1 Magnificent S&P 500 Dividend Stock Down 47% to Buy Right Now for a Lifetime of Passive Income

Key Points

Clorox has faced a number of challenges over the last few years.

However, its beloved brands appear to be as resilient as ever.

With its dividend yield now near 10-year highs, it may be a contrarian idea in a growth-focused market.

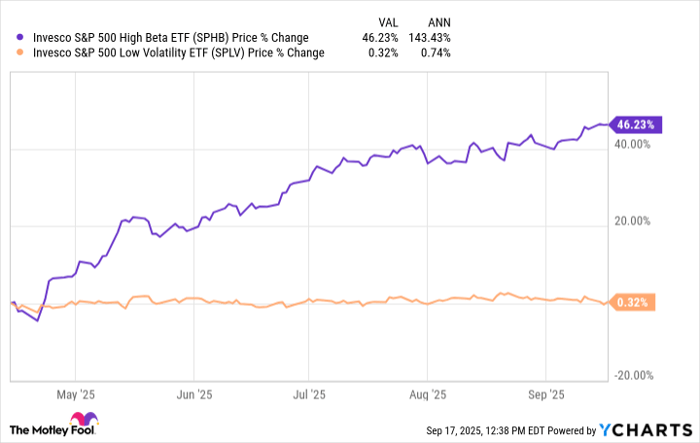

Over the last five months, high-beta stocks (typically considered growth stocks) have rocketed 46% higher, while low-volatility stocks (think value stocks, like staple goods) have remained flat.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

SPHB and SPLV data by YCharts.

While this is somewhat the norm for a typical bull market, it often leaves behind some stocks that are strong, but perhaps boring.

Consumer staples favorite Clorox (NYSE: CLX) is a perfect example of this phenomenon right now. With the company's shares down 22% year to date and 47% from their all-time highs, here's the case for why investors should consider this "forgotten" stock.

Image source: Getty Images.

Clorox: Marching through uncertainty

The market hates uncertainty. Unfortunately, Clorox has had no shortage of it lately.

First, it battled a cyberattack in 2023. Currently, it is replacing its enterprise resource planning (ERP) system, which is causing confusion due to fluctuations in sales and inventory as the implementation progresses. Furthermore, consumer confidence remains shaky, leaving the company's actual business of selling its popular brands somewhat in limbo.

Throw tariff changes and their impacts on top of it all, and it is fair to see management using adjusted financial figures to help investors have any clue as to how the business is performing.

However, amid all this confusion, CEO Linda Rendle used the fourth-quarter earnings call to reiterate that the company's brands look as strong as ever:

Our brands continue to be incredibly healthy with consumers. We grew household penetration in fiscal year '25 and although we lost share in Q4, we grew share for the year, and we came off of a quarter in Q3 where we maintained share. And if you look at our consumer value metric, that remains at a high point in fiscal year '25. So we know it's not our brands.

In my eyes, this is the most crucial takeaway from Clorox's recent results. Generating 80% of its sales from brands that hold a No. 1 or No. 2 market share position in their niche, Clorox's biggest weapon is the branding moat surrounding its essential items.

Besides its namesake brand itself, it also owns (among others) Kingsford charcoal, Burt's Bees skin care products, Hidden Valley Ranch salad dressing, Fresh Step cat litter, Pine-Sol, Brita water filters, Glad food wrapping, and Liquid-Plumr drain cleaner.

Image source: Clorox.

Thanks to this collection of household brands in regular use, Clorox is designed to forge through trying times, which is intriguing today as the market trades at all-time highs.

With management expecting the company to generate roughly $6.10 in adjusted earnings per share (EPS) in 2026, Clorox trades at a reasonable 20 times forward earnings. It currently trades at a similar 21 times free cash flow (FCF), both of which are well below the S&P 500's average ratios, which are closer to 30.

Strong profitability and a once-in-a-decade dividend yield

Besides its powerful brands, Clorox's robust profitability makes it a compelling investment opportunity -- particularly its return on invested capital (ROIC) of 25%.

