Could Buying SoFi Technologies Stock Today Set You Up for Life?

Key Points

SoFi's online banking model is helping it lure customers away from legacy banks.

The company's lending operations are growing quickly, and it is now profitable.

After rising sharply over the past 12 months, the stock now looks expensive.

Banking is slowly moving into the 21st century. Out are branches, checks, and physical currency. In are mobile banking applications, digital money transfers, and online-only banks. SoFi Technologies (NASDAQ: SOFI) is turning into the leading digital bank in the United States. By offering best-in-class interest rates and a comprehensive suite of personal finance options, SoFi has gained a ton of market share in recent years and is now profitable. Its stock is up 263% in the last 12 months alone.

But the party may just be getting started, as there are plenty of deposits and customers it can attract away from legacy banks. Does that make SoFi a stock that can set you up for life?

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Large market share gains

As a modern bank with no physical branches, SoFi has a cost advantage over the legacy institutions used by most Americans today. Managing its software and data center infrastructure doesn't require as much spending on overhead costs, employees, and technical debt, which enables it to offer much higher interest rates on savings accounts and still generate profits.

Today, SoFi offers a 3.8% annual interest rate on savings accounts, even as megabank competitors like Bank of America are paying close to 0%. That means a customer with $10,000 in a high-yield savings account could earn $380 in interest income a year by switching to SoFi. No wonder it has grown from 650,000 customers in 2018 to 11.7 million as of the end of last quarter.

Deposits, which fuel SoFi's lending operations, are growing rapidly as well. In early 2022, SoFi acquired a small bank in order to get a national banking charter, which enabled it to accept deposits onto its own balance sheet, giving it an advantage vs. other online banks that lack such banking licenses when it comes to making loans to customers. Deposits have grown from a standing start to $30 billion, with $2.3 billion added last quarter alone.

Smart savers are switching to SoFi, even more so than they are to its online banking competitors. For example, between Q2 2022 and Q2 2025, Ally Financial grew its deposits by less than $10 billion despite the fact that it has many more years of experience than SoFi in attracting online banking customers.

Clearly, there is some magic in SoFi's customer value proposition, and that should continue in the years to come, as it has thus far only scratched the surface in regards to its deposit opportunity.

Image source: Getty Images.

Increasing revenue per customer

Over time, SoFi should gain more customers and increase its deposits per customer. As it does so, it will have more funds to originate loans, which will help it grow its earnings for shareholders. This is the banking business model at its simplest.

Last quarter, SoFi had $30.7 billion in loans held on its balance sheet, up from $27.8 billion in Q1. Unsecured personal loans accounted for the majority of these assets, at $19.6 billion in fair value last quarter. The company also makes home loans and student loans (the business was founded as a student loan refinancer) and is expanding into other business lines such as debit and credit cards.

SoFi's overarching goal is to become a one-stop shop for its customers' personal finance needs. Through SoFi's mobile application, an individual today can save, invest, get a loan, and spend money. In the last few years, a lot of progress has been made on this front. In 2021, SoFi's total adjusted net revenue was $1 billion. In 2025, it expects to generate $3.375 billion. This makes it one of the fastest-growing banks in the world.

Further, after years of losses, the company is now profitable. Net income reached $562 million over the last 12 months, putting SoFi on a firm financial footing.

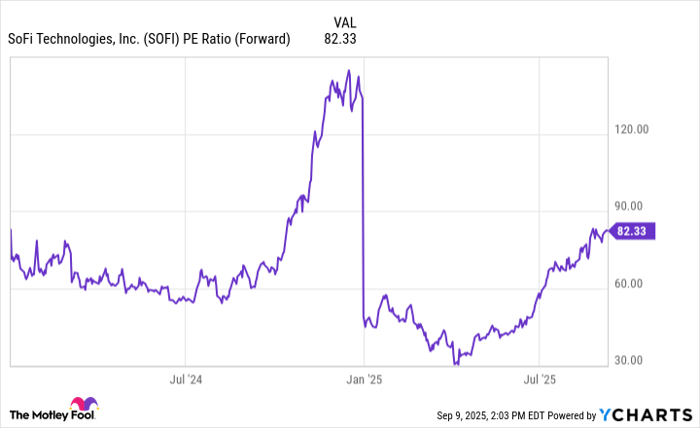

SOFI PE Ratio (Forward) data by YCharts.

Is SoFi stock a buy?

As Sofi has proven its huge growth opportunity, gained market share, and started to generate earnings, the stock has soared. As of the close of trading on Sept. 9, the stock was priced at $25.97 per share. During periods in 2022 and 2023, shares were trading around $5 or lower.

The question remains whether this leading online bank is still a buy today. With a forward price-to-earnings ratio (P/E) of 83, the stock price already has many years of expected growth baked into it. I am optimistic about the future business prospects of SoFi, but the stock is likely to underperform over the next few years because of its already lofty valuation. As such, I'd recommend keeping SoFi stock on your watch list for now.

Should you invest $1,000 in SoFi Technologies right now?

Before you buy stock in SoFi Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and SoFi Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $640,916!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,090,012!*

Now, it’s worth noting Stock Advisor’s total average return is 1,052% — a market-crushing outperformance compared to 188% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of September 8, 2025

Bank of America is an advertising partner of Motley Fool Money. Ally is an advertising partner of Motley Fool Money. Brett Schafer has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.