Best Stock to Buy Right Now: SiriusXM vs. Spotify

Key Points

Spotify is growing faster and has a larger customer base.

SiriusXM is slower growing, but offers consistent profitability and an impressive dividend.

Valuation further distinguishes these two stocks from one another.

Car entertainment has come a long way since the launch of satellite radio at the turn of the 21st century. When XM and Sirius each launched their respective satellite services, they became immediate competitors to terrestrial radio and cassette tapes or CDs.

It took less than a decade for those two satellite competitors to merge into what we now know as SiriusXM (NASDAQ: SIRI). While that merger may have helped both companies succeed, the landscape has continued to become more competitive with streaming music services like Spotify (NYSE: SPOT) competing on price and value.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

What matters to investors, however, is how these businesses will do moving forward. Let's dig into each to see which makes the better investment today.

Image source: Getty Images.

Growth favors Spotify

Spotify features a free, ad-supported option as well as a subscription, ad-free tier for its customers to choose between. The vast majority of Spotify's revenue comes from its subscription customers, even though 62% of its monthly average users are on the free, ad-supported tier. In the most recent quarter, Spotify grew its total monthly average users by 11%. It ended the quarter with 276 million premium (paid) subscribers, up 12 year over year.

Other than free trials, there is no free subscription option for SiriusXM, and it ended its most recent quarter with 33 million paid subscribers. Not only does SiriusXM have a fraction of the subscribers of Spotify, but they're also declining, with a Q2 year-over-year growth decline of 1%.

Where future growth will come from is also less clear with SiriusXM. Many customers subscribe after purchasing a new car that comes with a trial SiriusXM subscription. This ties SiriusXM's growth to auto sales to a certain degree. With no such limit on Spotify, it's easy to see how it would have a clearer path to future growth.

The bottom line favors SiriusXM

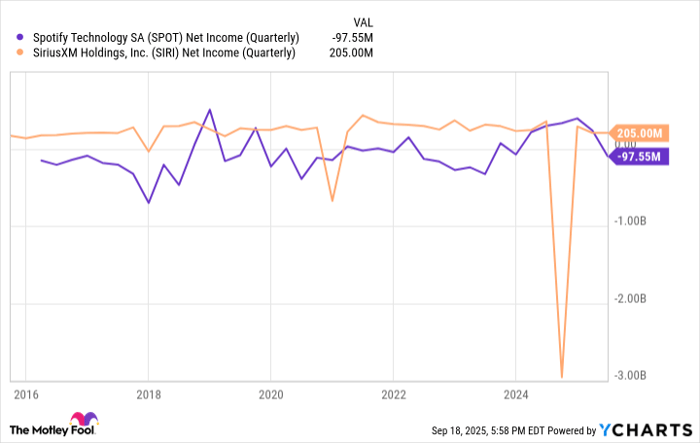

Despite the more impressive growth profile for Spotify, the bottom line tells a different story. SiriusXM is consistently profitable (except for its Q3 of 2024) while Spotify is still struggling to generate consistent profits.

SPOT Net Income (Quarterly) data by YCharts

This consistent profitability for SiriusXM has also allowed it to be more shareholder-friendly than Spotify. Over the last 10 years, SiriusXM has reduced its share count by almost 36% and the company pays a dividend that currently yields 4.7%.

With interest rates falling, and predicted to continue to fall, SiriusXM's dividend yield is even more attractive. Combine that with the share buybacks, and the stock becomes more interesting than at first glance.

Growth is expensive

There's no doubt that Spotify has a more attractive growth profile than SiriusXM. However, investors pay for that growth in the stock's valuation. SiriusXM currently trades for 0.9 times sales, while Spotify investors will pay 8 times sales for shares today.

Not only is SiriusXM cheaper than Spotify, it's near its cheapest point in the last 10 years. That's the reason for the attractive dividend yield. There may not be exciting growth to look forward to, but the company is profitable and generates positive free cash flow. Its total return profile makes it worth considering.

On the other hand, Spotify is nearly the most expensive it has been over the past 10 years. With no capital return to shareholders to speak of, investors need to rely on continued strong growth to see an investment from today pay off.

So, which is the best stock? It might come down to what investors are looking for. Spotify offers higher upside, but more risk from today's price. SiriusXM is cheap and offers stability with its dividend, allowing it to serve a different role in a well-diversified portfolio.

Should you invest $1,000 in Sirius XM right now?

Before you buy stock in Sirius XM, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Sirius XM wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $661,694!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,082,963!*

Now, it’s worth noting Stock Advisor’s total average return is 1,067% — a market-crushing outperformance compared to 190% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of September 15, 2025

Jeff Santoro has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Spotify Technology. The Motley Fool has a disclosure policy.