Could IonQ Outperform Nvidia in the Next Decade?

Key Points

Buzz has been building around quantum computing.

IonQ is the largest stock in the quantum sector at a market cap of $19 billion.

There's a lot of upside potential in quantum, but thus far, revenue has been minimal.

By now, Nvidia has become a household name. The artificial intelligence (AI) chip stock dominates the market for GPUs, the chips that make AI models like ChatGPT run, and has ridden the AI boom to become the most valuable company in the world.

However, some investors are already looking for the next big thing in technology, and seem to have settled on quantum computing, a revolutionary technology that uses qubits, or quantum bits, to process information. By doing so, these computers are able to perform complex calculations exponentially faster than traditional computers, meaning they could have a similar disruptive effect as AI.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: Getty Images.

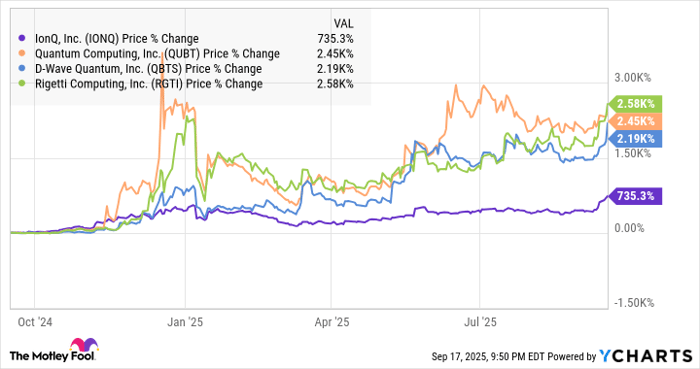

Quantum stocks have gotten buzzy this year, and stocks like IonQ (NYSE: IONQ) have surged. As you can see from the chart below, IonQ and its peers have skyrocketed over the last year in a rally that began last December with Alphabet's announcement of a breakthrough with its Willow quantum chip.

IonQ is the biggest of the four pure-play quantum stocks, now trading at a market cap of $19.4 billion. Though the company still has very little revenue, it's been building significant momentum and showing more evidence that it and quantum computing more generally can go mainstream. Let's take a closer look at where IonQ stands today and where it could go in the next decade.

IonQ today

IonQ reported $20.7 million in revenue in the second quarter, up 82% from the quarter a year ago. That's still tiny for a company with a market cap of nearly $20 billion, but there are signs of a bright future for IonQ.

In the second quarter, the company said a collaborative research program between it, AstraZeneca, Amazon Web Services (AWS), and Nvidia achieved more than 20 times improvement in end-to-end time-to-solution using a quantum-accelerated computational chemistry workflow for drug discovery. That's strong evidence of the potential of the technology.

The company also forged partnerships around the world in the second quarter, including in South Korea, Japan, and Sweden, and announced an expansion in the Asia-Pacific region in collaboration with Emergence Quantum, an Australian company.

Finally, IonQ has been growing through a string of acquisitions, beefing up its capabilities in quantum computing. Those include Lightsynq and Capella in the second quarter, and Oxford Ionics and Vector Atomic, which hasn't closed yet, in September.

Just on Wednesday, the company signed a memorandum of understanding with the U.S. Department of Energy to advance quantum technologies in space, showing the federal government is getting more involved in quantum.

Will it beat Nvidia over the next decade?

There's a ton of uncertainty in quantum computing over the next decade. The technology seems promising, but IonQ's growth forecast still seems relatively modest as it expects full-year revenue of $82 million to $100 million. It could still be several years before it reaches $1 billion.

Comparing IonQ's prospects to Nvidia's is difficult because Nvidia is at a much different stage of its life cycle. As the most valuable company in the world, the ceiling for Nvidia's growth is much lower than IonQ. At a price-to-earnings ratio of roughly 40, a 10x for Nvidia over the next decade would mean reaching $40 trillion in market cap and $1 trillion in profit if it maintained its valuation.

Currently, there aren't any companies with $1 trillion in revenue, let alone $1 trillion in profit, and the S&P 500's current market cap is about $55 trillion. Looking at it that way, a 10x return for Nvidia will be difficult, if not unrealistic, over the next decade.

With greater upside potential and the potential disruption from quantum computing, IonQ could outperform Nvidia, but it's much riskier than the AI leader.

For tech-minded growth investors, owning both stocks might be the best approach. It will also give you exposure to the top names in AI and quantum computing.

Should you invest $1,000 in IonQ right now?

Before you buy stock in IonQ, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and IonQ wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $661,694!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,082,963!*

Now, it’s worth noting Stock Advisor’s total average return is 1,067% — a market-crushing outperformance compared to 190% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of September 15, 2025

Jeremy Bowman has positions in Amazon and Nvidia. The Motley Fool has positions in and recommends Alphabet, Amazon, and Nvidia. The Motley Fool recommends AstraZeneca Plc. The Motley Fool has a disclosure policy.