How to Turn $100,000 Into $1 Million for Retirement: 3 Smart Investment Strategies

Key Points

Starting to invest early puts time on your side.

Diversifying your investments lowers your risk.

Reinvesting dividends can significantly boost your returns over time.

Retiring as a millionaire doesn't have to be a far-fetched dream. Achieving the goal is doable for many Americans, but it requires discipline.

Beginning with a tidy sum of money upfront helps a lot, too. Let's suppose you have $100,000. How could you turn that into $1 million for retirement? Here are three smart investment strategies.

Where to invest $1,000 right now? Our analyst team just revealed what they believe are the 10 best stocks to buy right now. Learn More »

Image source: Getty Images.

1. Start early

Probably the most important step to take to grow $100,000 into $1 million is to start investing as early as possible. The Rolling Stones were exactly right when they sang, "Time Is on My Side." Time can be on your side, too.

For example, let's say you have 40 years until you retire. If you invested $100,000 and your money increased by a compound annual growth rate (CAGR) of 6%, you'd have a little over $1 million for retirement.

The shorter your investment time horizon, the higher the return you'll need. However, if you start too late, growing $100,000 into $1 million could be out of reach unless you contribute more (which is a good idea even if you begin investing early).

2. Diversify your investments

You could put your entire $100,000 in cryptocurrency, early stage biotech stocks, or other high-risk, potentially high-reward assets. However, there's a not-so-insignificant chance that you could lose much of your money. A smarter strategy is to build a diversified portfolio. Diversifying your investments helps reduce risk.

One way to build a diversified portfolio is to buy a relatively large number of stocks, bonds, and perhaps other assets. Ideally, you should have at least 25 stocks, without one industry or sector making up an outsized portion of your total portfolio.

Another alternative is to put your money in funds that own a diversified array of assets. Many investors are familiar with mutual funds. One of the key downsides of mutual funds, though, is that they don't give you much control over your investments. They can also come with relatively high fees.

Exchange-traded funds (ETFs) can be bought and sold like stocks. You can find ETFs that own nearly every kind of asset, including stocks, bonds, and some types of cryptocurrency. Many ETFs have low annual expense ratios, too.

Closed-end funds (CEFs) also trade on stock exchanges like ETFs. These funds issue a fixed number of shares and are then closed to new investors (that's where they get the name "closed-end"). CEFs can invest in less liquid assets. They can also use leverage, which increases the risk for some funds.

3. Reinvest dividends

The third strategy to help you grow $100,000 into $1 million for retirement is to reinvest dividends into buying additional shares of the stocks you own. This could make you more money than you might think.

Not every stock pays dividends, but many stocks do (almost 5,900 of them trade on U.S. stock exchanges). If you own a mutual fund, ETF, or CEF that focuses on stocks, odds are you'll receive some regular dividend payments.

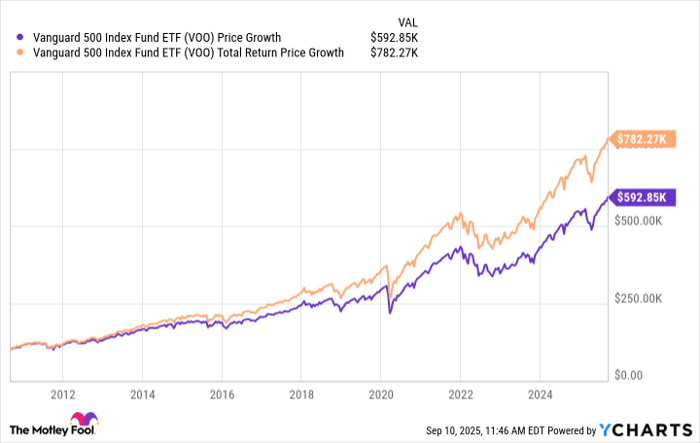

Let's look at an example of the power of reinvested dividends. Suppose you put your $100,000 into an S&P 500 (SNPINDEX: ^GSPC) index ETF such as the Vanguard 500 Index Fund (NYSEMKT: VOO) at the fund's inception in September 2010. If you didn't reinvest dividends, your money would have grown to around $592,000 by now. However, with dividends reinvested, your $100,000 would have increased to roughly $782,000 today.

Over the long run, dividends have made up a little over half of the S&P 500's total return. While the percentage could differ depending on where you invest your $100,000, reinvesting dividends is a no-brainer way to increase the likelihood that your money will grow to $1 million for retirement.

The $23,760 Social Security bonus most retirees completely overlook

If you're like most Americans, you're a few years (or more) behind on your retirement savings. But a handful of little-known "Social Security secrets" could help ensure a boost in your retirement income.

One easy trick could pay you as much as $23,760 more... each year! Once you learn how to maximize your Social Security benefits, we think you could retire confidently with the peace of mind we're all after. Join Stock Advisor to learn more about these strategies.

View the "Social Security secrets" »

Keith Speights has no position in any of the stocks mentioned. The Motley Fool has positions in and recommends Vanguard S&P 500 ETF. The Motley Fool has a disclosure policy.