Crypto Daily | SEC Paves Way for Crypto Spot ETFs With New Listing Rules; Bullish's Earnings Beat Estimates

Crypto Daily is our column tracking crypto market trends, offering timely insights and valuable updates to keep you informed.

Crypto News

SEC Paves Way for Crypto Spot ETFs with New Listing Rules

The Securities and Exchange Commission voted on Wednesday to approve proposed rule changes by three national securities exchanges, enabling them to adopt generic listing standards for new cryptocurrency and other spot commodity exchange-traded products.

The commission vote removes the last remaining hurdle to dozens of new spot ETFs tied to cryptocurrencies ranging from solana to dogecoin. In July, the SEC issued an order spelling out the details of the listing standards, which specify the criteria an asset manager and the exchanges -- the NYSE, Nasdaq and Cboe Global Markets -- must meet in order for a new spot crypto ETF to be approved without a lengthy, customized regulatory review. It is the latest step taken by the administration of President Donald Trump to bring crypto assets into the mainstream.

Until now, the SEC has handled every spot crypto ETF filing on a case-by-case basis, and required two separate filings, one from the exchange that plans to list the product and one from the asset manager, to receive approval from different divisions. The new process will cut the maximum time from filing to launch to 75 days from 240 days, or longer still.

Bullish Shares Jump Following Approval From New York Regulators

Crypto exchange Bullish has received the green light to operate in New York by regulators.

The BitLicense and Money Transmission License comes after the exchange had a roaring debut on the New York Stock Exchange in August.

Bullish shares rose 5.8% on Wednesday on the news.

Crypto Platform Bullish's Second Quarter Earnings Beats Wall Street's Estimates

Bullish reported second-quarter earnings on Wednesday, which beat Wall Street's estimates.

The crypto platform went public on the New York Stock Exchange at $37 a share in August.

The firm sees higher adjusted Ebitda for the third quarter.

Top Solana Treasury Firm Forward Industries Raising $4 Billion to Buy More SOL

Forward Industries, the largest publicly traded Solana treasury company, filed to raise $4 billion through an at-the-market equity offering to expand its SOL holdings.

The company's stock fell 10.3% following the announcement, while the proceeds could more than double the $3.1 billion currently held in Solana treasuries.

DeFi Development Corp. also registered a preferred stock offering with the SEC, following similar funding tactics used by Bitcoin treasury companies like MicroStrategy.

Coinbase Seeks Federal Intervention to Address State Regulations Hindering Crypto Market Growth

Coinbase has filed a letter with the DOJ urging federal preemption of state crypto laws, citing Oregon’s securities suit, New York’s ETH stance, and staking bans.

Chief Legal Officer Paul Grewal called state actions “government run amok,” warning that patchwork enforcement “slows innovation and harms consumers.”

A legal expert said that states risk violating interstate commerce rules and due process, and DOJ support for preemption may mark a potential turning point.

Trump Jr.-Connected Thumzup Media Buys 7.5 Million Dogecoin as It Expands Crypto Treasury

Thumzup Media Corporation announced Thursday its inaugural open-market acquisition of Dogecoin, buying approximately 7.5 million tokens valued at approximately $2 million, at a weighted average price of $0.2665.

Earlier this month, Thumzup Media said it plans to set up 3,500 Dogecoin mining rigs by year's end through its pending acquisition of mining firm Dogehash. The company is also strengthening its leadership team, highlighted by this week's appointments of DogeOS CEO and MyDoge Leader Jordan Jefferson and Alex Hoffman, head of ecosystem at DogeOS, to its Crypto Advisory Board.

This expansion follows the company’s offering of $50 million of common stock in August, priced at $10 per share.

