Where Will TSMC Stock Be in 1 Year?

Key Points

TSMC's growth in 2025 has been solid, and 2026 could turn out to be another strong year for the company.

TSMC's customers, including major cloud computing providers, are likely to want more chips next year to meet rapidly growing backlogs.

TSMC is undervalued right now, and the market could reward it with a premium valuation because of its elevated growth levels.

Taiwan Semiconductor Manufacturing (NYSE: TSM) has cemented its position as the world's largest semiconductor foundry, establishing a big lead over rivals thanks to the technological advantage of its manufacturing process and chip packaging technology.

The cutting-edge performance of the chips fabricated by TSMC is the reason why it is the foundry of choice for the top artificial intelligence (AI) chip designers. From data centers to automotive to personal computers (PCs) to smartphones, TSMC benefits from rapid AI adoption on multiple fronts. This is why its stock has jumped an impressive 59% in the past year, well above the 28% jump clocked by the PHLX Semiconductor Sector index over the same period.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Continue »

The good part is that TSMC looks well-positioned to deliver more upside in the coming year. But how much upside can investors expect from this semiconductor stock over the next year? Let's find out.

Image source: Getty Images.

TSMC's biggest catalyst is likely to get stronger in 2026

TSMC's revenue in the first eight months of 2025 increased by 37% from the same period last year. TSMC management forecasted revenue growth of 30% for the year, but its performance so far suggests that it will exceed that mark. That should set TSMC stock up for a strong finish to 2025.

TSMC will likely carry this momentum into 2026 thanks to strong prospects for its largest business segment. Roughly 60% of TSMC's revenue came from the high-performance computing (HPC) segment in the previous quarter. That's not surprising, as TSMC fabricates chips for Nvidia, AMD, Broadcom, and Marvell Technology. These companies are the dominant players in the graphics processing unit (GPU) and custom AI processor markets, the two main types of chips that power AI data centers.

All these companies have been growing at a tremendous pace in recent quarters, and they are likely to sustain that momentum in 2026 as well. Broadcom's AI revenue, for instance, is expected to double next year. The company has brought a new customer for its AI chips on board, and it finished the previous quarter with a massive backlog of $110 billion.

Marvell, on the other hand, projects a substantial increase in the number of customers for its custom AI processors. Nvidia and AMD should also see a significant boom in demand for their chips in 2026 because all the major cloud computing companies are short of data center capacity.

Oracle, for instance, just announced that its remaining performance obligations (RPO) in the previous quarter jumped a stunning 359% year over year to a whopping $455 billion. Management added that it expects "to sign-up several additional multi-billion-dollar customers and RPO is likely to exceed half-a-trillion dollars" in the next few months.

Similarly, Microsoft management remarked on its August earnings conference call that it saw "capacity constraints despite significant capacity coming online." That's because the demand for Microsoft's AI data centers is ahead of supply despite efforts to ramp up capacity. Bloomberg estimates that the major tech companies are likely to increase their capital spending by $33 billion next year to $369 billion as they add more AI capacity.

Actual growth could be much higher than that, as big tech companies are expected to hike their capital spending in 2025 owing to the AI-fueled demand for data center capacity. And a look at the massive backlogs reported by cloud computing giants of late indicates that the trend could continue in 2026. These cloud computing companies will have to purchase more GPUs and custom AI processors as they build out more data centers. This bodes well for TSMC because of its relationship with the top AI chip designers.

How much upside is in store for investors in the next year?

TSMC's 12-month median stock price target of $278 (as per 45 analysts covering the stock) points toward a potential jump of 11% from current levels. What's worth noting is that 96% of the analysts covering TSMC suggest buying it right now. But then, don't be surprised to see TSMC's stock jumping higher than analysts' expectations in the coming year.

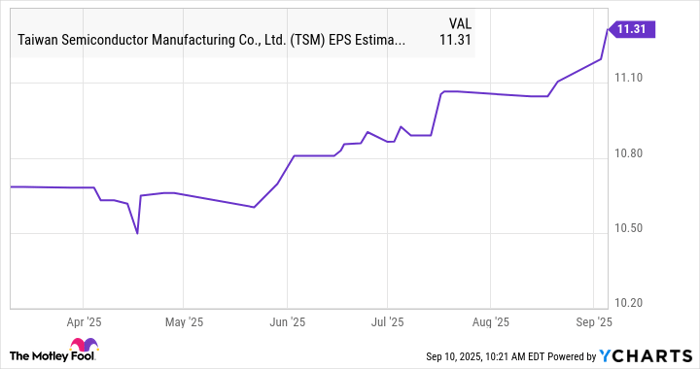

Its 2026 earnings are expected to land at $11.31 per share. However, that forecast has moved up significantly of late.

Data by YCharts.

More upward revisions to TSMC's 2026 forecast cannot be ruled out on the back of potentially stronger spending on AI chips next year. Assuming TSMC manages to increase its earnings to $12.00 per share and trades at 29 times earnings after a year (in line with the tech-laden Nasdaq-100 index's forward earnings multiple), its stock price could hit $348.

That would be a 36% jump from current levels. With TSMC trading at just 22 times forward earnings right now, investors would do well to buy this AI stock hand over fist as it has the potential to rise impressively in the coming year.

Should you invest $1,000 in Taiwan Semiconductor Manufacturing right now?

Before you buy stock in Taiwan Semiconductor Manufacturing, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Taiwan Semiconductor Manufacturing wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $649,037!* Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,086,028!*

Now, it’s worth noting Stock Advisor’s total average return is 1,056% — a market-crushing outperformance compared to 188% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

*Stock Advisor returns as of September 8, 2025

Harsh Chauhan has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Advanced Micro Devices, Microsoft, Nvidia, Oracle, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom and Marvell Technology and recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.