Better Fintech Stock: Nu Holdings vs. SoFi Technologies

Key Points

Nu has enormous opportunities as it enters new markets and expands its target demographics.

SoFi is launching new products to appeal to its core demographic of young adults.

Both stocks trade at compelling valuations.

Nu Holdings (NYSE: NU) and SoFi Technologies (NASDAQ: SOFI) are two of my favorite stocks. They're both impressive all-digital banks, though they differ in some features and serve customers in different regions. But when compared head to head as investments, which one wins?

Image source: Getty Images.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

The case for Nu: Unbeatable opportunities

Nu is based in Brazil, its primary market, and also serves customers in Mexico and Colombia. Brazil's financial sector was historically dominated by a handful of large, legacy banks that imposed high barriers to access, a situation that left many people there unbanked or underbanked. Nu was launched to provide financial services for these populations, but it has become increasingly popular across many demographics, and now, 60% of adults in Brazil have Nu accounts. The bank is making strides in its other markets too: 13% of the adult population in Mexico are Nu customers, as are 9% of adults in Colombia.

It revenue has been growing fast, both by adding new customers and by cross-selling more and higher-cost products to its established base. Management has pointed out that even though it has a majority of the adult market in Brazil as users, they're far from fully monetized. In fact, it's just getting started with the higher-income market, and it's launching new products and services to attract members of this population and increase engagement.

It has been steadily launching new products in all of its markets, and it was recently approved for a full banking charter in Mexico, which will allow it to expand in that market. It's also already investing in other global markets, and it has implied that it would expand into new Latin American regions soon. In other words, it has huge opportunities to grow in all directions.

Not only is it consistently growing at rapid rates every quarter, it is scaling profitably. Nu's online bank model has low overhead since it has no physical branches and relies heavily on technology for the heavy lifting, and its cost to serve each customer has remained fairly steady for years now. In fact, it's actually declining a bit. In the second quarter, it was $0.80, down from $0.90 in the prior year period. And despite the many new customers it adds every quarter, average revenue per active user continues to increase: It was up 18% year over year in the second quarter.

Let's take a look at how it's growing compared with SoFi.

| Company | Total Revenue | Revenue Growth (YOY) | Net Income | Net Income Growth (YOY) | Members | Membership Growth (YOY) |

|---|---|---|---|---|---|---|

| Nu Holdings | $3.7 billion | 40% | $637 million | 42% | 123 million | 17% |

| SoFi Technologies | $858 million | 44% | $97 million | 458% | 11.7 million | 34% |

Data sources: Nu and SoFi quarterly reports. All data is for the second quarter of 2025. YoY = year over year. SoFi's revenue metric is adjusted net revenue. Nu metrics are currency neutral.

Nu is already much bigger than SoFi, but its sales are still growing just as quickly.

The case for SoFi: Close to home

SoFi is an all-digital bank serving U.S. customers, and it, too, is growing both by attracting new customers and upselling and cross-selling to its existing ones. The company started out specializing in student loans, and it still heavily targets the student and young professional market.

It's not expanding outside of its U.S. geography, but it's adding many new features and services to generate higher engagement and attract more business. It also has a business-to-business financial infrastructure product that it calls its Tech Platform.

Lending is still its core segment, and it's growing in all three of its categories -- personal, student, and home -- despite relatively high interest rates. This business is likely to thrive as market interest rates come down, and its credit metrics should continue to improve as SoFi gains more experience and data for its underwriting.

SoFi's highest-growing segment is financial services, which covers all of its non-lending products outside of Tech Platform. Financial services revenue increased 106% in the second quarter, and its contribution profit rose 241%. Although lending still accounts for most of SoFi's profits, its non-lending segments now provide the majority of revenue -- 55% in the second quarter.

SoFi is launching new features that appeal to its digital-savvy clientele, such as access to private equity funds through its investing products. It also brought back cryptocurrency trading, which it had halted to help facilitate its acquisition of a banking charter a few years ago. The regulation that required that has been lifted, and cryptocurrency trading is back, and SoFi's internal research suggests that people prefer to trade crypto through their banks rather than on dedicated crypto platforms. Management has many other blockchain-based services in the works, starting with international money transfers.

SoFi is still a lot smaller than Nu, which means its growth opportunities might be bigger.

Two amazing digital bank stocks

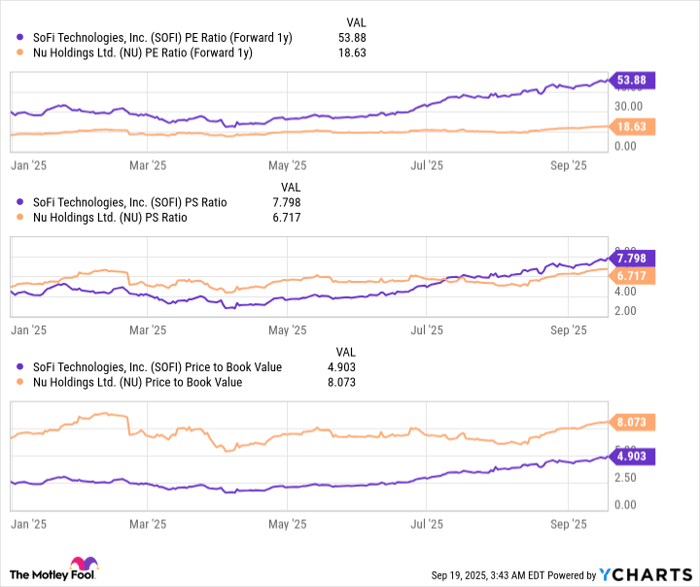

Based on their valuations, the two banks look similar, though SoFi is more expensive by certain metrics while Nu is pricier on others.

SOFI PE Ratio (Forward 1y) data by YCharts

Both would fall in the higher risk category for investors, but Nu might be slightly higher since it operates in countries with more volatile economies. It might have larger opportunities, though, as it moves to enter new regions. If that suits your risk profile, you might want to choose Nu.

However, I highly recommend both of these stocks. I think that they could deliver multibagger returns over the next decade, adding tremendous value to your portfolio.

Should you invest $1,000 in Nu Holdings right now?

Before you buy stock in Nu Holdings, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Nu Holdings wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $661,694!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,082,963!*

Now, it’s worth noting Stock Advisor’s total average return is 1,067% — a market-crushing outperformance compared to 190% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of September 22, 2025

Jennifer Saibil has positions in Nu Holdings and SoFi Technologies. The Motley Fool recommends Nu Holdings. The Motley Fool has a disclosure policy.