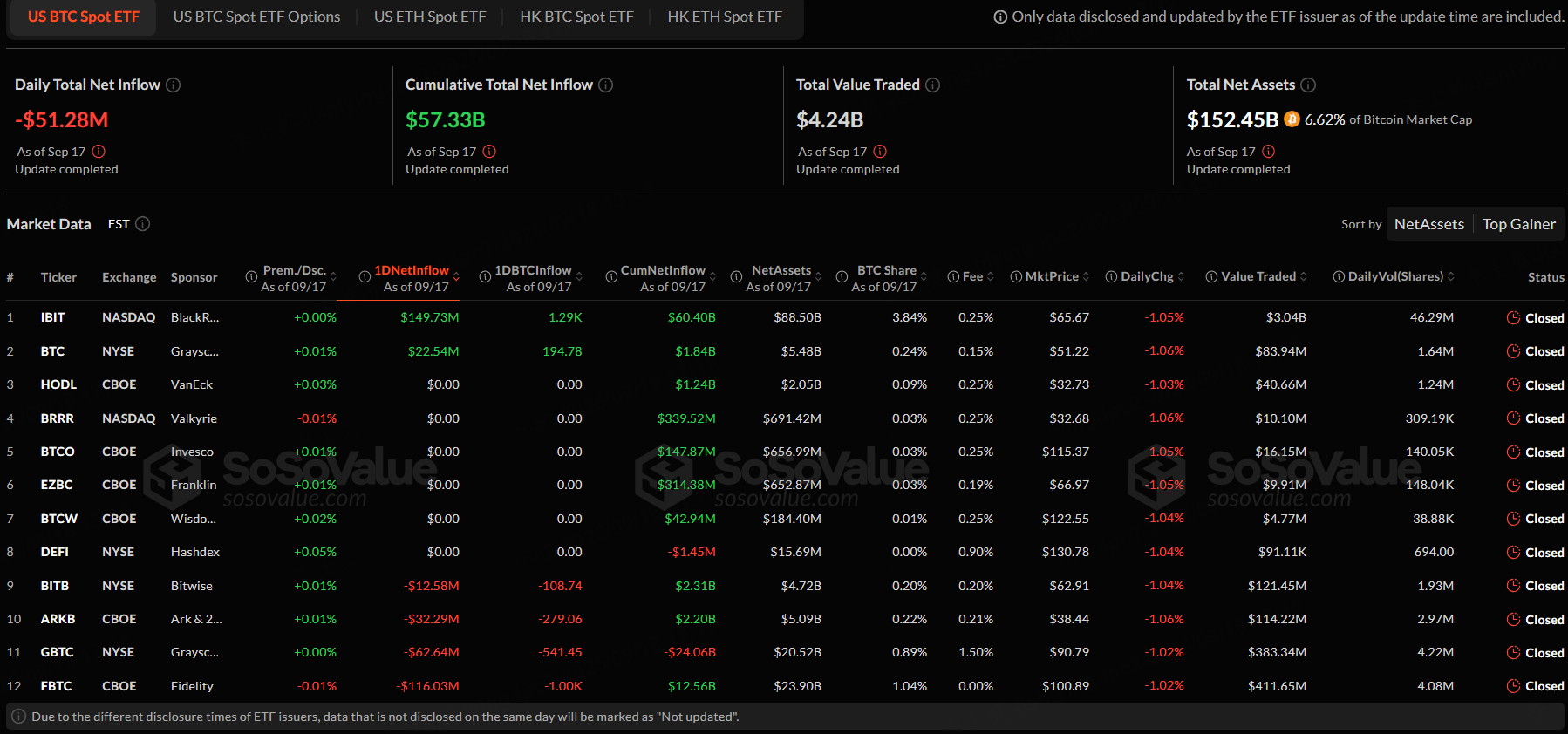

Bitcoin & Ethereum Spot ETF Flow

The overall net outflow of the US Bitcoin spot ETF on Wednesday was $51.28 million. The total net asset value of Bitcoin spot ETFs is $1524.45 billion, and the ETF net asset ratio (market value compared to total Bitcoin market value) is 6.62%.

