70 Million Social Security Beneficiaries Are Set for a "Trump Bump" in 2026 (but It's Not Expected to Amount to Much)

Key Points

Oct. 15 is the big day when Social Security's 2026 cost-of-living adjustment (COLA) will be announced.

The inflationary impact of President Trump's tariff and trade policy will provide a boost to the Social Security payouts of retired workers, workers with disabilities, and survivor beneficiaries next year.

However, other factors all but ensure the full effect of Social Security's 2026 raise won't be felt by beneficiaries.

The most important day of the year for Social Security's approximately 70 million beneficiaries is just weeks away. On Oct. 15, the U.S. Bureau of Labor Statistics (BLS) will release the September inflation report and provide the final puzzle piece needed to reveal Social Security's 2026 cost-of-living adjustment (COLA).

With 80% to 90% of retired workers relying on their Social Security income to cover their expenses in some capacity, knowing how much they'll receive each month in the upcoming year is important.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

However, Social Security's 2026 COLA will be unlike any of the previous "raises" passed along to beneficiaries. That's because next year's payout will be lifted, in part, by President Donald Trump's tariff and trade policy. Call it a "Trump bump," if you will.

President Trump delivering remarks. Image source: Official White House Photo by Joyce N. Boghosian, courtesy of the National Archives.

What is Social Security's COLA, and how is it calculated?

Before going any further, it's imperative to understand what purpose Social Security's cost-of-living adjustment serves and how this oft-talked-about measure is calculated.

Social Security's COLA is essentially a mechanism that allows beneficiaries to fight back against the effects of inflation. If the cost to purchase goods and services increases from one year to the next, Social Security benefits would also need to rise to avoid a loss of buying power. The program's cost-of-living adjustment is a tool that beefs up benefits to account for inflation.

Prior to 1975, there wasn't any rhyme or reason to assigning COLAs. From 1940 to 1974, only 11 adjustments were passed along by special sessions of Congress.

Beginning in 1975, America's leading retirement program switched to the near-annual adjustments we're used to today by adopting the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) as its inflationary measure. The CPI-W has over 200 spending categories, each with its own unique percentage weighting, thereby allowing the index to be reported as a single figure each month. This makes it easy to compare to the prior-year period to determine whether prices have, collectively, increased (inflation) or declined (deflation).

Although the BLS reports the CPI-W monthly, only readings from the third quarter (July through September) are used to calculate Social Security's COLA. If the average third-quarter CPI-W reading from the current year is higher than the comparable period of 2024, beneficiaries can expect a larger monthly check in 2026.

The year-over-year percentage difference in average third-quarter CPI-W readings, rounded to the nearest tenth of a percent, equates to the COLA passed along. It's that simple.

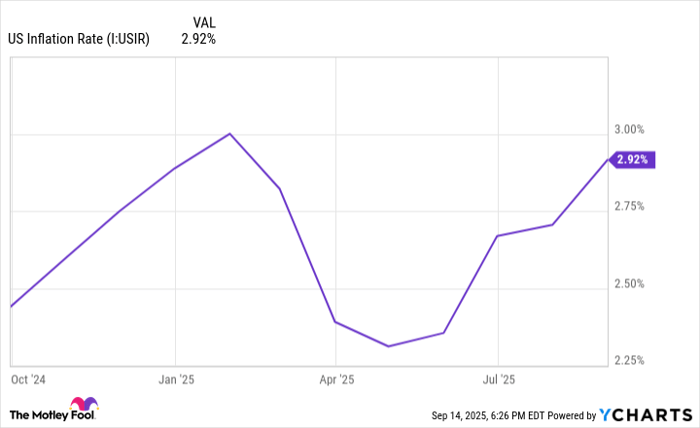

President Trump's tariff policy has lifted the prevailing rate of inflation and Social Security's projected 2026 COLA along with it. US Inflation Rate data by YCharts.

Social Security beneficiaries are a virtual lock to receive a modest "Trump bump" in 2026

Over the last four years, Social Security beneficiaries have been privy to above-average cost-of-living adjustments. Following menial increases throughout much of the 2010s, recipients saw their respective checks climb by 5.9% in 2022, 8.7% in 2023, 3.2% in 2024, and 2.5% in 2025. For context, the average COLA over the previous 16 years is 2.3%.

