Are the Bulls Right About Opendoor Technologies Stock?

Key Points

Opendoor's stock is surging on a new AI and CEO bull case.

The company has bad profit margins and has historically lost money.

At its current market cap, shares of Opendoor stock are getting ahead of any future growth from AI initiatives.

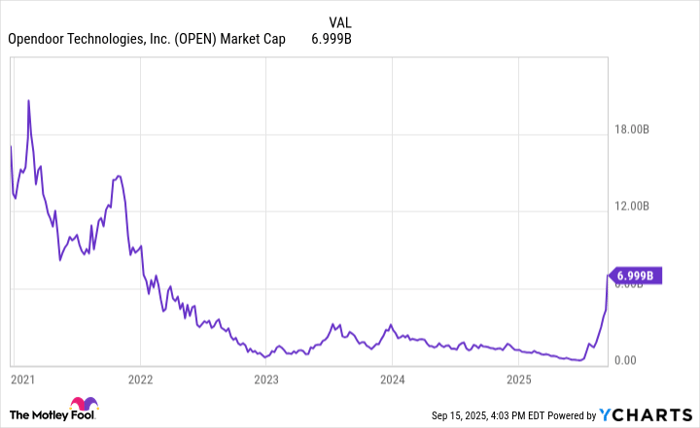

Opendoor Technologies (NASDAQ: OPEN) is trying to come back from the dead. Its stock was trading at around $0.50 and down more than 95% from all-time highs earlier this year, with the pain for shareholders so intense that the company was planning on performing a reverse stock split.

Now, life is being breathed back into this real estate disruptor, which makes cash offers to people selling homes.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

The stock recently was up over 10x from the lows at just under $10 a share. An army of investors have started to buy Opendoor stock, with a thesis around changing management and product innovation around artificial intelligence (AI) in residential real estate.

Should you join this Opendoor investor group and buy the stock? Let's take a closer look at its financials and future potential to find out.

Image source: Getty Images.

AI-powered real estate

The first business model conceived by Opendoor is still alive today: buying and selling residential real estate at scale utilizing a digital platform. Opendoor makes cash offers to people selling homes, hoping to earn a spread when selling it to a buyer down the line. Scaling this model has proven difficult given the company's slim margins and capital intensity (the company continuously has a large inventory of homes sitting on its balance sheet).

New CEO Kaz Nejatian aims to build on top of this iBuying business. Najatian was just announced as the leader of Opendoor Technologies last week, coming from Shopify where he worked for six years, most recently as the chief operating officer (COO). At Shopify, Najatian was able to help build a culture of innovation, helping Shopify take market share in e-commerce, website software, and online payments.

Nejatian -- along with new board members Kevin Wu and Keith Rabois, who founded Opendoor -- aims to use AI for new business lines. These include tools for real estate agents, sellers, and buyers to improve the real estate buying process. Although it will be unable to copy Zillow's breadth of listings anytime soon, Opendoor is now aiming to to become a software partner with real estate stakeholders as opposed to disrupting the entire home-buying process with its vertically integrated iBuying model.

Searching for better profit margins

Opendoor is making this pivot because of the poor unit economics of iBuying, or buying and selling real estate using cash offers. Last quarter, Opendoor had $1.6 billion in revenue but just $128 million in gross profit, for a margin of 8.2%. This is a worse gross margin than most grocery stores, which famously run extremely thin business models.

Adding new products such as its cash plus offer and signing up real estate agents to utilize its software will help Opendoor provide more value for real estate transactions without actually flipping homes and running a capital-intensive business that has historically never generated a profit. As it provides more value to real estate stakeholders, it will be able to extract high margin revenue for utilizing is software and AI services.

While it hasn't shown up in the numbers yet, this is the plan going forward for Opendoor and its new CEO.

OPEN Market Cap data by YCharts

Are the bulls right about Opendoor?

It is wrong to ask if the bulls are right about Opendoor, but rather: could they be correct in owning this stock today? There is definitely a possibility for future disruption in residential real estate if a digital platform can utilize AI to radically improve how people buy and sell homes, an arduous, paperwork-filled process today.

Around 4 million existing homes are sold in the United States every year, with closer to 6 million historically before the Federal Reserve raised interest rates and froze the real estate market. Trillions of dollars exchange hands every year, brokered by millions of registered real estate agents. If Opendoor can earn a slice of these transactions through a new disruptive model, the stock may be worth owning at its current market cap of $7 billion.

The problem is knowing the probability of this occurring. Plenty of companies have tried to disrupt residential real estate. A lot of existing profits in the industry flow to Zillow and its popular real estate portal, and that stock only has a market cap of $18 billion. Given that Opendoor is losing money today and has not even launched this new business model, a $7 billion market cap seems much too steep for a bull case that is not guaranteed to succeed.

Opendoor stock has gotten ahead of itself. Keep this disruptive company on the watchlist, but don't buy the stock at these elevated levels.

Should you invest $1,000 in Opendoor Technologies right now?

Before you buy stock in Opendoor Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Opendoor Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $662,520!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,043,346!*

Now, it’s worth noting Stock Advisor’s total average return is 1,056% — a market-crushing outperformance compared to 188% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of September 15, 2025

Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Shopify and Zillow Group. The Motley Fool has a disclosure policy.