Is CoreWeave's Stock in Trouble?

Key Points

CoreWeave went public earlier this year and quickly became a hot artificial intelligence (AI) stock.

However, there's a lot of short interest in the stock as the company's poor financials make it a risky investment.

If its stock doesn't rally, its planned acquisition of Core Scientific may fall through.

This year, CoreWeave (NASDAQ: CRWV) joined the list of hot new artificial intelligence (AI) stocks to buy. The company's close partnership with chipmaker Nvidia made it appear to be a fairly safe way to invest in AI, and its valuation has tripled since it went public back in March.

In the past three months, however, the price of this AI stock has fallen by around 26% (returns as of Sept. 17). One reason for the price drop is that insiders appear to be cashing in and selling stock after the post-IPO lockup period expired last month. Unfortunately, the decline in valuation this creates has introduced worries that CoreWeave's plans for an acquisition (which could help improve CoreWeave's financials) are now in jeopardy. These worries are exacerbating the selloff.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Image source: Getty Images.

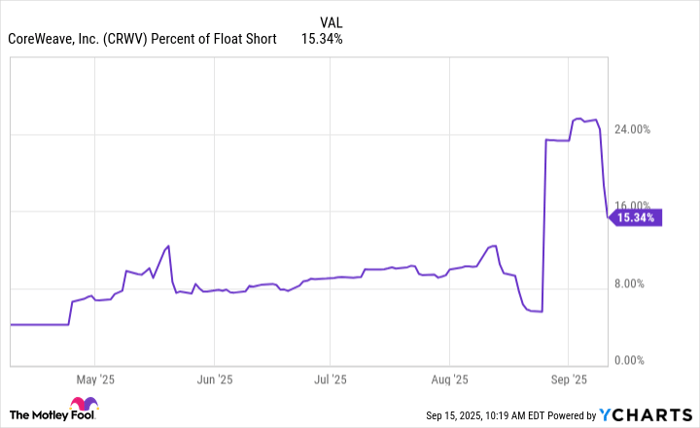

The stock is heavily shorted

Short interest in CoreWeave is relatively high, which is a sign that many investors are worried about its growth prospects and potential for long-term success. And when there is a decline in the share price, that can lead to a greater sell-off for the stock as bearish investors pile on.

Data by YCharts.

Although the short interest (as a percentage of float) has declined recently, it's still higher than it was a few months ago, and it's a significant percentage overall. It's not uncommon for volatile stocks to have a lot of short interest. That can play a big role in their rapid movements as short-sellers cover their positions (which pushes the share price up) or double down on their bets (which can drive a price lower).

The problem is that CoreWeave's declining share price could create issues for its business.

Key acquisition in doubt?

Back in July, CoreWeave announced plans to acquire Core Scientific (NASDAQ: CORZ) in an all-stock deal worth $9 billion. The move was seen as a strategic one for CoreWeave, which rents out compute power and access to Nvidia's latest chips. By acquiring Core Scientific, a data center company, CoreWeave would be able to get rid of up to $10 billion in future lease obligations while improving its overall efficiency.

The problem is that with its share price crashing, it could result in a renegotiation and put the deal at risk. Core Scientific's largest shareholder, Two Seas Capital LP, opposes the deal, citing a low valuation. When the deal was announced, CoreWeave's stock was trading around $160. On Wednesday, the stock was trading around $116.

CoreWeave's business needs a way to improve its earnings because its bottom line is deeply in the red. In the trailing 12 months, the tech company incurred losses totaling $1.1 billion, despite generating $3.5 billion in sales. If it loses the Core Scientific deal, that could give bearish investors and short-sellers even more reason to expect the stock to fall even further, in both the short term and the long term.

Is CoreWeave stock a good buy on the dip?

CoreWeave's stock has been rallying in recent days, but unless it goes on a strong run, it may not be enough to convince Core Scientific shareholders to move ahead with the planned acquisition. However, even if it does end up happening, that may still not be nearly enough to get CoreWeave anywhere near breakeven.

The company's vast losses are a concern that investors shouldn't ignore, as it calls into question just how sustainable its business model is, especially if there's a slowdown in tech spending due to poor economic conditions. Even though the stock may look cheaper than it was a few months ago, you may still want to think twice about owning shares of CoreWeave, as there are many questions around the business, including whether it has a path to profitability.

Should you invest $1,000 in CoreWeave right now?

Before you buy stock in CoreWeave, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and CoreWeave wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $662,520!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,043,346!*

Now, it’s worth noting Stock Advisor’s total average return is 1,056% — a market-crushing outperformance compared to 188% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of September 15, 2025

David Jagielski has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Nvidia. The Motley Fool has a disclosure policy.