Intel Gets a $5 Billion Boost from Nvidia

Key Points

Intel and Nvidia announced a blockbuster deal on Thursday.

The two companies will develop custom data center and PC chips integrating Intel and Nvidia technology, and Intel will manufacture them.

Nvidia will also invest $5 billion in Intel stock.

Semiconductor giant Intel (NASDAQ: INTC) entered this year in a state of disarray. It had no permanent CEO until March, when industry veteran Lip-Bu Tan took over after former CEO Pat Gelsinger was forced out. Intel's foundry business, a capital-intensive endeavor meant to open up Intel's manufacturing technology and facilities to third-party customers, wasn't winning meaningful customers. Tan made it clear that without significant external revenue, Intel may have to get out of the chip manufacturing business altogether.

For the foundry to work, Intel needs plenty of cash to scale up its Intel 18A process and complete development of its upcoming Intel 14A process. It also needs enough external customers to justify those massive investments. The company got both on Thursday, courtesy of Nvidia (NASDAQ: NVDA).

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

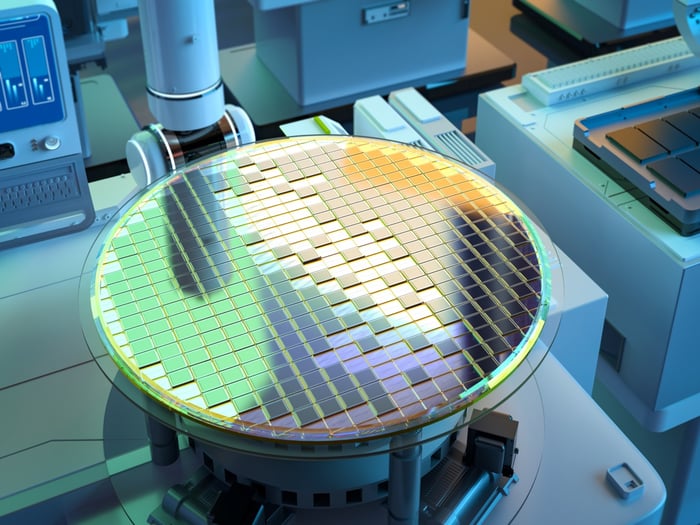

Image source: Getty Images.

A game-changing deal

Artificial intelligence (AI) chip leader Nvidia has agreed to a deal with Intel that will see both companies jointly develop multiple generations of data center and PC products. For the data center, custom x86 chips will be used by Nvidia and sold to other customers. In the PC market, Intel's CPU technology will be combined with Nvidia GPU chiplets to create system-on-chips that will be offered to external customers.

This announcement comes on the heels of Intel's push into custom silicon. Earlier this month, Intel disclosed that it was creating a new group that would design custom semiconductor chips for external customers. Nvidia appears to be the first such customer.

Importantly, Intel will also manufacture these custom Nvidia chips. The company didn't disclose timelines, process nodes, or much other information, but the announcement noted that Intel would both "design and manufacture" custom data center and client CPUs integrating Nvidia technology. Intel desperately needed a major external foundry customer, and now it has one.

Intel also desperately needs capital to fund its foundry business, and the other part of the deal with Nvidia provides just that. Nvidia will invest $5 billion in Intel, buying shares at $23.28 a pop. Intel didn't disclose the planned use of this capital injection, but the company certainly needs cash to scale up its latest process nodes.

Cash infusions are adding up

Nvidia's $5 billion investment adds to Intel's haul over the past month. In August, Intel reached a deal for the U.S. government to invest $8.9 billion in the company. Some of the funding came from previous grants under the U.S. CHIPS and Science Act, which had not yet been paid, although those grants originally had conditions that were then dropped as part of the deal. Intel confirmed that it had received a $5.7 billion payment from the U.S. government in late August related to the deal.

Intel also received a $2 billion investment from Softbank in August, announced a few days before the deal with the U.S. government. The Softbank investment, the Nvidia investment, and the payment from the U.S. government add up to a $12.7 billion cash infusion. Intel also recently closed on its sale of a majority stake in Altera, which brought in an additional $3.3 billion. All told, that's around $16 billion in cash, before any taxes related to the Altera sale.

These cash infusions give Intel some breathing room, and the collaboration with Nvidia provides an enormous vote of confidence for Intel's custom silicon business and its foundry business. While Intel's turnaround will still be a slow process, things are clearly looking up for the struggling chip company.

Should you invest $1,000 in Intel right now?

Before you buy stock in Intel, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Intel wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $662,520!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,043,346!*

Now, it’s worth noting Stock Advisor’s total average return is 1,056% — a market-crushing outperformance compared to 188% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of September 15, 2025

Timothy Green has positions in Intel. The Motley Fool has positions in and recommends Intel and Nvidia. The Motley Fool recommends the following options: short November 2025 $21 puts on Intel. The Motley Fool has a disclosure policy.