This sudden surge in Social Security COLAs was the result of a rapid expansion in U.S. money supply during the COVID-19 pandemic. With the prevailing rate of inflation rocketing to a four-decade high, beneficiaries saw their payouts rise rapidly, as well. The 8.7% raise passed along in 2023 marked the highest percentage increase in 41 years.

Inflation is the root cause of Social Security COLAs, and it's precisely why Donald Trump's tariff and trade policy is going to influence payouts in the upcoming year.

On April 2, the president unveiled his much-touted trade policy, which included a 10% global tariff as well as higher "reciprocal tariffs" on dozens of countries that have adverse trade imbalances with America. It's worth noting that Trump has paused the implementation of reciprocal tariffs on a number of occasions, and his administration has negotiated a handful of trade deals over the past five months.

The inflationary concern with Trump's tariff policy, as outlined by four New York Federal Reserve economists in a published study ("Do Import Tariffs Protect U.S. Firms?") with Liberty Street Economics, is that it makes little differentiation between output and input tariffs. An output tariff is assigned to a finished product imported into the U.S., while an input tariff is an added tax on a good used to complete the manufacture of a product domestically. Input tariffs can raise production costs and increase the prevailing rate of inflation.

In mid-January, nonpartisan senior advocacy group The Senior Citizens League (TSCL) estimated Social Security's 2026 COLA at 2.1% following the December inflation report from the BLS. But in its most recent projection, TSCL now anticipates a 2.7% COLA will be announced on Oct. 15. This increase of 0.6% is prominently based on the inflationary lift of President Trump's tariffs.

If TSCL's forecast is on the money and Social Security checks expand by 2.7% in the upcoming year, the average retired-worker beneficiary would see their monthly payout rise by $54. Meanwhile, the average worker with disabilities and survivor beneficiary would have their payout climb by approximately $43 per month, respectively.

This means that Trump's tariff policy, based on TSCL's estimates between January and September, is providing, on average, up to a $12 boost for retired workers each month in 2026 and a greater-than-$9 monthly bump for workers with disabilities and survivor beneficiaries.

Image source: Getty Images.

Unfortunately, beneficiaries are facing an expected double whammy next year

While this "Trump bump" is expected to modestly fatten the payouts of 70 million traditional Social Security beneficiaries in the new year, other factors are projected to partially or fully offset the impact of the 2026 COLA.

One of the biggest headwinds facing dual Social Security and traditional Medicare enrollees next year is an expected jump in the Part B premium. Part B is the segment of Medicare responsible for outpatient services.

In both 2024 and 2025, Medicare's Part B premium rose by 5.9%. According to the 2025 Medicare Trustees Report, the premium for Part B is forecast to soar by 11.5% to $206.20 per month in 2026. For dual-program enrollees, it's common to have their Part B premium deducted from their monthly Social Security benefit. This double-digit percentage increase all but ensures that most retirees won't enjoy the full impact of their 2026 COLA or the aforementioned "Trump bump."

To make matters worse, the buying power of Social Security income has been on a fairly steady decline since this century began. An analysis published last year by TSCL found the purchasing power of Social Security benefits had dropped 20% from 2010 to 2024.

Compared to working-age Americans, retirees spend a higher percentage of their monthly budget on shelter and medical care services. Keep in mind that 87% of Social Security's 70 million traditional beneficiaries are aged 62 and older.

However, the CPI-W is tasked with tracking the inflationary pressures for "urban wage earners and clerical workers," who are typically working-age Americans not currently receiving a Social Security payout. The costs that matter most to aging workers simply aren't being properly accounted for by the CPI-W.

Not even a modest Trump bump is going to fix these issues.

The $23,760 Social Security bonus most retirees completely overlook

If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.

One easy trick could pay you as much as $23,760 more... each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we're all after. Join Stock Advisor to learn more about these strategies.

View the "Social Security secrets" »

The Motley Fool has a disclosure policy.