Meet the $1 Trillion Stock Warren Buffett Has Plowed $77.8 Billion Into Since 2018

Key Points

Berkshire Hathaway CEO Warren Buffett oversees numerous wholly owned subsidiaries and a $302 billion stock portfolio.

Buffett has spent more money on share buybacks since 2018 than he has invested in any company in Berkshire's history.

Buffett will step down as Berkshire's CEO at the end of 2025, but its buyback program is likely to continue despite a recent pause.

Warren Buffett has invested in hundreds of different stocks on behalf of his Berkshire Hathaway (NYSE: BRK.A)(NYSE: BRK.B) holding company since he became its chief executive officer in 1965. Apple (NASDAQ: AAPL) is one of his most famous bets; he put $38 billion into the iPhone maker between 2016 and 2023, and that position was valued at more than $170 billion by the start of 2024.

However, Buffett has plowed a whopping $77.8 billion into another stock since 2018 -- more than twice as much as he invested in Apple -- but you won't find it in Berkshire's portfolio.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

Image source: The Motley Fool.

Buffett's simple investing strategy yields incredible returns

Buffett is a long-term value investor who typically backs companies with steady growth, reliable profits, and strong management teams. He especially likes companies with shareholder-friendly initiatives like stock buyback programs and dividends, because they compound his returns much faster.

Berkshire owns a $302 billion portfolio of publicly traded stocks and securities, and Apple is just one of many successful investments stemming from Buffett's approach. Coca-Cola (NYSE: KO) is another; he spent $1.3 billion to acquire 400 million shares in the beverage giant between 1988 and 1994, and he has never sold a single one. That position is worth an eye-popping $27.1 billion today, and it will pay Berkshire $816 million in dividends during 2025 alone.

Berkshire also has full ownership of subsidiaries like Dairy Queen, Duracell, Fruit of the Loom, Clayton Homes, and GEICO Insurance, in addition to numerous companies in the utilities, logistics, and energy industries. These businesses often provide the cash flow that Buffett and his team invests in publicly traded stocks.

Since Buffett took control of Berkshire in 1965, its stock has delivered a compound annual return of 19.9%, nearly double the average annual gain of 10.4% generated by the S&P 500 (SNPINDEX: ^GSPC) index during the same period. The difference in dollar terms is mind-boggling: Had you invested $1,000 in Berkshire stock in 1965, it would have grown to a staggering $44.7 million by the end of 2024, whereas the same investment in the S&P would have be worth just $342,906.

Buffett has plowed $77.8 billion into Berkshire stock since 2018

Berkshire now has a market capitalization of more than $1 trillion. Buffett and his team are constantly scouring the world for new investment opportunities, but only a small number of them are large enough to make a meaningful contribution to Berkshire's growth. An even smaller number fit within Buffett's typical investment criteria.

As a result, Buffett occasionally returns some of Berkshire's spare cash to shareholders when he can't find a good home for it elsewhere. Buybacks are his preferred method rather than dividends, something Berkshire has never paid. Buybacks shrink the number of Berkshire shares in circulation, which organically increases the price per share and raises shareholders' equity stake in the company. Since investors can then sell their shares whenever they like, they can defer any tax liabilities to a time that suits them. Dividends, on the other hand, incur taxes as soon as they are paid.

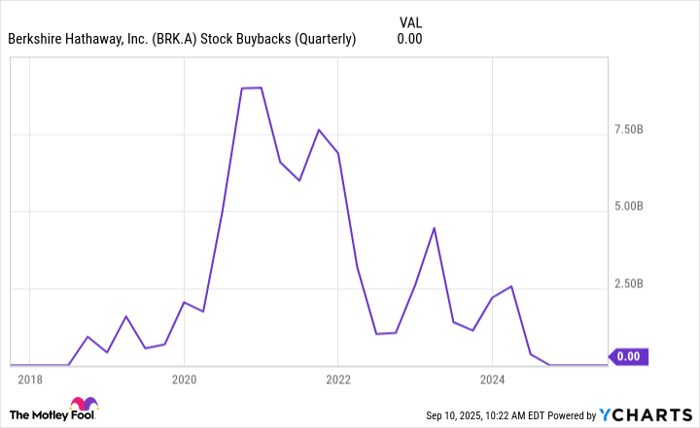

Buffett has authorized a whopping $77.8 billion worth of buybacks since 2018, which is more than twice as much as he invested in Apple. This is rarely a bad decision given Berkshire's consistent market-beating returns, but it's worth noting that Buffett hasn't authorized any repurchases during the past four quarters.

BRK.A Stock Buybacks (Quarterly) data by YCharts

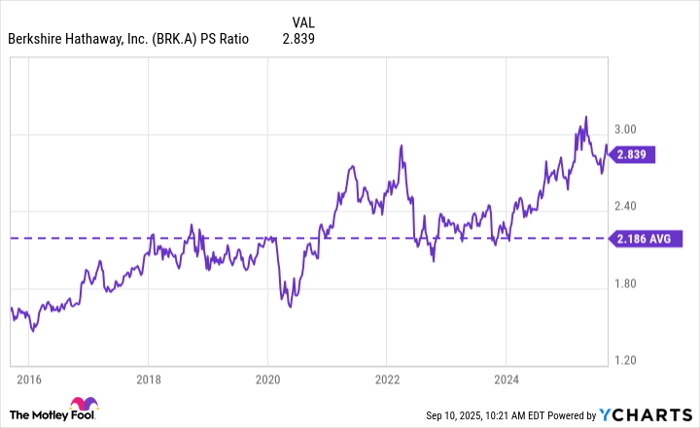

Berkshire's valuation might be a reason. Its stock is trading at a price-to-sales (P/S) ratio of 2.84, which is a 31% premium to its 10-year average of 2.18. Therefore, Buffett might feel the stock is too expensive right now -- he is a value investor, after all.

BRK.A PS Ratio data by YCharts

Expect buybacks to make a comeback

Berkshire can resume buybacks at management's discretion, as long as the balance of its cash, cash equivalents, and holdings in government Treasury bonds is more than $30 billion. Since the conglomerate is sitting on a whopping $344 billion in cash and equivalents right now, that certainly isn't an issue. A large chunk of that cash was raised during the past year as Buffett trimmed some of Berkshire's largest stock holdings, including more than half of its Apple position.

Buffett will step down as CEO at the end of this year and hand the reins to his chosen successor, Greg Abel. That could be another reason for the pause in buybacks -- Buffett probably wants to give Abel an opportunity to decide what to do with Berkshire's enormous cash pile. Perhaps he has new acquisitions in mind and sees less value in returning money to shareholders.

Nevertheless, companies that return money to shareholders are very popular with investors, and they often earn a premium valuation as a result. Therefore, I don't think we've seen the last of Berkshire's buyback program.

Should you invest $1,000 in Berkshire Hathaway right now?

Before you buy stock in Berkshire Hathaway, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Berkshire Hathaway wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $649,037!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,086,028!*

Now, it’s worth noting Stock Advisor’s total average return is 1,056% — a market-crushing outperformance compared to 188% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of September 8, 2025

Anthony Di Pizio has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Apple and Berkshire Hathaway. The Motley Fool has a disclosure policy.