Stocks with consistently high ROICs like Clorox's have historically produced market-beating returns over the long haul as they generate outsize profits from the debt and equity they use to fund their operations.

Furthermore, despite all the challenges facing the company, it has already returned its free cash flow margin to 11%, reaching pre-pandemic and pre-cyberattack levels.

However, there may be room for further upside as management believes it could reach 13% FCF margins after it switches ERP systems and divests from lower-margin businesses.

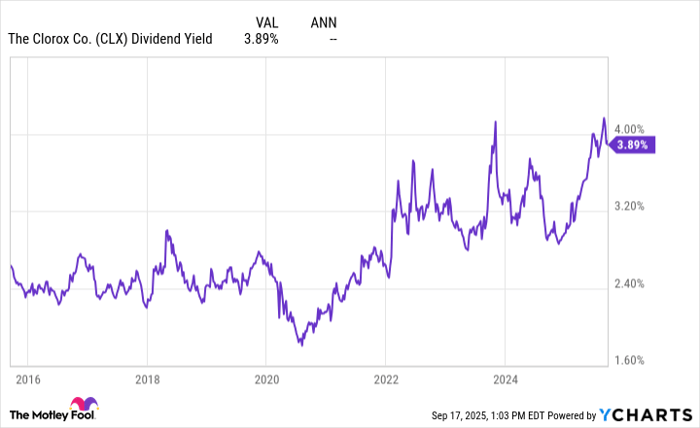

Armed with this healthy and resilient FCF creation, Clorox is able to handsomely reward shareholders with a 3.9% dividend yield that is near a decade-long high.

CLX Dividend Yield data by YCharts.

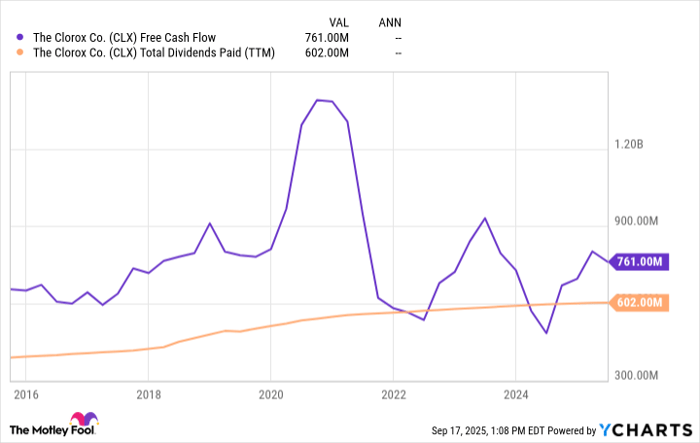

Despite this hefty yield, Clorox still generates ample FCF to cover these payments, even with the challenges it has faced in recent years.

CLX Free Cash Flow and Dividends Paid, data by YCharts; TTM = trailing 12 months.

While dividend growth has slowed to the low single digits over the last few years, the company's potential for higher margins once it has navigated its numerous headwinds could reinvigorate dividend growth.

Best yet for investors, Clorox uses the leftover FCF after paying dividends to buy back shares. Clorox has lowered its shares outstanding by 0.6% annually over the last decade, and by 1.3% in just the last year alone.

These buybacks will help juice the company's per-share figures and are especially potent while shares trade at a sub-market valuation.

Ultimately, Clorox is not going to be a multibagger for investors anytime soon. But with its strong brand moat, a 3.9% dividend yield, and potential for further margin improvement once headwinds abate, it could provide market-matching returns and a lifetime of passive income with less risk than most stocks.

Should you invest $1,000 in Clorox right now?

Before you buy stock in Clorox, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Clorox wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $661,694!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,082,963!*

Now, it’s worth noting Stock Advisor’s total average return is 1,067% — a market-crushing outperformance compared to 189% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of September 15, 2025

Josh Kohn-Lindquist has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.