The Bitcoin spot ETF with the highest net inflow on September 17 was iShares Bitcoin Trust ETF (IBIT), with a net inflow of $149.73 million, according to SoSoValue.

Source: SoSoValue

Source: SoSoValue

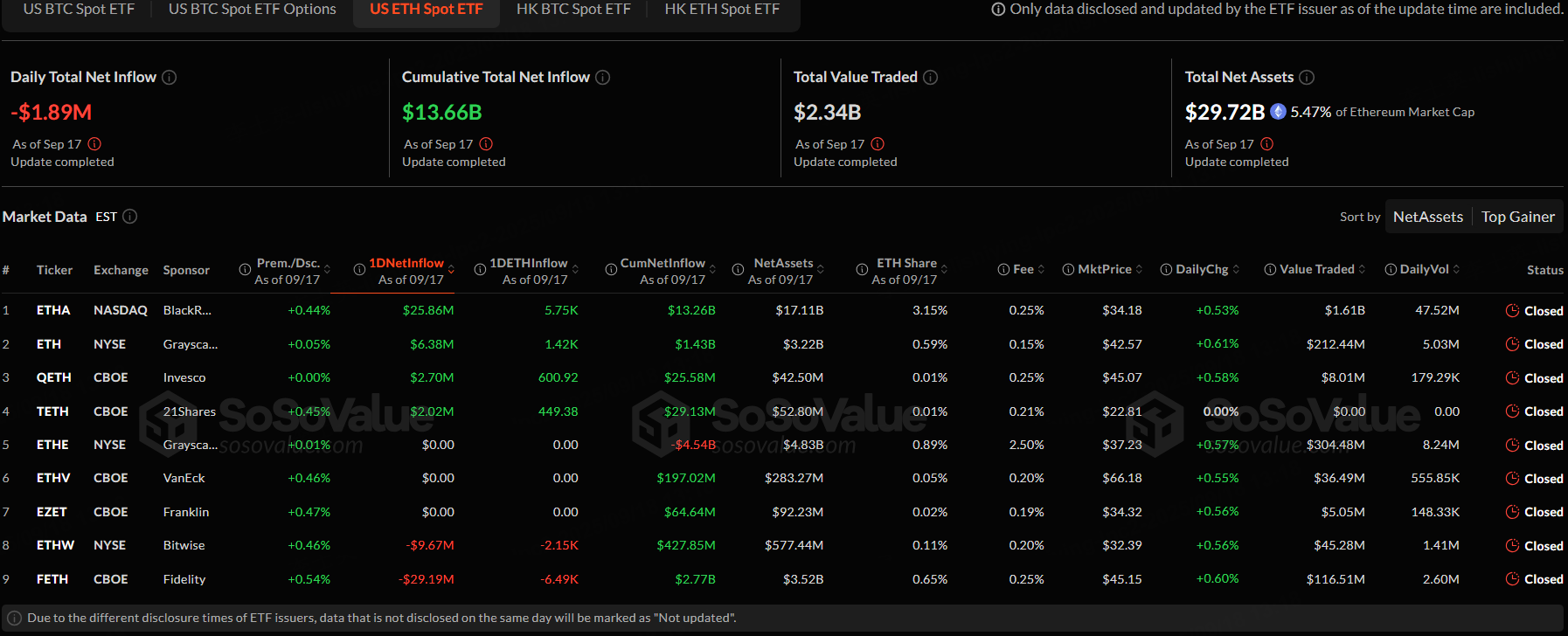

The overall net outflow of the US Ethereum spot ETF on Wednesday was $1.89 million. The total net asset value of Ethereum spot ETFs is $29.72 billion, and the ETF net asset ratio (market value compared to total Ethereum market value) is 5.47%.

The Ethereum spot ETF with the highest net inflow on September 17 was iShares Ethereum Trust ETF (ETHA), with a net inflow of $25.86 million, according to SoSoValue.

Source: SoSoValue

Source: SoSoValue