Meet the Popular Index Fund That Could Turn $500 Per Month Into $1 Million by 2055

Key Points

High-growth technology stocks like those in the "Magnificent Seven" have very high weightings in the Nasdaq-100 index.

The Invesco QQQ Trust tracks the performance of the Nasdaq-100, and it has delivered a powerful compound annual return of 19.4% over the last decade.

The Invesco QQQ ETF could turn an investment of $500 per month into $1 million over the long term, even if that rate of return slows.

The Nasdaq-100 index is home to 100 of the largest non-financial companies listed on the Nasdaq stock exchange. It tends to maintain a very high exposure to companies in the technology and technology-adjacent industries, and it has delivered spectacular long-term returns thanks to powerful themes like the internet, cloud computing, enterprise software, and now, artificial intelligence (AI).

The Invesco QQQ Trust (NASDAQ: QQQ) is an exchange-traded fund (ETF) that tracks the performance of the Nasdaq-100 by holding the same stocks, with similar weightings. Here's how it could turn an investment of $500 per month into $1 million by the year 2055 (but likely even sooner).

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Image source: Getty Images.

America's most dominant tech stocks packed into one ETF

Although the Invesco QQQ ETF is home to 100 different companies, its top 10 holdings alone represent 55.8% of the value of its entire portfolio. That list is jam-packed with technology stocks, including all of the famous "Magnificent Seven" that operate at the forefront of the AI industry.

|

Stock |

Invesco ETF Portfolio Weighting |

|---|---|

|

1. Nvidia |

9.43% |

|

2. Microsoft |

8.36% |

|

3. Apple |

7.86% |

|

4. Alphabet |

6.26% |

|

5. Broadcom |

6.18% |

|

6. Amazon |

5.49% |

|

7. Meta Platforms |

3.74% |

|

8. Tesla |

3.39% |

|

9. Netflix |

2.78% |

|

10. Costco Wholesale |

2.31% |

Data source: Invesco. Portfolio weightings are accurate as of Sept. 16, 2025, and are subject to change.

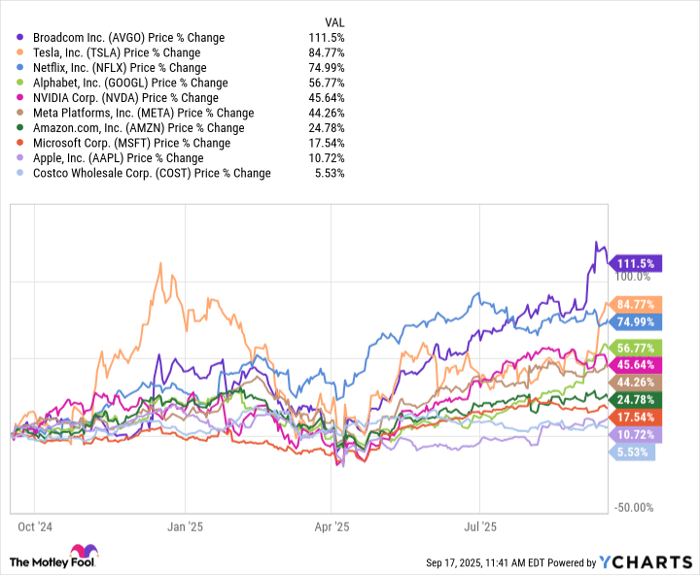

They have been 10 of the best performing stocks in America over the past year, delivering a median return of 45%. As a result, they are responsible for the bulk of the 24% gain in the Nasdaq-100 over the same period.

But they aren't the only red-hot stocks in the Nasdaq-100. Sitting just outside its top 10, investors will find powerhouses like:

- Palantir Technologies, which soared 355% over the past year. The company sells AI software that helps businesses and government organizations extract valuable insights from their data.

- Micron Technology, which is up 79% in the last 12 months. The company is a leading supplier of memory and storage solutions for data centers, computers, and smartphones. Its high-bandwidth memory can be found inside Nvidia's most advanced AI chips.

- CrowdStrike, which is sitting on a 12-month gain of 63%. It specializes in AI-powered cybersecurity, and its Falcon platform is one of the most popular solutions in the industry.

Turning $500 per month into $1 million could take as little as 19 years

The Invesco QQQ Trust delivered a compound annual return of 10.2% since its inception in 1999. However, it has generated an accelerated average return of 19.4% per year over the last decade, specifically thanks to the proliferation of technologies like cloud computing, enterprise software, machine learning, and AI.

Here is a breakdown of how long it would take to turn a consistent investment of $500 per month into a final balance of $1 million based on three different compound annual returns.

|

Monthly Investment |

Compound Annual Return |

Time To Reach $1 Million |

|---|---|---|

|

$500 |

10.2% |

29 years (by 2055) |

|

$500 |

14.8% (midpoint) |

22 years (by 2048) |

|

$500 |

19.4% |

19 years (by 2045) |

Calculations by author.

As you can see, the ETF could be a millionaire-maker in 29 years even if its annual return reverts back to its long-term average of 10.2%. It would propel investors into the million-dollar club much faster if it maintains its accelerated annual return of 19.4%, but no ETF -- not even one as tech-heavy as this -- can grow at that pace forever.

The law of large numbers eventually becomes a limiting factor, because companies like Nvidia, Microsoft, Apple, and Meta already have such a dominant market share in their respective industries that they will eventually run out of new prospective customers. There are already more than 2.35 billion active Apple devices worldwide, for instance, and over 3.4 billion people use one of Meta's social media apps every single day.

With that said, the AI boom probably still has legs. Nvidia CEO Jensen Huang predicts data center operators will spend $4 trillion to upgrade their infrastructure over the next five years, in order to meet demand from AI developers. Plus, new themes like agentic AI could be even more valuable, with Salesforce CEO Marc Benioff predicting demand for digital labor could be worth up to $12 trillion in the future.

As a result, investing in the Invesco QQQ Trust consistently over the long term will probably still yield excellent results, as has been the case since its inception 26 years ago.

Should you invest $1,000 in Invesco QQQ Trust right now?

Before you buy stock in Invesco QQQ Trust, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Invesco QQQ Trust wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $662,520!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,043,346!*

Now, it’s worth noting Stock Advisor’s total average return is 1,056% — a market-crushing outperformance compared to 188% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of September 15, 2025

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Alphabet, Amazon, Apple, Costco Wholesale, CrowdStrike, Meta Platforms, Microsoft, Netflix, Nvidia, Palantir Technologies, Salesforce, and Tesla. The Motley Fool recommends Broadcom and Nasdaq and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.