Coca-Cola, Altria, PepsiCo, Target, and Kimberly Clark.

A sustained high dividend yield

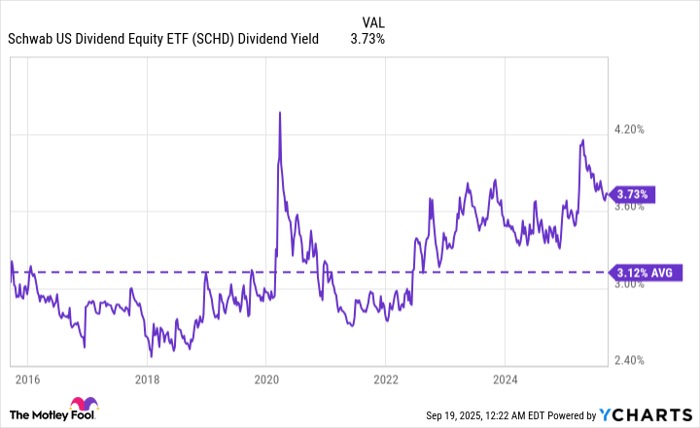

You shouldn't solely focus on dividend yields because they fluctuate with stock price movements, but it's still worth paying attention to the dividend yield a dividend-focused ETF is able to sustain. At the time of this writing, SCHD's dividend yield is 3.7%. This is above its 3.1% average over the past decade, and around three times what the S&P 500 currently offers.

SCHD Dividend Yield data by YCharts

At its current dividend yield, a $1,000 investment would pay around $37 annually. This isn't early retirement type money, but it can snowball into meaningful income, especially if you take advantage of your brokerage platform's dividend reinvestment plan (DRIP). With a DRIP, your broker will take the dividends SCHD pays you and automatically reinvest them to buy more shares of the ETF.

Add in the fact that SCHD has increased its payout by over 160% in the past decade and should continue to increase its payout over time, and you have a chance for a $1,000 investment to go a long way.

Don't expect explosive stock price growth

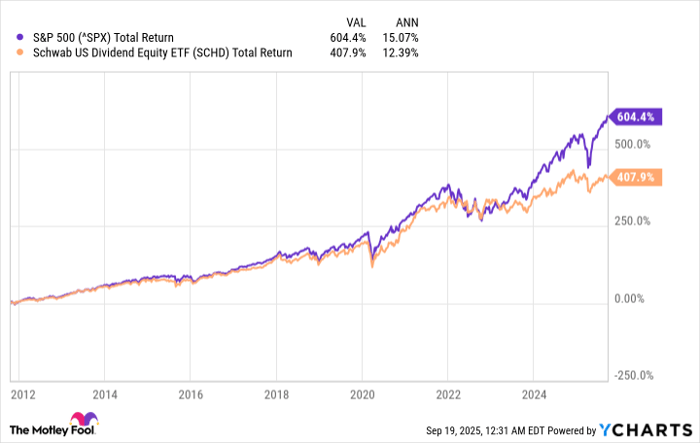

Since SCHD hit the market in October 2011, it has underperformed the S&P 500, averaging 12.4% annual total returns compared to the index's 15%. Despite the underperformance, those are returns that most investors would still be happy to receive.

Past results don't guarantee future performance, but for the sake of illustration, let's assume the ETF continues to average 12% annual total returns. A single $1,000 investment today could grow to over $9,600 in 20 years. If you were to add just $100 monthly to the ETF, it would grow to over $96,000. And with a low 0.06% expense ratio, you can keep more of these gains in your pocket.

Should you invest $1,000 in Schwab U.S. Dividend Equity ETF right now?

Before you buy stock in Schwab U.S. Dividend Equity ETF, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Schwab U.S. Dividend Equity ETF wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $661,910!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,125,504!*

Now, it’s worth noting Stock Advisor’s total average return is 1,079% — a market-crushing outperformance compared to 191% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of September 22, 2025

Stefon Walters has positions in Coca-Cola. The Motley Fool has positions in and recommends Target. The Motley Fool has a disclosure policy.