Why I Think Domino's Pizza (DPZ) Is a Warren Buffett-Worthy Investment

Key Points

Domino's is the world's biggest pizza restaurant chain.

The company has partnerships with Uber and DoorDash, as well as a sophisticated digital presence.

Domino's dividend payout is up more than 100% in the last five years.

For many people, pizza is a classic comfort food that rarely loses its appeal. And there's something for everyone -- thin or thick crust, white or red sauce, vegetarian or meat toppings, gluten-free, thick, or thin crust. Pizza is incredibly versatile, which is why it's so popular.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Globally, the pizza market size is expected to grow from $152.4 billion in 2024 to $269.5 billion by 2034, for a compound annual growth rate of 5.8%. And while Europe has the largest market share, consuming 39% of pizzas made, the United States is no slouch -- it has an estimated 77,000 pizza restaurants.

This makes pizza a compelling investment opportunity, which is undoubtedly what the Oracle of Omaha, Warren Buffett, realized when he led Berkshire Hathaway to take a stake in Domino's Pizza (NASDAQ: DPZ). Berkshire owns 2.63 million shares of Domino's stock, or 7.8% of the company. The conglomerate's total stake is valued at $1.16 billion.

Buffett, the CEO of Berkshire Hathaway for 60 years, prefers stocks with strong management, a leading position in their fields, consistent earnings, and a solid dividend. But there's one area where I think Domino's really stands out, making this truly a Buffett-worthy investment.

Image source: The Motley Fool.

About Domino's Pizza

Headquartered in Michigan, Domino's Pizza is the biggest pizza company in the world, boasting more than 21,500 stores in 90 markets. Domino's is growing rapidly with its franchise model -- 99% of its stores are franchises, which keeps the company's overhead to a minimum. Domino's opened 160 stores in 2024 with 60 new franchise owners, and has a pipeline of 120 additional prospective franchise owners.

As a quick-service pizza restaurant, Domino's has a mobile app that has been critical for its success. The company generates 85% of its sales from digital ordering channels through its Anyware platform. Customers can place their orders on Domino's mobile app, send a text message, or order through Apple Carplay, Amazon Alexa, Google Home, Facebook Messenger, or Slack.

Dominos also has partnerships with Uber and DoorDash that allow its drivers to deliver Domino's Pizza, giving the company access to their platforms and fleets of drivers.

Domino's started the Uber partnership in 2024, and launched the DoorDash partnership in May 2025, which connects Domino's to DoorDash Marketplace.

"The ability to connect seamlessly with DoorDash customers means more sales for Domino's stores, while efficiently leveraging our brand's robust delivery network," Domino's Chief Operating Officer Joe Jordan said. "Tapping into incremental customers, particularly in suburban and rural markets, is a meaningful opportunity for Domino's, as our brand continues to open stores nationwide."

Why Domino's is a Buffett-worthy stock

Although quick-service pizza restaurants as a sector saw flat growth in the first half of the year, Domino's is enjoying growth. The company reported 3.4% same-store sales growth in the second quarter, sparked by strong sales from the company's Parmesan-stuffed crust pizza launch.

Revenues were $1.14 billion, up 4.3% from a year ago, thanks to higher supply chain revenues and franchise royalties. The company's net income and earnings per share slipped because of Domino's investment into DPC Dash, which is its master franchisee for China, Hong Kong, and Macao. The company reported net income of $131.1 million, down 7.7% from a year ago, and earnings per share of $3.81, down 5.5% from a year ago.

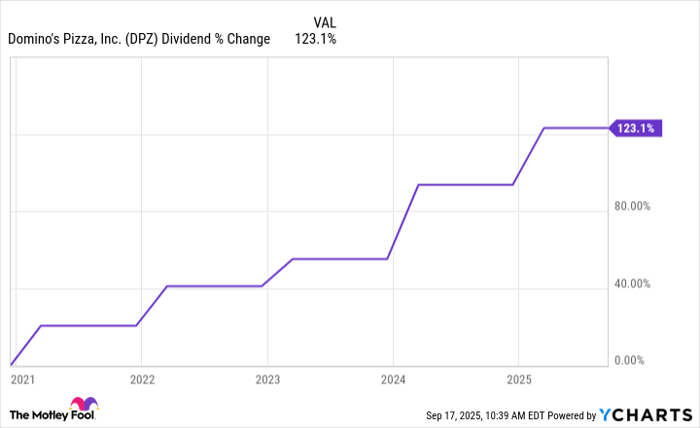

Domino's pays a dividend of $0.58 per share, which is a dividend yield of just 1.6%. That may not sound like a lot, but the dividend growth is much more attractive. Domino's has grown its dividend for 12 consecutive years, but it's growing fast, with a $0.23 jump this year and a $0.30 vault in 2024. The company's dividend growth is 123% over the last five years.

DPZ Dividend data by YCharts

Buffett, of course, loves his dividend stocks and uses them to amplify his returns. Domino's is in an ideal position to do that, and with a payout ratio of just 36%, the dividend appears secure for the foreseeable future.

The bottom line

Domino's checks every box for Buffett, and it's no surprise that Berkshire Hathaway has taken such a large position. But as much as I like the moves the company is making to solidify its position in the market, the dividend growth makes Domino's stock stand out as a Buffett-worthy stock to buy.

Should you invest $1,000 in Domino's Pizza right now?

Before you buy stock in Domino's Pizza, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Domino's Pizza wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $661,694!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,082,963!*

Now, it’s worth noting Stock Advisor’s total average return is 1,067% — a market-crushing outperformance compared to 189% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of September 15, 2025

Patrick Sanders has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Amazon, Apple, Berkshire Hathaway, Domino's Pizza, DoorDash, and Uber Technologies. The Motley Fool has a disclosure policy.